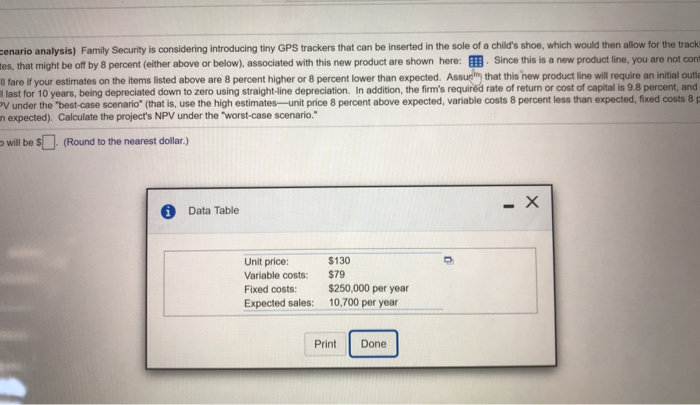

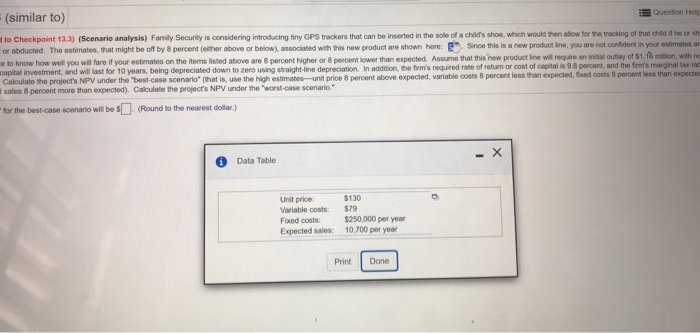

Question Help P13-6 (similar to) Related to Checkpoint 13.3) (Scenario analysis) Family Security is considering Introducing tiny GPS trackers hat can be inserted in the sole of a childs shoe, which would then alow for the tracking of that child if he or she was ever lost or abducted. The estimates, that might be off by 8 percent (ether above or below), assoclated with this new product are shown hene Since this is a new product line, you ane not confident in your estimates and would like to know how well ou will tare if your estimates on the ems isted above are s percent higher or 8 percent lower than expected. Assume that this hew product ine wil roquive an inial outlay of .0 malion with no working captal investment, and wd last for 10years, bengdepredated down to zero uin g straghine depreciaon Inad ton, the f mhighed rate of retim orcost of a tal apetint and the ens mar ru u rate it percent. Caloulate the projects NPV under the best-case scenario" (that is, use the high estimaes-uk price 8 percent above expected, variable costs 8 peroent less than expected, fixed oosts 8 pencent less than expected, and expected sales 8 percent more than expected). Caloulate the project's NPV under the worst-case soenario The NPV for the best case scenario will be $(Round to the nearest dolla I enario analysis) Family Security is considering introducing tiny GPS trackers that can be inserted in the sole of a child's shoe, which would then allow for the track es, that might be o by 8 percent either above or below associated with this new product are shown here: since this is a new prduct line, you are not co fare if your estimates on the items listed above are 8 percent higher or 8 percent lower than expected. Assur that this new p oduct line will require an initial outi last for 10 years, being depreciated down to zero using straight-line depreciation. In addition, the firm's required rate of return or cost of capital is 9.8 percent, and V under the "best-case scenario" (that is, use the high estimates-unit price 8 percent above expected, variable costs 8 percent less than expected, fixed costs 8p n expected). Calculate the project's NPV under the "worst-case scenario." (Round to the nearest dollar.) will be S Data Table $130 $79 $250,000 per year 10,700 per year Unit price: Variable costs: Fixed costs: Expected sales: Print Done 3-6 (similar to) ated to Checkpoint 13.3) (Scenario analysis) Family Security is considering introducing siny GPS trackers that can be inserted in the sole of a child's shoe, which would then allow for the tracking of that child if he or she was EQuestion Help ost or abducted. The estimaes, that might be off by 8 percent (ether above or below) associaned with this ew product are shown hece: . Since this is a new peoduct line, you are not contident in your esatimatoes and d ike to know how well you will tare if your estimates on the ihems listed above are 8 percent higher or 8 percent lower than expected. Assume that this new product line will require an initial outjay of $1.18 mition, with no ng capital investment, and weill last for 10 years, being depreciated down to zero using straight-line depreciation. In addition, the firm's required rate of return or cost of capital is 9.8 percent, and the Sirm's marginal tax rate is 34 -unit price 8 percent above expected, variable costs 8 percent less than expected, fixed costs 8 percent less than expected, and Calculate the projects NPW under the "best-case scenario (that is, use the high estsimates cted sales 8 percent more than expected) Calculate the project's NPV under the worst-case scenario. PV for the best-case scenario will e s(Round to the nearest doila) l i Question Hee (similar to) to Checkpoint 13.3) (Scenario analysis) Family Security is considering introducing tiny GPS trackers that can be inserted in the sole of a child's shoe, which would then allow tor the tracking of that child it he or sh or abducted. The estimates, that might be off by 8 percent (either above or below, associated with this new product are shown here: Since this is a new product line, you are not conident in your esimanes ar e to know how well you will fare if your estimates on the items lissed above are 8 percent higher or 8 peroent lower than expected. Assume that this hew product ine Caloulate the project's NIPV under the "best-case scenario (that is, use the high estimates-unit price 8 percent above expected, variable costs 8 percent sales 8 percent more than expected). Calculate the project's NPV under the "worst-case scenario. wil require an initial outlay of $1 1.18 million, with ne of return or cost of capital is 9.8 percent, and the frm's marginal tax rat less than expected, fxed costs 8 percent less than expecte for the best-case scenario will be S(Round to the nearest doillar.) Data Table $130 Unit price Variable costs: $79 Fixed costs $250,000 per year Expected sales: 10,700 per year Print Done