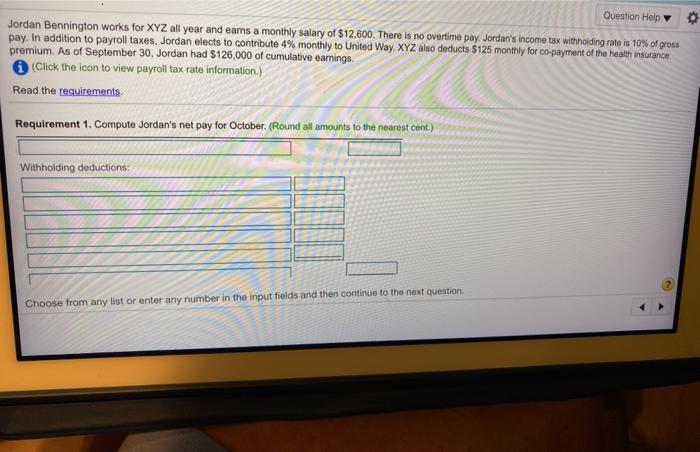

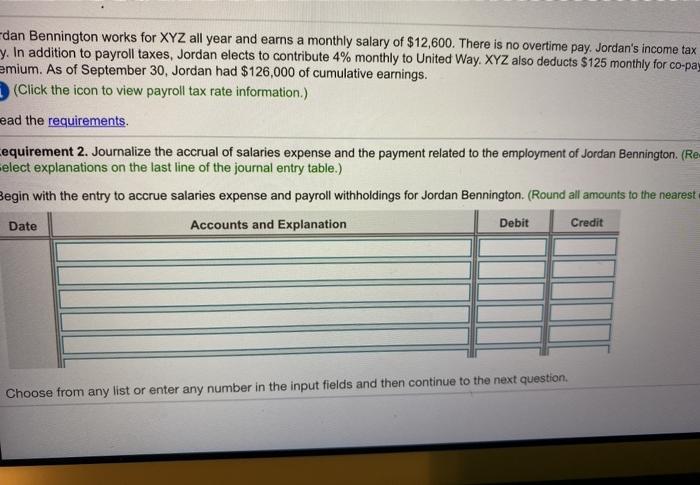

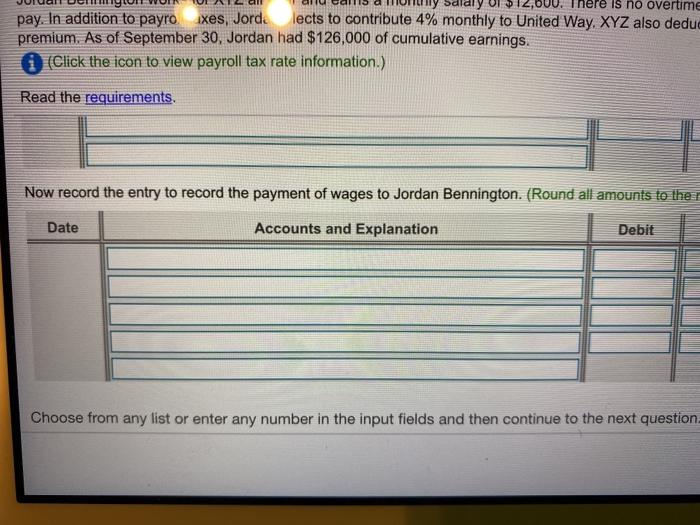

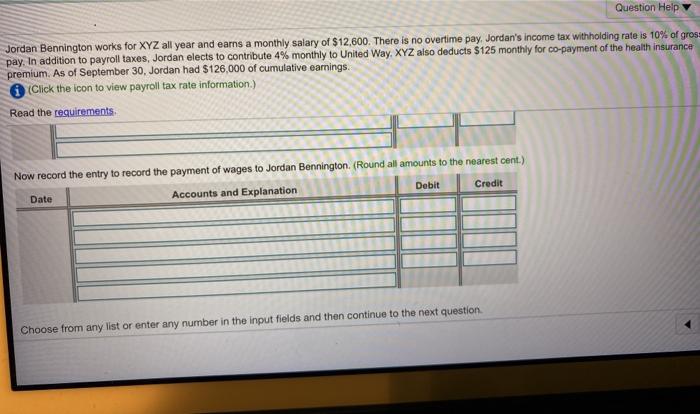

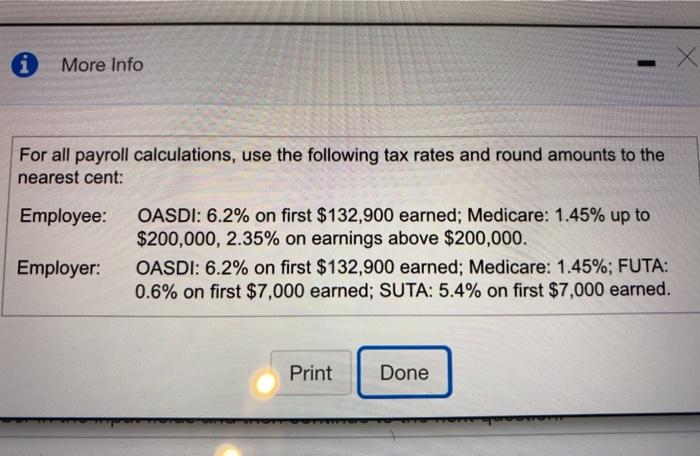

Question Help Jordan Bennington works for XYZ all year and earns a monthly salary of $12,600. There is no overtime pay, Jordan's income tax withholding rate is 10% of gross pay. In addition to payroll taxes, Jordan elects to contribute 4% monthly to United Way, XYZ also deducts $125 monthly for co-payment of the health insurance premium. As of September 30, Jordan had $126,000 of cumulative earnings (Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Compute Jordan's net pay for October (Round all amounts to the nearest cent.) Withholding deductions: Choose from any list or enter any number in the input fields and then continue to the next question dan Bennington works for XYZ all year and earns a monthly salary of $12,600. There is no overtime pay. Jordan's income tax y. In addition to payroll taxes, Jordan elects to contribute 4% monthly to United Way. XYZ also deducts $125 monthly for co-pay emium. As of September 30, Jordan had $126,000 of cumulative earnings. (Click the icon to view payroll tax rate information.) ead the requirements cequirement 2. Journalize the accrual of salaries expense and the payment related to the employment of Jordan Bennington. (Re elect explanations on the last line of the journal entry table.) Begin with the entry to accrue salaries expense and payroll withholdings for Jordan Bennington (Round all amounts to the nearest Date Accounts and Explanation Credit Debit Choose from any list or enter any number in the input fields and then continue to the next question 12,000. There is no overtime Salary pay. In addition to payro xes, Jorda lects to contribute 4% monthly to United Way. XYZ also deduc premium. As of September 30, Jordan had $126,000 of cumulative earnings. (Click the icon to view payroll tax rate information.) Read the requirements, Now record the entry to record the payment of wages to Jordan Bennington. (Round all amounts to the r Date Accounts and Explanation Debit Choose from any list or enter any number in the input fields and then continue to the next question Question Help Jordan Bennington works for XYZ all year and earns a monthly salary of $12,600. There is no overtime pay, Jordan's income tax withholding rate is 10% of gross pay. In addition to payroll taxes, Jordan elects to contribute 4% monthly to United Way XYZ also deducts $125 monthly for co-payment of the health insurance premium. As of September 30, Jordan had $126,000 of cumulative earnings. Click the icon to view payroll tax rate information.) Read the requirements Now record the entry to record the payment of wages to Jordan Bennington (Round all amounts to the nearest cont.) Debit Credit Date Accounts and Explanation Choose from any list or enter any number in the input fields and then continue to the next question