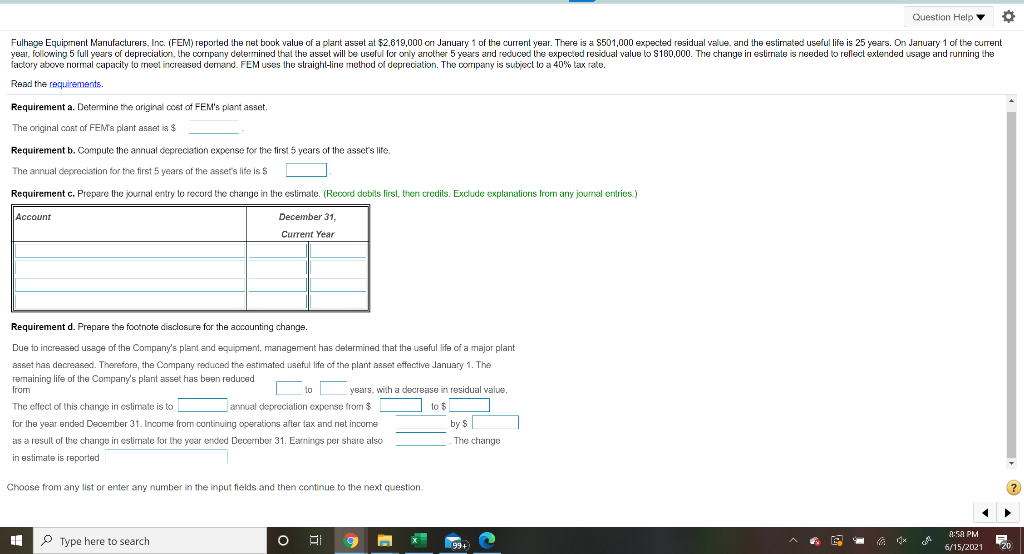

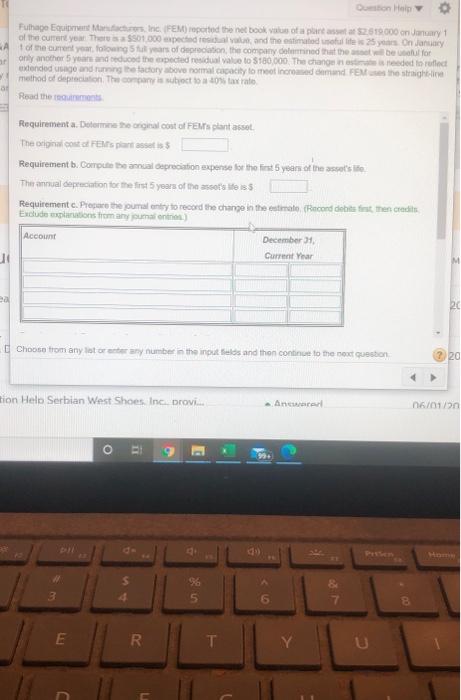

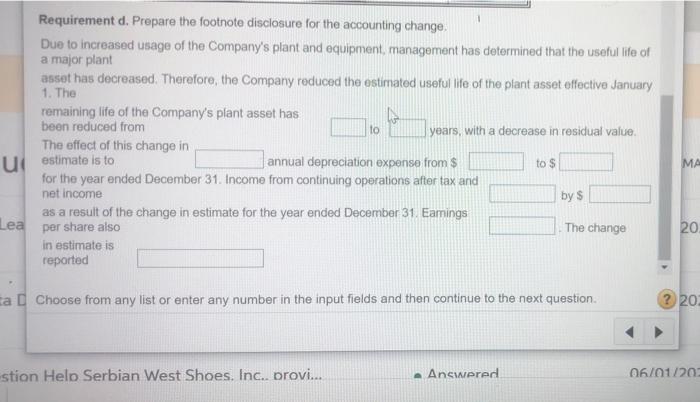

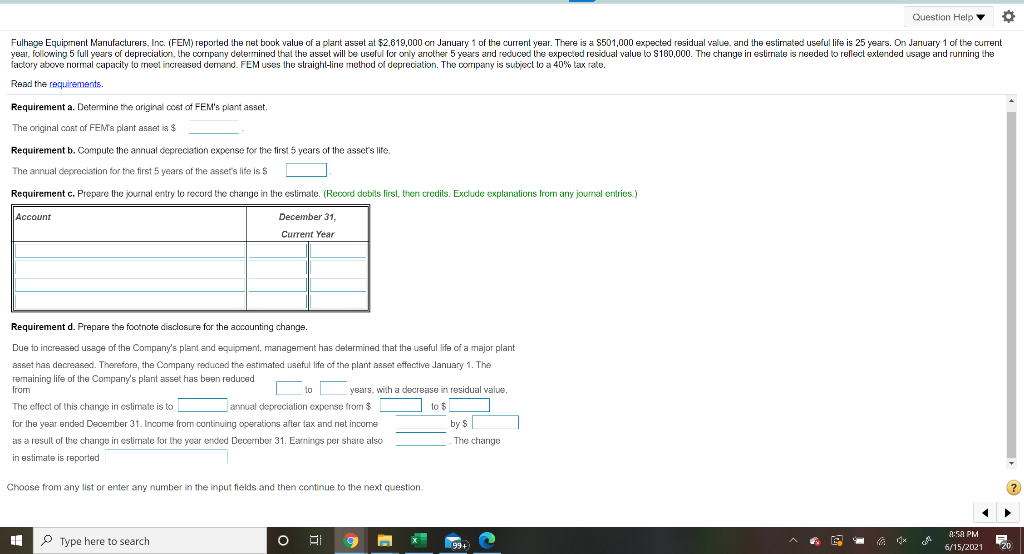

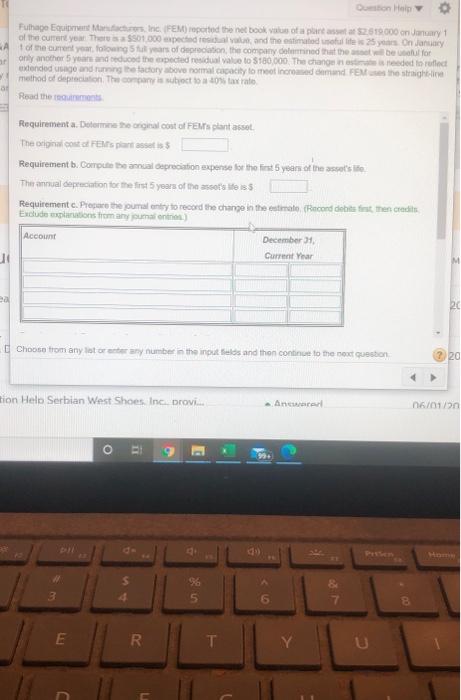

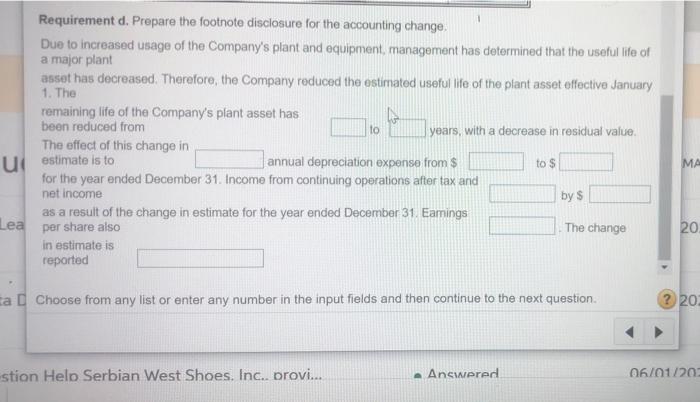

Question Help Fulhage Equipment Manufacturers, Inc. (FEM) reported the net book value of a plant asset at $2.819,000 on January 1 of the current year. There is a S501,000 expected residual value, and the estimated useful life is 25 years. On January 1 of the current year, following 5 full years of depreciation, the company determined that the asset will be useful for only another 5 years and reduced the expected residual value to $160,000. The change in estimate is needed to reflect extended usage and rurining the factory above normal capacity to meet increased demand. FEM uses the straight-line method of depreciation. The company is subject to a 40% lax rate. Read the requirements Requirement a. Determine the original cost of FEM's plant asset. The original cost of FEM's plant asset is $ Requirement b. Compute the annual depreciation expense for the first 5 years of the asset's life. The annual depreciation for the first 5 years of the asset's life is s Requirement c. Prepare the journal entry to record the change in the estimate. (Record debits first, then credils. Exclude explanations from any journal entries.) Account December 31, Current Year Requirement d. Prepare the footnote disclosure for the accounting change. Due to increased usage of the Company's plant and equipment, management has determined that the useful life of a major plant asset has decreased. Therefore, the Company reduced the estimated useful life of the plant asset effective January 1. The remaining life of the Company's plant asset has been reduced from to years, with a decrease in residual value. The effect of this change in estimate is to annual deprecialion expense from $ to $ for the year ended December 31. Income from continuing operations after tax and net income by s as a result of the change in estirnale for the year ended December 31. Earnings per share also The change in estimate is reported Choose from any list or enter any number in the input fields and then continue to the next question. ? 