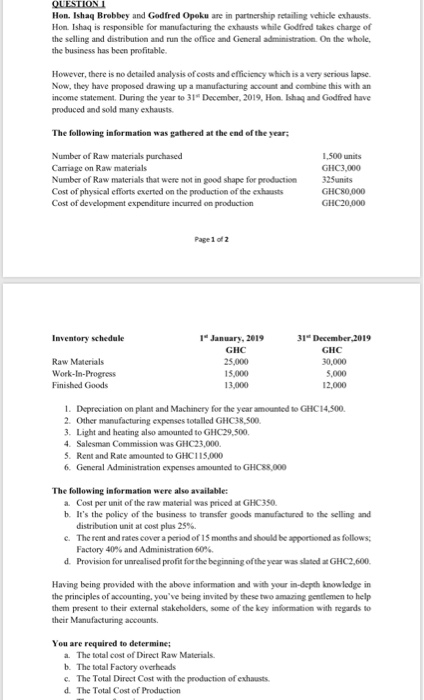

QUESTION Hon. Ishaq Brobbey and Godfred Opeku are in partnership retailing vehicle exhausts. Hon. Ishaq is responsible for manufacturing the exhausts while Godfred takes charge of the selling and distribution and run the office and General administration. On the whole the business has been profitable. However, there is no detailed analysis of costs and efficiency which is a very serious lapse. Now, they have proposed drawing up a manufacturing account and combine this with an income statement. During the year to 31" December, 2019, Hon. Ishaq and Godfred have produced and sold many exhausts. The following information was gathered at the end of the year; Number of Raw materials purchased 1.500 units Carriage on Raw materials GHC3,000 Number of Raw materials that were not in good shape for production 325 units Cost of physical efforts exerted on the production of the exhausts GHC80,000 Cost of development expenditure incurred on production GHC20,000 Page 1 of 2 Inventory schedule Raw Materials Work-In-Progress Finished Goods 14 January, 2019 GHC 25,000 15,000 13,000 31 December,2019 GHC 30,000 5.000 12.000 1. Depreciation on plant and Machinery for the year amounted to GHC14.500. 2. Other manufacturing expenses totalled GHC38,500. 3. Light and heating also amounted to GHC29.500 4. Salesman Commission was GHC23,000 5. Rent and Rate amounted to GHC115.000 6. General Administration expenses amounted to GHCS8,000 The following information were also available: a. Cost per unit of the raw material was priced at GHC350. b. It's the policy of the business to transfer goods manufactured to the selling and distribution unit at cost plus 25% c. The rent and rates cover a period of 15 months and should be apportioned as follows: Factory 40% and Administration 60% d. Provision for unrealised profit for the beginning of the year was slated GHC2,600. Having being provided with the above information and with your in-depth knowledge in the principles of accounting, you've being invited by these two amazing gentlemen to help them present to their external stakeholders, some of the key information with regards to their Manufacturing accounts. You are required to determine; a. The total cost of Direct Raw Materials. b. The total Factory overheads c. The Total Direct Cost with the production of exhausts. d. The Total Cost of Production