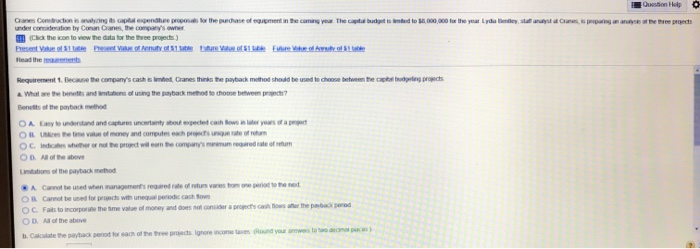

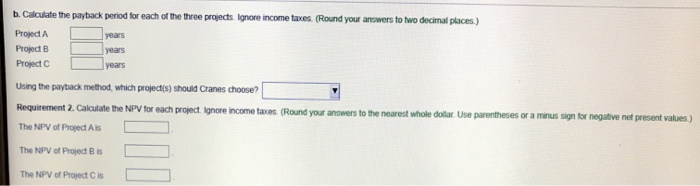

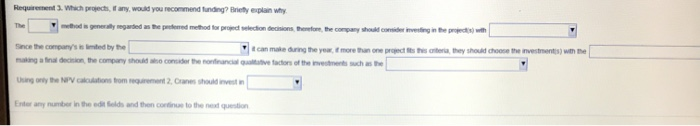

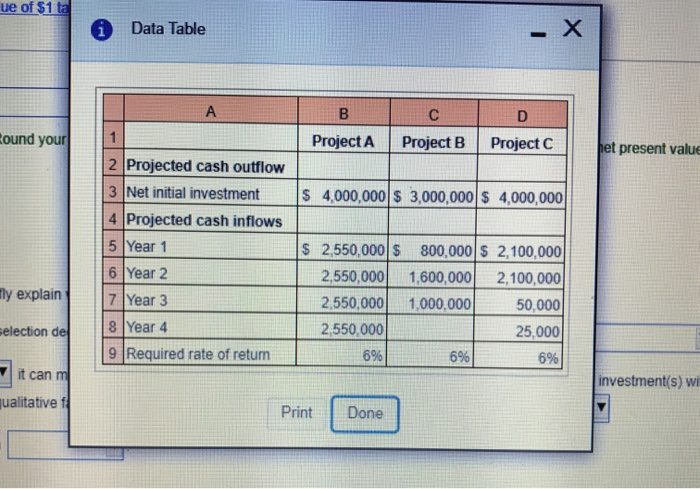

Question Help O Canes Constructions along ts capital expenditure proposals for the purchase of equipment in the coming year. The capta budget isted to 8000,000 to the year Lyda Bentley stay at spring an any of the three projects under consideration by Conan Cranes, the company's owner Click the icon to view the data for the three projects Presentat per a trenuta 31. t Future of Futebolo Head the Requirement. Because the company's Cathed Cranes think the payback method should be used to choose between the capitaluring projects What we the benefits and instations of using the payback method to home between projects? Benefits of the back to OA Easy to understand and are uncertainty hotelcachows the years of O tem of money and computers are from OC Indice her or not the produce the company's role of tum OD. All of the above Litom of the payback method SA Cartie sed when managements regardle of refuse tone period to the next O Carnot be used for precis with negal pedic cash from OC Fals to incorporate the time value of money and does not considerator the bad peod On of the above 1. Calculate the payback period for each of the three signore income and your Project A years years b. Calculate the payback period for each of the three projects. Ignore income taxes. (Round your answers to two decimal places.) years Projed B Project C Using the payback method, which project(s) should Cranes choose? Requirement 2. Calculate the NPV for each project. Ignore income taxes (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project Als The NPV of Project is The NPV of Project is Requirement 3. Which projects, if any, would you recommend funding friety explain why method is generally regarded as the pertemed method for projed selection decisions, therefore, the company should consider investing in the pred with Since the company's sted by the can make during the yew more than one projects this they should choose the investments with the making a final decision, the company should consider the nonfinancial live factors of the investments such as the Using only the NPV cacations from norment 2 Canesthouden Enter any number in the edifolds and then continue to the next question ue of $1 ta i Data Table -X B D Round your 1 Project A Project B Project C het present value 2 Projected cash outflow 3 Net initial investment 4 Projected cash inflows 5 Year 1 $ 4,000,000 $ 3,000,000 $ 4,000,000 6 Year 2 Tly explain 7 Year 3 $ 2,550,000 $ 800,000 $ 2,100,000 2,550,000 1,600,000 2,100,000 2,550,000 1,000,000 50,000 2,550,000 25,000 6% 6% 6% selection de 8 Year 4 Required rate of return 9 it can m investment(s) wi qualitative f Print Done Question Help O Canes Constructions along ts capital expenditure proposals for the purchase of equipment in the coming year. The capta budget isted to 8000,000 to the year Lyda Bentley stay at spring an any of the three projects under consideration by Conan Cranes, the company's owner Click the icon to view the data for the three projects Presentat per a trenuta 31. t Future of Futebolo Head the Requirement. Because the company's Cathed Cranes think the payback method should be used to choose between the capitaluring projects What we the benefits and instations of using the payback method to home between projects? Benefits of the back to OA Easy to understand and are uncertainty hotelcachows the years of O tem of money and computers are from OC Indice her or not the produce the company's role of tum OD. All of the above Litom of the payback method SA Cartie sed when managements regardle of refuse tone period to the next O Carnot be used for precis with negal pedic cash from OC Fals to incorporate the time value of money and does not considerator the bad peod On of the above 1. Calculate the payback period for each of the three signore income and your Project A years years b. Calculate the payback period for each of the three projects. Ignore income taxes. (Round your answers to two decimal places.) years Projed B Project C Using the payback method, which project(s) should Cranes choose? Requirement 2. Calculate the NPV for each project. Ignore income taxes (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project Als The NPV of Project is The NPV of Project is Requirement 3. Which projects, if any, would you recommend funding friety explain why method is generally regarded as the pertemed method for projed selection decisions, therefore, the company should consider investing in the pred with Since the company's sted by the can make during the yew more than one projects this they should choose the investments with the making a final decision, the company should consider the nonfinancial live factors of the investments such as the Using only the NPV cacations from norment 2 Canesthouden Enter any number in the edifolds and then continue to the next question ue of $1 ta i Data Table -X B D Round your 1 Project A Project B Project C het present value 2 Projected cash outflow 3 Net initial investment 4 Projected cash inflows 5 Year 1 $ 4,000,000 $ 3,000,000 $ 4,000,000 6 Year 2 Tly explain 7 Year 3 $ 2,550,000 $ 800,000 $ 2,100,000 2,550,000 1,600,000 2,100,000 2,550,000 1,000,000 50,000 2,550,000 25,000 6% 6% 6% selection de 8 Year 4 Required rate of return 9 it can m investment(s) wi qualitative f Print Done