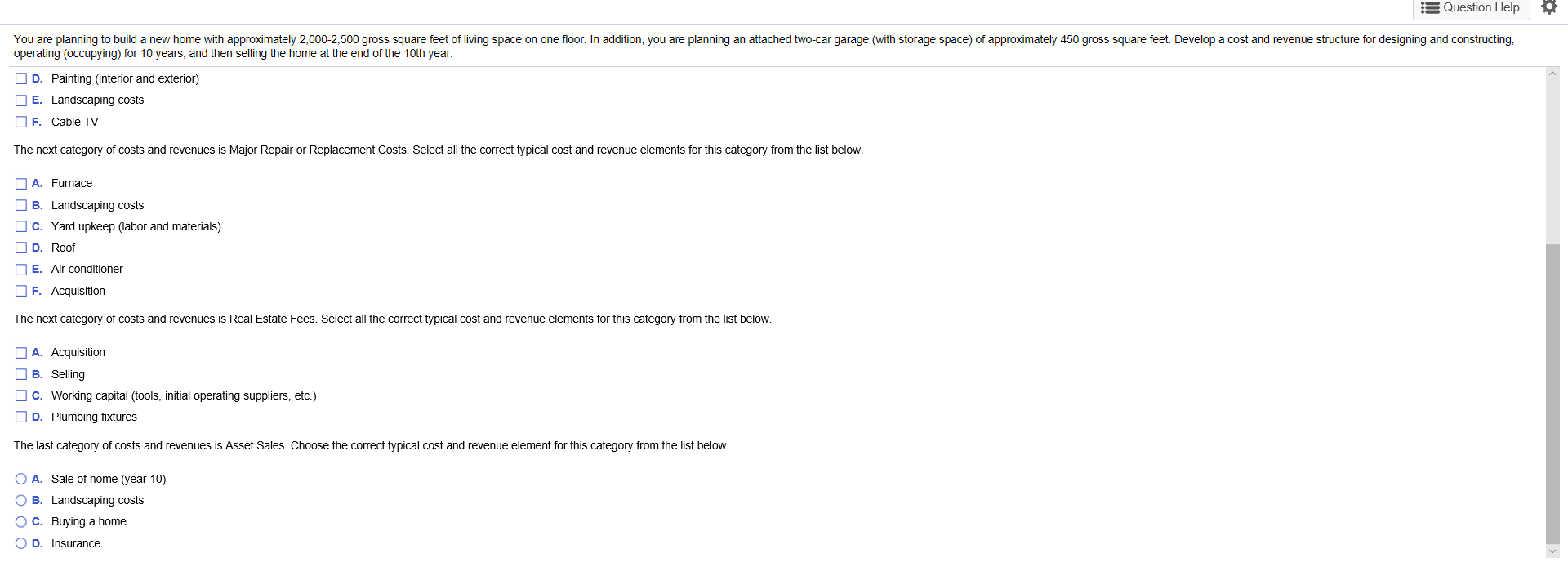

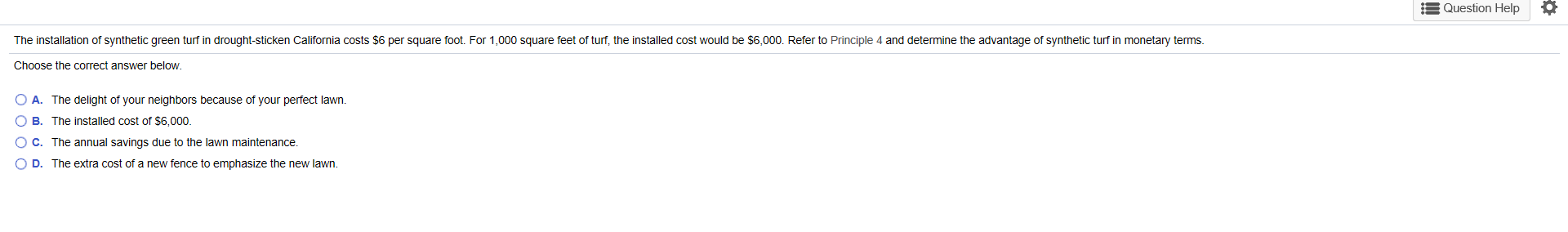

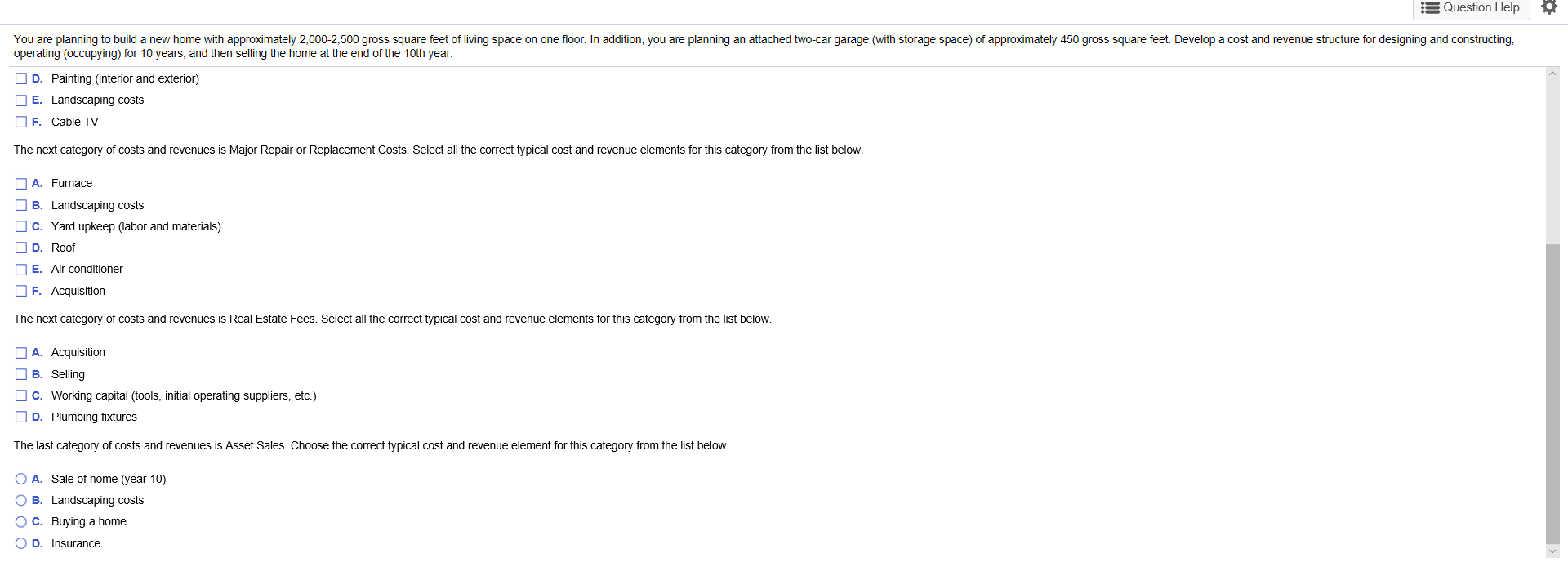

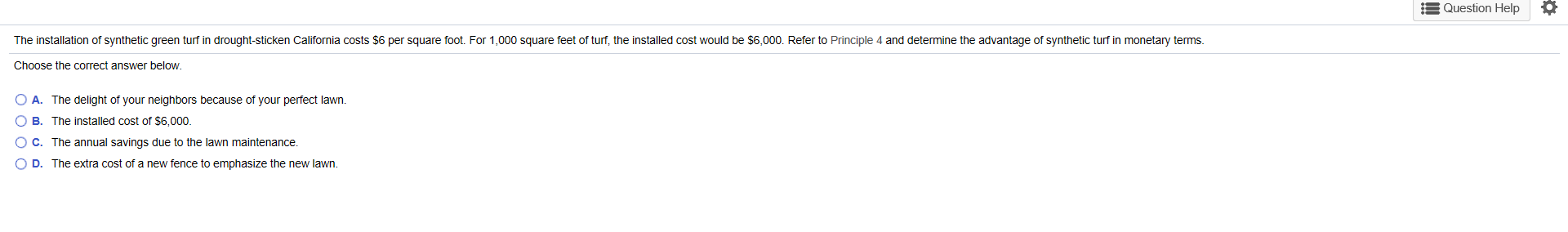

Question Help You are planning to build a new home with approximately 2,000-2,500 gross square feet of living space on one floor. In addition, you are planning an attached two-car garage (with storage space) of approximately 450 gross square feet. Develop a cost and revenue structure for designing and constructing, operating (occupying) for 10 years, and then selling the home at the end of the 10th year. D. Painting (interior and exterior) E. Landscaping costs F. Cable TV The next category of costs and revenues is Major Repair or Replacement Costs. Select all the correct typical cost and revenue elements for this category from the list below. A. Furnace B. Landscaping costs C. Yard upkeep (labor and materials) D. Roof E. Air conditioner F. Acquisition The next category of costs and revenues is Real Estate Fees. Select all the correct typical cost and revenue elements for this category from the list below. A. Acquisition B. Selling C. Working capital (tools, initial operating suppliers, etc.) D. Plumbing fixtures The last category of costs and revenues is ASset Sales. Choose the correct typical cost and revenue element for this category from the list below O A. Sale of home (year 10) B. Landscaping costs O C. Buying a home O D. Insurance Question Help The installation of synthetic green turf in drought-sticken California costs $6 per square foot. For 1,000 square feet of turf, the installed cost would be $6,000. Refer to Principle 4 and determine the advantage of synthetic turf in monetary terms Choose the correct answer below. OA. The delight of your neighbors because of your perfect lawn. O B. The installed cost of $6,000. O C. The annual savings due