8:59 PM Type here to search O 1] 1994 6/15/2021 20 Question Help Puthage Equipment Manufactures, Inc. FEM) reported the netbook value of a parasta $2619.000 on January 1 of the current year. There is a $501 000 expected to do and the estimated nullite 25 years on January At of the current year, foloang 5 years of deprecation, the company detained that the best for of only another 5 years and reduced the expected residual value to S180 000. The change reeded to retet extended age and running the factory above normal city to meet increased demand the straight method of depreciation. The company is subject to 40% tax rate Read the Requirementa. Determine the original cost of Fansplant asset. The original costat Fems partes Requirement b. Compute the annual depreciation expense for the first 5 years of the asset's The annual cepaciation for the first 5 years of the soet's life is Requirement c. Prepare the journal entry to record the change in the estimate (Racord debts fint, mens credits Exclude explanations from any oumas) December Account Current Year Choose from any store any number in the input selds and then continue to the box Question 2. 20 tion Help Serbian West Shoes, Inc. prov. Anwar 4. 06/01/2 O E 96 6 E R T C 1 1. The Requirement d. Prepare the footnote disclosure for the accounting change, Due to increased usage of the Company's plant and equipment management has determined that the useful life of a major plant asset has decreased. Therefore, the Company reduced the estimated useful life of the plant asset effective January remaining life of the Company's plant asset has been reduced from years, with a decrease in residual value The effect of this change in annual depreciation expense from $ for the year ended December 31. Income from continuing operations after tax and as a result of the change in estimate for the year ended December 31. Eamings to ul estimate is to to $ MA net income by s Lea per share also The change 20 in estimate is reported ta Choose from any list or enter any number in the input fields and then continue to the next question ? 20 stion Help Serbian West Shoes, Inc., orovi... Answered 06/01/200 tiem neys