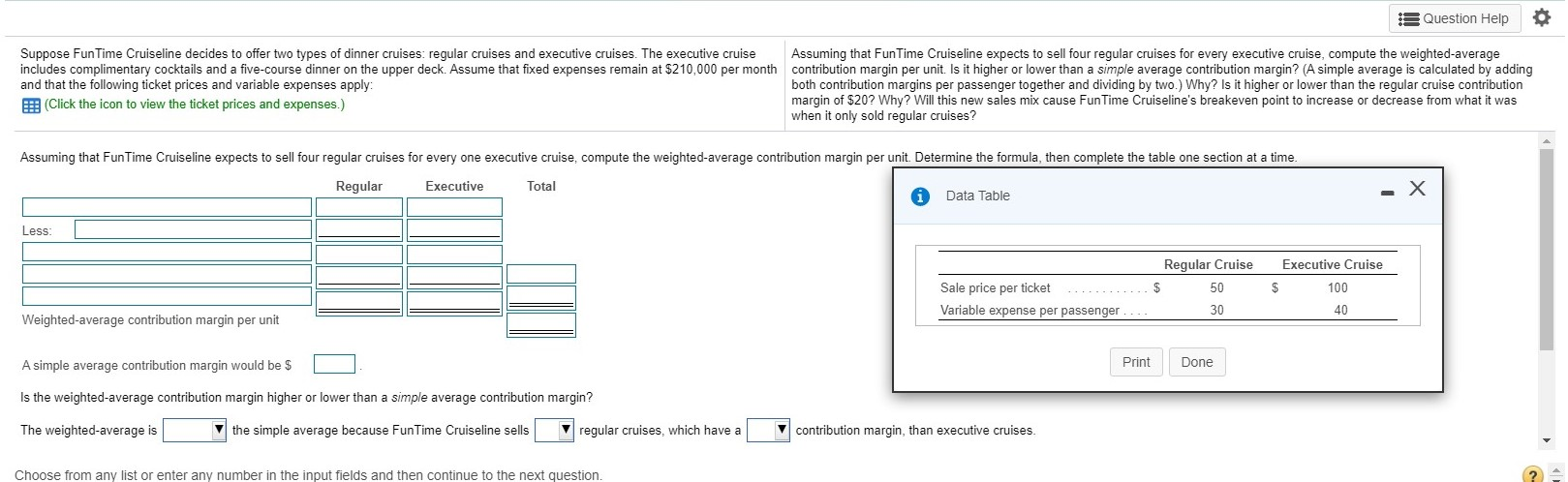

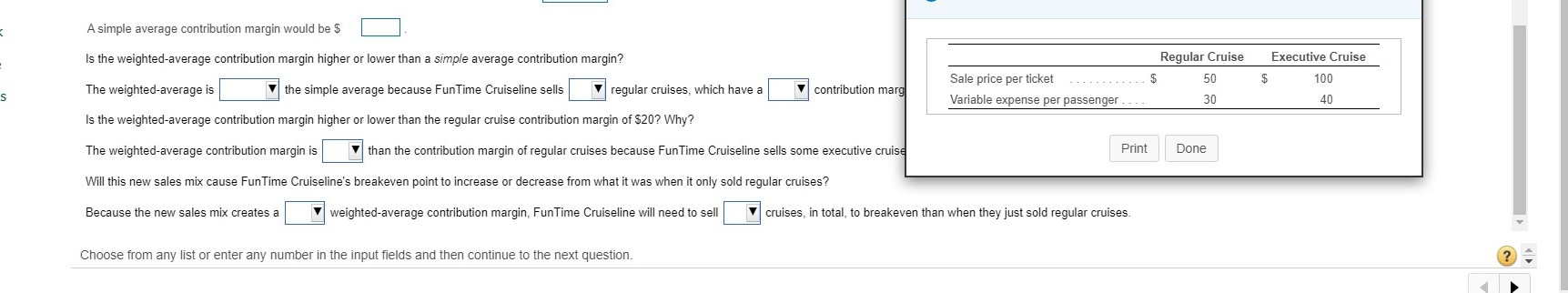

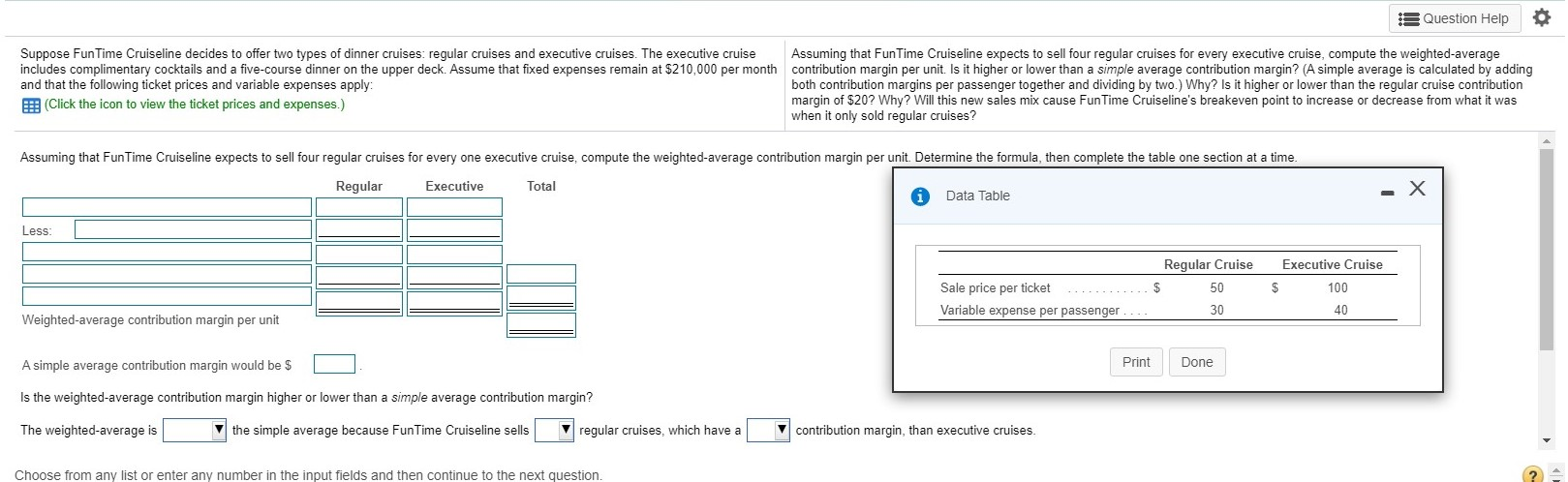

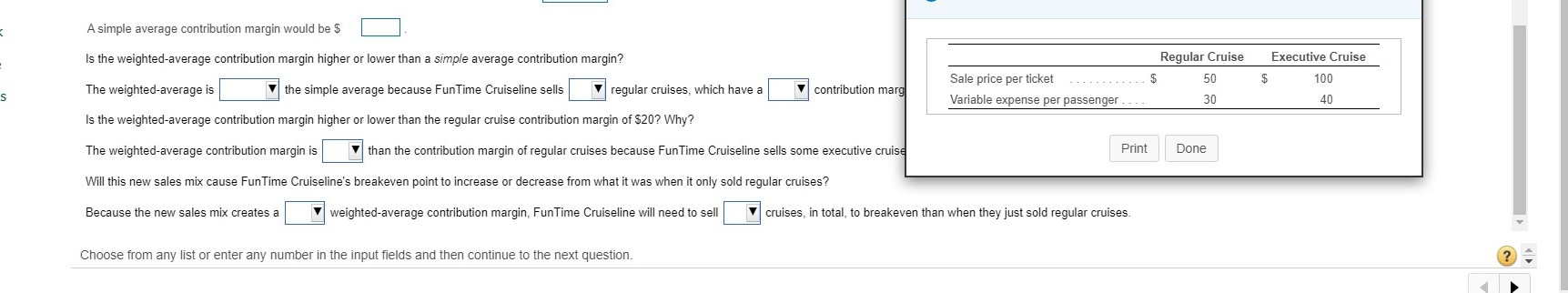

* Question Help Suppose FunTime Cruiseline decides to offer two types of dinner cruises: regular cruises and executive cruises. The executive cruise Assuming that FunTime Cruiseline expects to sell four regular cruises for every executive cruise, compute the weighted-average includes complimentary cocktails and a five-course dinner on the upper deck. Assume that fixed expenses remain at $210,000 per month contribution margin per unit. Is it higher or lower than a simple average contribution margin? (A simple average is calculated by adding and that the following ticket prices and variable expenses apply: both contribution margins per passenger together and dividing by two.) Why? Is it higher or lower than the regular cruise contribution (Click the icon to view the ticket prices and expenses.) margin of $20? Why? Will this new sales mix cause FunTime Cruiseline's breakeven point to increase or decrease from what it was when it only sold regular cruises? Assuming that FunTime Cruiseline expects to sell four regular cruises for every one executive cruise, compute the weighted average contribution margin per unit. Determine the formula, then complete the table one section at a time. Regular Executive Total Data Table Less: Regular Cruise 50 30 Executive Cruise 100 Sale price per ticket Variable expense per passenger $ 40 Weighted average contribution margin per unit A simple average contribution margin would be $ Print Done Is the weighted-average contribution margin higher or lower than a simple average contribution margin? The weighted average is the simple average because FunTime Cruiseline sells V regular cruises, which have a contribution margin, than executive cruises. Choose from any list or enter any number in the input fields and then continue to the next question. A