Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Help Suppose you group all the stocks in the world into mutually exclusive portfolios (each stock is in only one portfolio): growth stocks and

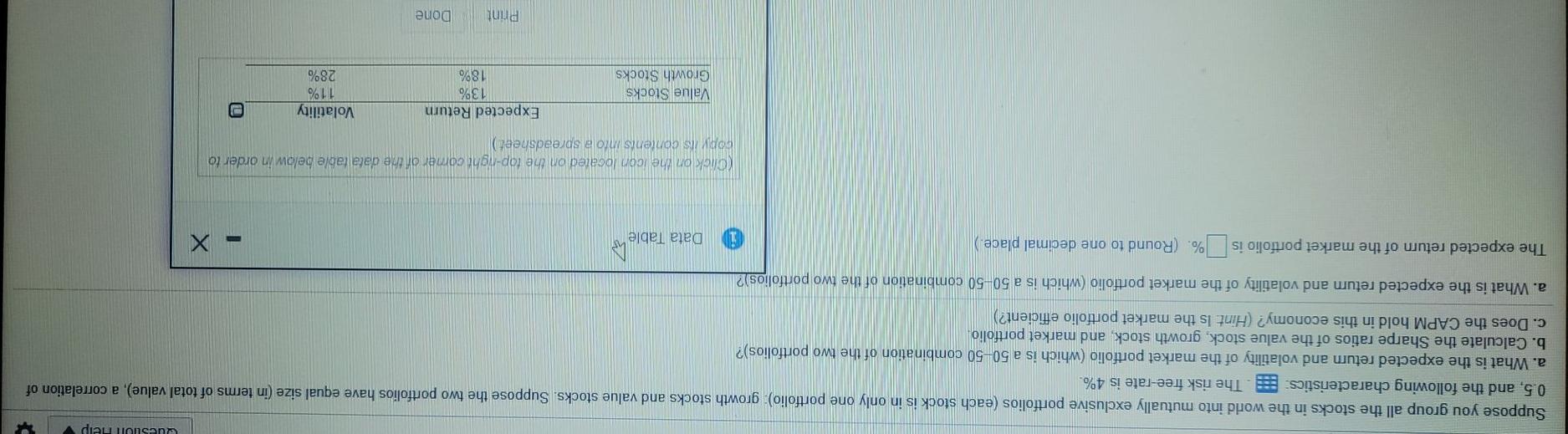

Question Help Suppose you group all the stocks in the world into mutually exclusive portfolios (each stock is in only one portfolio): growth stocks and value stocks. Suppose the two portfolios have equal size (in terms of total value), a correlation of 0.5, and the following characteristics: es. The risk free-rate is 4%. a. What is the expected return and volatility of the market portfolio (which is a 50-50 combination of the two portfolios)? b. Calculate the Sharpe ratios of the value stock, growth stock, and market portfolio c. Does the CAPM hold in this economy? (Hint Is the market portfolio efficient?) a. What is the expected return and volatility of the market portfolio (which is a 50-50 combination of the two portfolios)? The expected return of the market portfolio is %. (Round to one decimal place. IN Data Table Click on the icon located on the top-night comer or the date table below in order to cop its contents to a spreadsheet) Value Stocks Growth Stocks Expected Return 13% 18% Volatility 11% 28% Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started