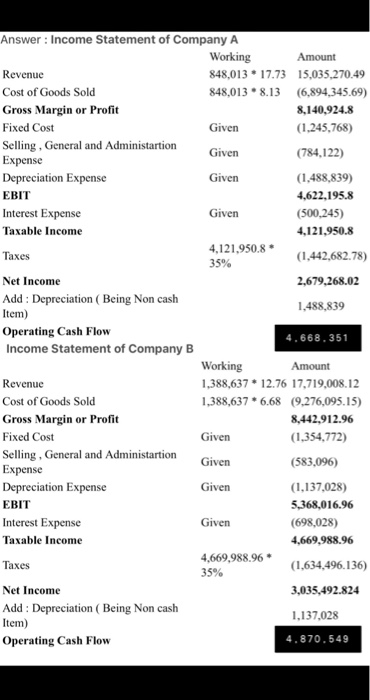

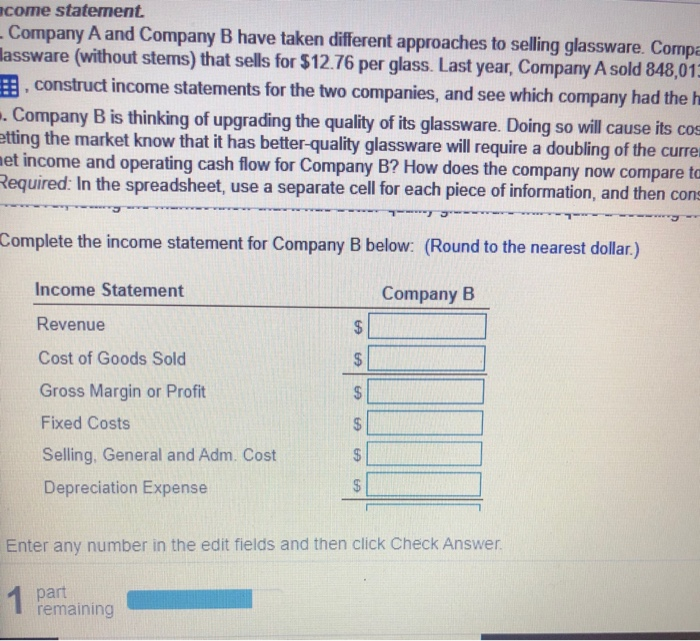

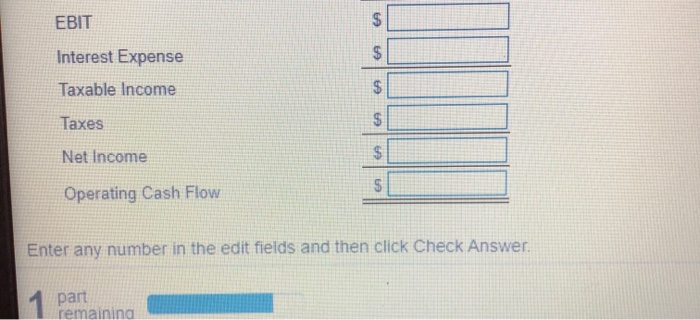

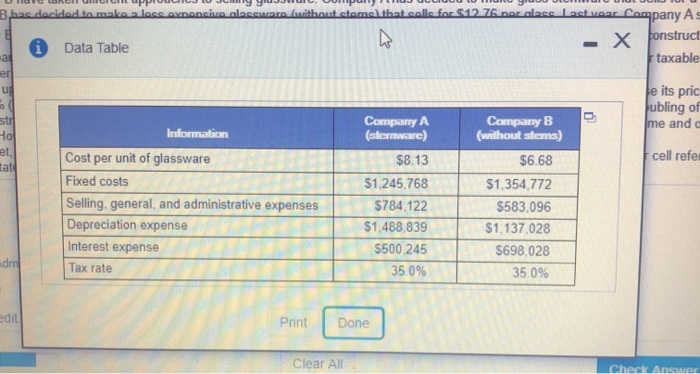

Question Hep o Income statement a. Company A and Company have taken different approaches to selling glowww Company has decided to make a steware that is for a premium at 517 3er Company has decided to make a less expensive www.are without stems that sells for $12.76 per glass Last year, Company Asold 348013 med Company Bod 1.388.637 Given the towing additional Womation about each firm in the popup Window .construct income statements for the two companies, and see which company had the higher gross pro revenue un cost of goods so higher EBIT, higher table income here income, and higher OCH b. Company is thinking of upgrading the quality of the glass Doing so will causes cool per unit the by 17%, but beves canales price by 30% tes vome will by 11% (of contokome. However, leting the market know that it has better quality glasware a doubling of the consegneral and ecosing a spreadsheet, redo Company's income statement for this scenario Does improve net income and operating cash fow for Company B? How does the company now.compare to Company A? Required in the spreadsheet use a separate call for each piece of information, and then contact the income statement by using a formular cell reference for each individual line of the statement Feed Co Answer: Income Statement of Company A Working Amount Revenue 848,013 17.73 15,035,270.49 Cost of Goods Sold 848,013 * 8.13 (6,894,345.69) Gross Margin or Profit 8,140,924.8 Fixed Cost Given (1,245,768) Selling, General and Administartion Given (784,122) Expense Depreciation Expense Given (1,488,839) EBIT 4,622,195.8 Interest Expense Given (500,245) Taxable income 4,121,950.8 4,121,950.8 Taxes 35% (1,442,682.78) Net Income 2,679,268.02 Add : Depreciation ( Being Non cash Item) 1,488,839 Operating Cash Flow 4.668.351 Income Statement of Company B Working Amount Revenue 1,388,637 * 12.76 17,719,008.12 Cost of Goods Sold 1,388,637 * 6.68 (9,276,095.15) Gross