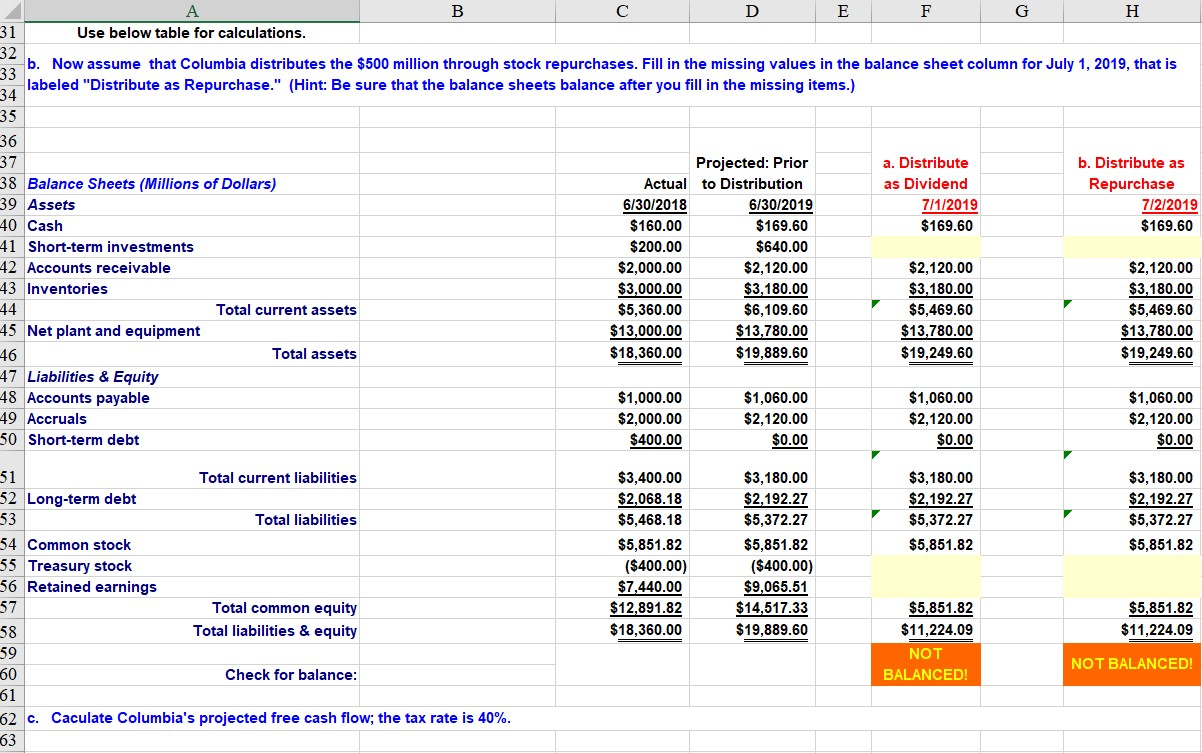

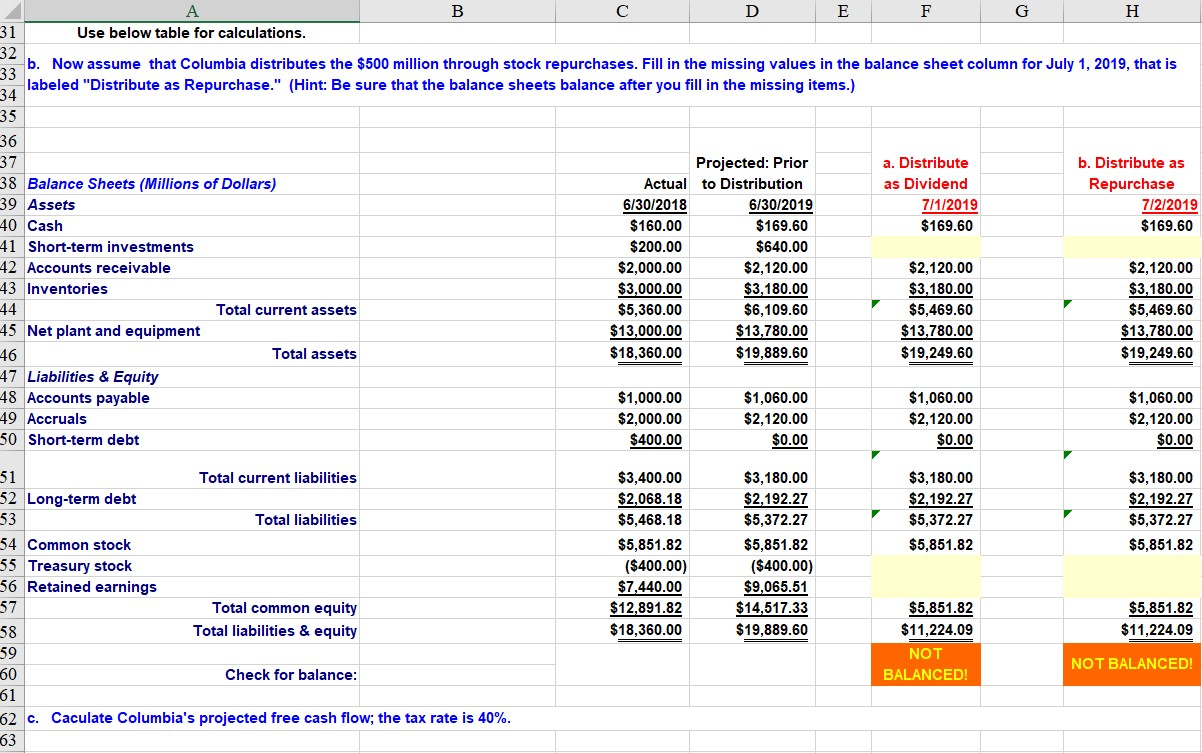

Question: How do you calculate each highlighted cell and answer?

