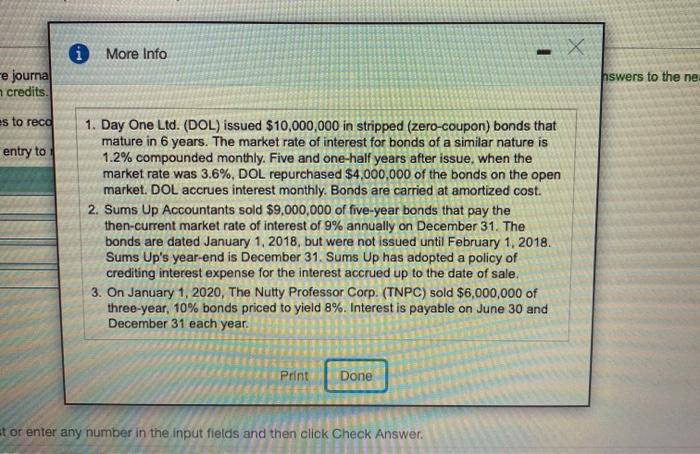

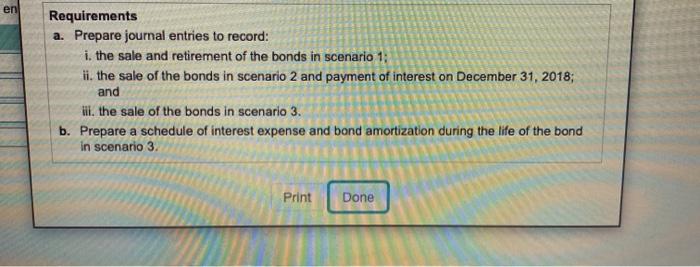

Question Help Three Independent situations follow: (Click the icon to view the independent situations.) Read the requirements More Info 1 e journal credits nswers to the ne es to reco entry to 1. Day One Ltd. (DOL) issued $10,000,000 in stripped (zero-coupon) bonds that mature in 6 years. The market rate of interest for bonds of a similar nature is 1.2% compounded monthly. Five and one-half years after issue, when the market rate was 3.6%, DOL repurchased $4,000,000 of the bonds on the open market. DOL accrues interest monthly. Bonds are carried at amortized cost. 2. Sums Up Accountants sold $9,000,000 of five-year bonds that pay the then-current market rate of interest of 9% annually on December 31. The bonds are dated January 1, 2018, but were not issued until February 1, 2018. Sums Up's year-end is December 31. Sums Up has adopted a policy of crediting interest expense for the interest accrued up to the date of sale. 3. On January 1, 2020, The Nutty Professor Corp. (TNPC) sold $6,000,000 of three-year, 10% bonds priced to yield 8%. Interest is payable on June 30 and December 31 each year. Print Done et or enter any number in the input fields and then click Check Answer. en Requirements a. Prepare journal entries to record: i. the sale and retirement of the bonds in scenario 1: fi. the sale of the bonds in scenario 2 and payment of interest on December 31, 2018; and Hi, the sale of the bonds in scenario 3. b. Prepare a schedule of interest expense and bond amortization during the life of the bond in scenario 3 Print Done Question Help Three Independent situations follow: (Click the icon to view the independent situations.) Read the requirements More Info 1 e journal credits nswers to the ne es to reco entry to 1. Day One Ltd. (DOL) issued $10,000,000 in stripped (zero-coupon) bonds that mature in 6 years. The market rate of interest for bonds of a similar nature is 1.2% compounded monthly. Five and one-half years after issue, when the market rate was 3.6%, DOL repurchased $4,000,000 of the bonds on the open market. DOL accrues interest monthly. Bonds are carried at amortized cost. 2. Sums Up Accountants sold $9,000,000 of five-year bonds that pay the then-current market rate of interest of 9% annually on December 31. The bonds are dated January 1, 2018, but were not issued until February 1, 2018. Sums Up's year-end is December 31. Sums Up has adopted a policy of crediting interest expense for the interest accrued up to the date of sale. 3. On January 1, 2020, The Nutty Professor Corp. (TNPC) sold $6,000,000 of three-year, 10% bonds priced to yield 8%. Interest is payable on June 30 and December 31 each year. Print Done et or enter any number in the input fields and then click Check Answer. en Requirements a. Prepare journal entries to record: i. the sale and retirement of the bonds in scenario 1: fi. the sale of the bonds in scenario 2 and payment of interest on December 31, 2018; and Hi, the sale of the bonds in scenario 3. b. Prepare a schedule of interest expense and bond amortization during the life of the bond in scenario 3 Print Done