More Info X For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Employer: Print Done Question Help Jordan Bennington works for XYZ all year and earns a monthly salary of $12,600. There is no overtime pay, Jordan's income tax withholding rate is 10% of gross pay. In addition to payroll taxes, Jordan elects to contribute 4% monthly to United Way, XYZ also deducts $125 monthly for co-payment of the health insurance premium. As of September 30, Jordan had $126,000 of cumulative earnings (Click the icon to view payroll tax rate information) Read the requirements Requirement 1. Compute Jordan's net pay for October (Round all amounts to the nearest cent.) Withholding deductions: Choose from any list or enter any number in the input fields and then continue to the next question dan Bennington works for XYZ all year and earns a monthly salary of $12,600. There is no overtime pay. Jordan's income tax y. In addition to payroll taxes, Jordan elects to contribute 4% monthly to United Way. XYZ also deducts $125 monthly for co-pay emium. As of September 30, Jordan had $126,000 of cumulative earnings. (Click the icon to view payroll tax rate information.) ead the requirements cequirement 2. Journalize the accrual of salaries expense and the payment related to the employment of Jordan Bennington. (Re elect explanations on the last line of the journal entry table.) Begin with the entry to accrue salaries expense and payroll withholdings for Jordan Bennington (Round all amounts to the nearest Date Accounts and Explanation Credit Debit Choose from any list or enter any number in the input fields and then continue to the next question 12,000. There is no overtime Salary pay. In addition to payro xes, Jorda lects to contribute 4% monthly to United Way. XYZ also deduc premium. As of September 30, Jordan had $126,000 of cumulative earnings. (Click the icon to view payroll tax rate information.) Read the requirements, Now record the entry to record the payment of wages to Jordan Bennington. (Round all amounts to the r Date Accounts and Explanation Debit Choose from any list or enter any number in the input fields and then continue to the next question Question Help Jordan Bennington works for XYZ all year and earns a monthly salary of $12,600. There is no overtime pay, Jordan's income tax withholding rate is 10% of gross pay. In addition to payroll taxes, Jordan elects to contribute 4% monthly to United Way XYZ also deducts $125 monthly for co-payment of the health insurance premium. As of September 30, Jordan had $126,000 of cumulative earnings. Click the icon to view payroll tax rate information.) Read the requirements Now record the entry to record the payment of wages to Jordan Bennington (Round all amounts to the nearest cont.) Debit Credit Date Accounts and Explanation Choose from any list or enter any number in the input fields and then continue to the next question More Info X For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Employer: Print Done