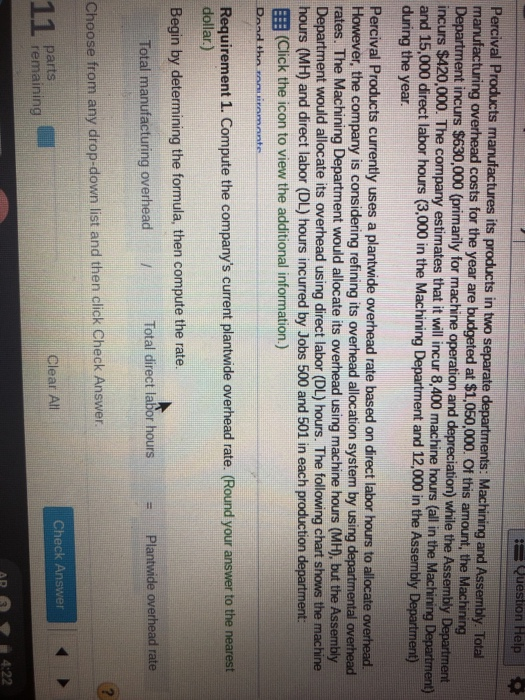

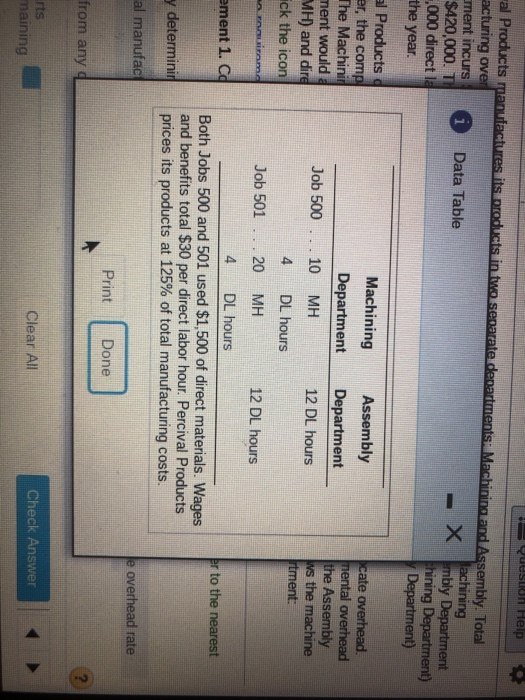

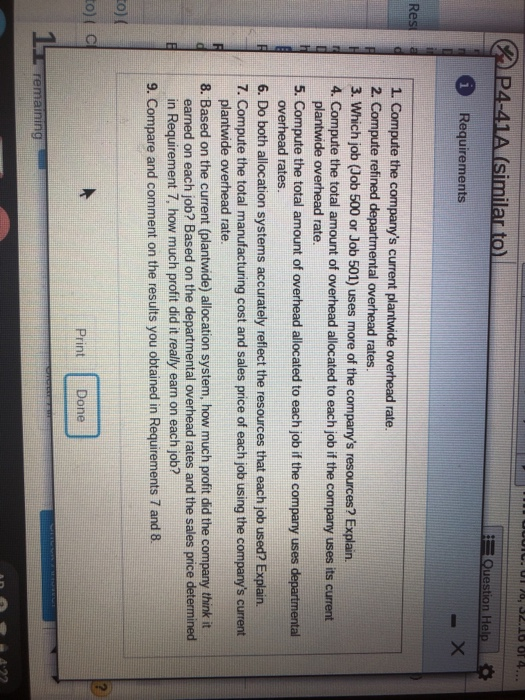

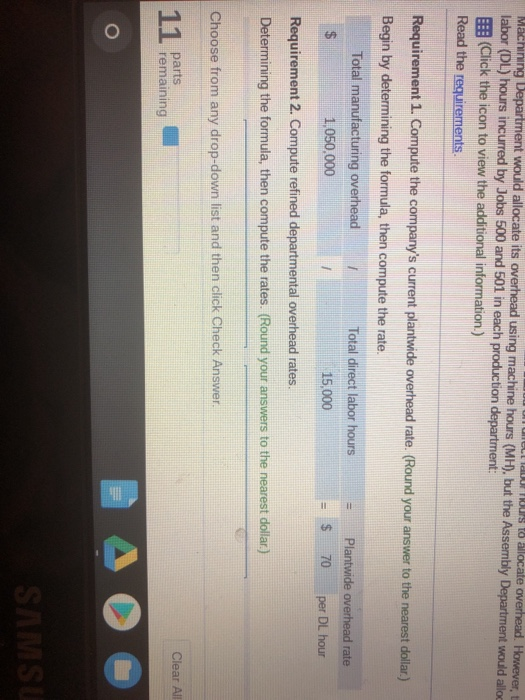

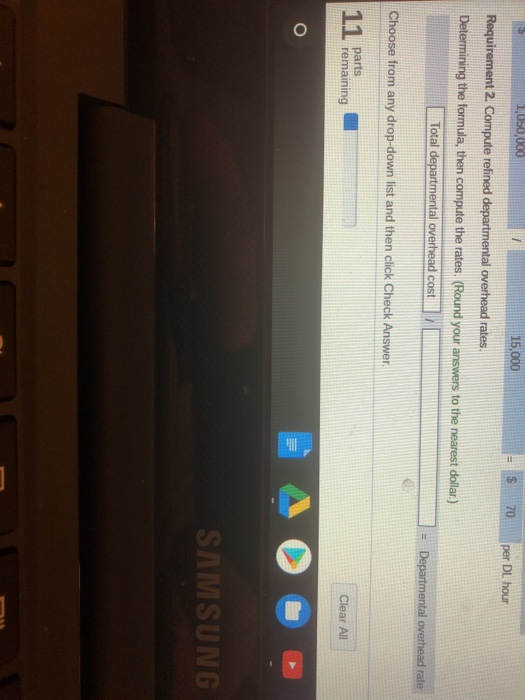

Question Help Percival Products manufactures its products in two separate departments: Machining and Assembly. Total manufacturing overhead costs for the year are budgeted at $1,050,000. Of this amount, the Machining Department incurs $630,000 (primarily for machine operation and depreciation) incurs $420,000. and 15,000 direct labor hours (3,000 in the during the year while the Assembly Department The company estimates that it will incur 8,400 machine hours (all in the Machining Department) Machining Department and 12,000 in the Assembly Department) Percival Products currently uses a plantwide overhead rate based on direct labor hours to allocate overhead er, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labor (DL) hours. The following chart shows the machine hours (MH) and direct labor (DL) hours incurred by Jobs 500 and 501 in each production department EEB (Click the icon to view the additional information.) Requirement 1. Compute the company's current plantwide overhead rate. (Round your answer to the nearest dollar.) Begin by determining the formula, then compute the rate. Total direct labor hours Plantwide overhead rate Total manufacturing overhead/ Choose from any drop-down list and then click Check Answer Check Answer Clear All parts remaining al Products acturing ov ment incurs $420,000. T 000 directl Sembly. Total achining Data Table ning l Products er, the comp he Machini ment would MH) and dire ck the icorn Machining Assembly DepartmentDepartment 12 DL hours cate overhead. ental overhead the Assembly ws the machine tment Job 500. 10 MH 4 DL hours Job 501 20 MH 12 DL hours 4 DL hours ment 1. Co r to the nearest Both Jobs 500 and 501 used $1,500 of direct materials. Wages and benefits total $30 per direct labor hour. Percival Products | prices its products at 125% of total manufacturing costs. y determini| e overhead rate al manufac Print Done from any Clear All Check Answer maining P4-41A (similar to) Requirements Res 1. Compute the company's curent plantwide overthead rate 2. Compute refined departmental overhead rates. 