to the lawn maintenance. D. The extra cost of a new fence to emphasize the new lawn. Question Help You are planning to build a new home with approximately 2,000-2,500 gross square feet of living space on one floor. In addition, you are planning an attached two-car garage (with storage space) of approximately 450 gross square feet. Develop a cost and revenue structure for designing and constructing, operating (occupying) for 10 years, and then selling the home at the end of the 10th year. D. Painting (interior and exterior) E. Landscaping costs F. Cable TV The next category of costs and revenues is Major Repair or Replacement Costs. Select all the correct typical cost and revenue elements for this category from the list below. A. Furnace B. Landscaping costs C. Yard upkeep (labor and materials) D. Roof E. Air conditioner F. Acquisition The next category of costs and revenues is Real Estate Fees. Select all the correct typical cost and revenue elements for this category from the list below. A. Acquisition B. Selling C. Working capital (tools, initial operating suppliers, etc.) D. Plumbing fixtures The last category of costs and revenues is ASset Sales. Choose the correct typical cost and revenue element for this category from the list below O A. Sale of home (year 10) B. Landscaping costs O C. Buying a home O D. Insurance Question Help The installation of synthetic green turf in drought-sticken California costs $6 per square foot. For 1,000 square feet of turf, the installed cost would be $6,000. Refer to Principle 4 and determine the advantage of synthetic turf in monetary terms Choose the correct answer below. OA. The delight of your neighbors because of your perfect lawn. O B. The installed cost of $6,000. O C. The annual savings due to the lawn maintenance. D. The extra cost of a new fence to emphasize the new lawn