Question: How do you calculate each highlighted cell and answer?

B D E F G H 31 Use below table for calculations. 32 b. Now assume that Columbia distributes the $500 million through stock repurchases. Fill in the missing values in the balance sheet column for July 1, 2019, that is 33 34 labeled "Distribute as Repurchase." (Hint: Be sure that the balance sheets balance after you fill in the missing items.) 35 a. Distribute as Dividend 7/1/2019 $169.60 b. Distribute as Repurchase 7/2/2019 $169.60 36 37 38 Balance Sheets (Millions of Dollars) 39 Assets 40 Cash 41 Short-term investments 42 Accounts receivable 43 Inventories 44 Total current assets 45 Net plant and equipment 46 Total assets 47 Liabilities & Equity 48 Accounts payable 49 Accruals 50 Short-term debt Projected: Prior Actual to Distribution 6/30/2018 6/30/2019 $160.00 $169.60 $200.00 $640.00 $2,000.00 $2,120.00 $3,000.00 $3,180.00 $5,360.00 $6,109.60 $13,000.00 $13,780.00 $18,360.00 $19,889.60 $2,120.00 $3,180.00 $5,469.60 $13,780.00 $19,249.60 $2,120.00 $3,180.00 $5,469.60 $13,780.00 $19,249.60 $1,000.00 $2,000.00 $400.00 $1,060.00 $2,120.00 $0.00 $1,060.00 $2,120.00 $0.00 $1,060.00 $2,120.00 $0.00 $3,180.00 $2,192.27 $5,372.27 $5.851.82 $3,180.00 $2,192.27 $5,372.27 $5,851.82 51 Total current liabilities 52 Long-term debt 53 Total liabilities 54 Common stock 55 Treasury stock 56 Retained earnings 57 Total common equity 58 Total liabilities & equity 59 60 Check for balance: 61 62 c. Caculate Columbia's projected free cash flow; the tax rate is 40%. 63 $3,400.00 $2,068.18 $5,468.18 $5,851.82 ($400.00) $7,440.00 $12,891.82 $18,360.00 $3,180.00 $2,192.27 $5,372.27 $5,851.82 ($400.00) $9,065.51 $14,517.33 $19,889.60 $5,851.82 $11,224.09 $5,851.82 $11,224.09 NOT BALANCED! NOT BALANCED! B D E F G H 31 Use below table for calculations. 32 b. Now assume that Columbia distributes the $500 million through stock repurchases. Fill in the missing values in the balance sheet column for July 1, 2019, that is 33 34 labeled "Distribute as Repurchase." (Hint: Be sure that the balance sheets balance after you fill in the missing items.) 35 a. Distribute as Dividend 7/1/2019 $169.60 b. Distribute as Repurchase 7/2/2019 $169.60 36 37 38 Balance Sheets (Millions of Dollars) 39 Assets 40 Cash 41 Short-term investments 42 Accounts receivable 43 Inventories 44 Total current assets 45 Net plant and equipment 46 Total assets 47 Liabilities & Equity 48 Accounts payable 49 Accruals 50 Short-term debt Projected: Prior Actual to Distribution 6/30/2018 6/30/2019 $160.00 $169.60 $200.00 $640.00 $2,000.00 $2,120.00 $3,000.00 $3,180.00 $5,360.00 $6,109.60 $13,000.00 $13,780.00 $18,360.00 $19,889.60 $2,120.00 $3,180.00 $5,469.60 $13,780.00 $19,249.60 $2,120.00 $3,180.00 $5,469.60 $13,780.00 $19,249.60 $1,000.00 $2,000.00 $400.00 $1,060.00 $2,120.00 $0.00 $1,060.00 $2,120.00 $0.00 $1,060.00 $2,120.00 $0.00 $3,180.00 $2,192.27 $5,372.27 $5.851.82 $3,180.00 $2,192.27 $5,372.27 $5,851.82 51 Total current liabilities 52 Long-term debt 53 Total liabilities 54 Common stock 55 Treasury stock 56 Retained earnings 57 Total common equity 58 Total liabilities & equity 59 60 Check for balance: 61 62 c. Caculate Columbia's projected free cash flow; the tax rate is 40%. 63 $3,400.00 $2,068.18 $5,468.18 $5,851.82 ($400.00) $7,440.00 $12,891.82 $18,360.00 $3,180.00 $2,192.27 $5,372.27 $5,851.82 ($400.00) $9,065.51 $14,517.33 $19,889.60 $5,851.82 $11,224.09 $5,851.82 $11,224.09 NOT BALANCED! NOT BALANCED

Question: How do you calculate each highlighted cell and answer?

Question: How do you calculate each highlighted cell and answer?