3. Which job (Job 500 or Job 501) uses more of the company's resources? Explain. 4. Compute the total amount of overhead allocated to each job if the company uses its current plantwide overhead rate. 5. Compute the total amount of overhead allocated to each job if the company uses departmental overhead rates. 6. Do both allocation systems accurately reflect the resources that each job used? Explain. 7. Compute the total manufacturing cost and sales price of each job using the company's current plantwide overhead rate 8. Based on the current (plantwide) allocation system, how much profit did the company think it earned on each job? Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job? 9. Compare and comment on the results you obtained in Requirements 7 and 8. to)I C Print Done remainin Machining Department would allocate its labor (DL) hours incurred by Jobs 500 and 501 in each production department: EE (Click the icon to view the additional information.) Read the requirements. using machine hours (MH), but the Assembly Department would allo s current plantwide overhead rate. (Round your answer to the nearest Begin by determining the formula, then compute the rate Total manufacturing overhead 1,050,000 Total direct labor hours 15,000 =$ 70 per DL hour Requirement 2. Compute refined departmental overhead rates. Determining the formula, then compute the rates. (Round your answers to the nearest dolar.) Choose from any drop-down list and then click Check Answer Clear All parts remaining 70 per Dl hour 15,000 per DL hour overhead rates uirement 2. Compute refined Determining the formula, then compute the rates. (Round your answers to the nearest dollar.) Total departmental overhead cost Choose from any drop-down list and then click Check Answer 11 remaining Clear All