simple average contribution margin would be $ Regular Cruise Executive Cruise Is the weighted average contribution margin higher or lower than a simple average contribution margin? The weighted average is the simple average because FunTime Cruiseline sells regular cruises, which have a $ 50 $ 100 contribution marg Sale price per ticket Variable expense per passenger S 30 40 Is the weighted average contribution margin higher or lower than the regular cruise contribution margin of $20? Why? The weighted average contribution margin is than the contribution margin of regular cruises because FunTime Cruiseline sells some executive cruise Print Done Will this new sales mix cause FunTime Cruiseline's breakeven point to increase or decrease from what it was when it only sold regular cruises? Because the new sales mix creates a weighted average contribution margin, FunTime Cruiseline will need to sell cruises, in total, to breakeven than when they just sold regular cruises Choose from any list or enter any number in the input fields and then continue to the next question. * Question Help Suppose FunTime Cruiseline decides to offer two types of dinner cruises: regular cruises and executive cruises. The executive cruise Assuming that FunTime Cruiseline expects to sell four regular cruises for every executive cruise, compute the weighted-average includes complimentary cocktails and a five-course dinner on the upper deck. Assume that fixed expenses remain at $210,000 per month contribution margin per unit. Is it higher or lower than a simple average contribution margin? (A simple average is calculated by adding and that the following ticket prices and variable expenses apply: both contribution margins per passenger together and dividing by two.) Why? Is it higher or lower than the regular cruise contribution (Click the icon to view the ticket prices and expenses.) margin of $20? Why? Will this new sales mix cause FunTime Cruiseline's breakeven point to