Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Help Roan Hoffman is evaluating a business opportunity to sell premium car wax at vintage car shows. The wax is sold in 64-ounce tubs

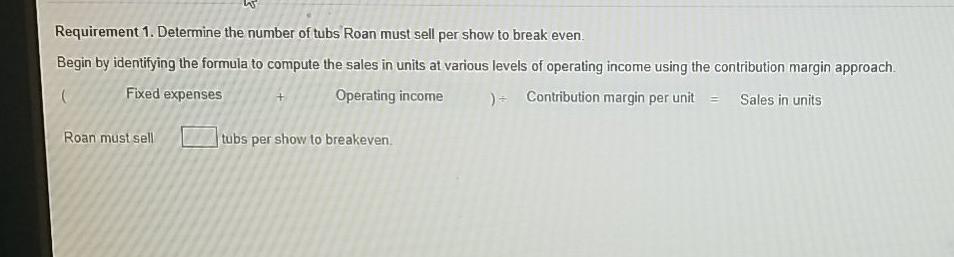

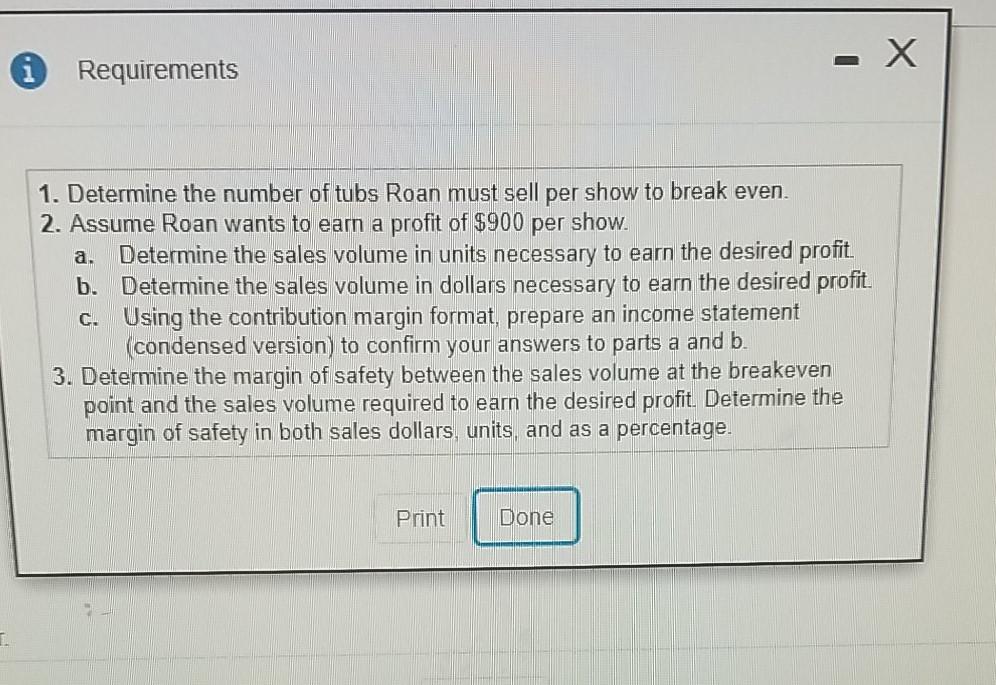

Question Help Roan Hoffman is evaluating a business opportunity to sell premium car wax at vintage car shows. The wax is sold in 64-ounce tubs Roan can buy the premium wax at a wholesale cost of $32 per tub He plans to sell the premium wax for $62 per tub He estimates foxed costs such as travel costs booth rental cost and lodging to be $600 per car show Read the equirement Requirement 1. Determine the number of tubs Roan must sell per show to break even Begin by identifying the formula to compute the sales in units at various levels of operating income using the contribution margin approach. Fixed expenses Operating income ) Contribution margin per unit = Sales in units Roan must sell tubs per show to breakeven . i Requirements a. 1. Determine the number of tubs Roan must sell per show to break even. 2. Assume Roan wants to earn a profit of $900 per show Determine the sales volume in units necessary to earn the desired profit. b. Determine the sales volume in dollars necessary to earn the desired profit c. Using the contribution margin format, prepare an income statement (condensed version) to confirm your answers to parts a and b 3. Determine the margin of safety between the sales volume at the breakeven point and the sales volume required to earn the desired profit. Determine the margin of safety in both sales dollars, units, and as a percentage. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started