Margin or Profit 8,442,912.96 Fixed Cost Given (1,354,772) Selling, General and Administartion Given (583,096) Expense Depreciation Expense Given (1,137,028) EBIT 5,368,016.96 Interest Expense Given (698,028) Taxable Income 4,669,988.96 4,669,988.96 Taxes 35% (1,634,496.136) Net Income 3,035,492.824 Add : Depreciation ( Being Non cash 1,137,028 Item) Operating Cash Flow 4.870.549 come statement. - Company A and Company B have taken different approaches to selling glassware. Compa lassware (without stems) that sells for $12.76 per glass. Last year, Company A sold 848,015 E. construct income statements for the two companies, and see which company had the h .. Company B is thinking of upgrading the quality of its glassware. Doing so will cause its cos etting the market know that it has better-quality glassware will require a doubling of the curre met income and operating cash flow for Company B? How does the company now compare to Required: In the spreadsheet, use a separate cell for each piece of information, and then cons wwww Complete the income statement for Company B below: (Round to the nearest dollar.) Income Statement Company B Revenue $ Cost of Goods Sold Gross Margin or Profit Fixed Costs Selling, General and Adm. Cost Depreciation Expense $ $ $ Enter any number in the edit fields and then click Check Answer 1 part remaining EBIT $ $ Interest Expense Taxable Income 69 Taxes $ Net Income EA S Operating Cash Flow Enter any number in the edit fields and then click Check Answer 1 part remainina 8 bae decided to make a lace evnensive alaseuare (cithout stomak that calls for $12.76 nor alace Last year Company As 1 Data Table taxable w . X ponstruct al er ui je its pric publing of Ime and a Information stri to et, tat cell refer Cost per unit of glassware Fixed costs Selling, general, and administrative expenses Depreciation expense Interest expense Tax rate Company A (stemware) $8.13 $1,245,768 $784.122 $1,488.839 $500 245 35 0% Company B (without stems) $6.68 $1,354,772 $583.096 $1,137,028 $698,028 35.0% mar edit Print Done Clear All Check