increase or decrease from what it was when it only sold regular cruises? Assuming that FunTime Cruiseline expects to sell four regular cruises for every one executive cruise, compute the weighted average contribution margin per unit. Determine the formula, then complete the table one section at a time. Regular Executive Total Data Table Less: Regular Cruise 50 30 Executive Cruise 100 Sale price per ticket Variable expense per passenger $ 40 Weighted average contribution margin per unit A simple average contribution margin would be $ Print Done Is the weighted-average contribution margin higher or lower than a simple average contribution margin? The weighted average is the simple average because FunTime Cruiseline sells V regular cruises, which have a contribution margin, than executive cruises. Choose from any list or enter any number in the input fields and then continue to the next question. A simple average contribution margin would be $ Regular Cruise Executive Cruise Is the weighted average contribution margin higher or lower than a simple average contribution margin? The weighted average is the simple average because FunTime Cruiseline sells regular cruises, which have a $ 50 $ 100 contribution marg Sale price per ticket Variable expense per passenger S 30 40 Is the weighted average contribution margin higher or lower than the regular cruise contribution margin of $20? Why? The weighted average contribution margin is than the contribution margin of regular cruises because FunTime Cruiseline sells some executive cruise Print Done Will this new sales mix cause FunTime Cruiseline's breakeven point to increase or decrease from what it was when it only sold regular cruises? Because the new sales mix creates a weighted average contribution margin, FunTime Cruiseline will need to sell cruises, in total, to breakeven than when they just sold regular cruises Choose from any list or enter any number in the input fields and then continue to the next