Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ID Active Resources is a business owned by Isaac, Don and Aira. The business is in supplying sports attires to the sport centers, schools

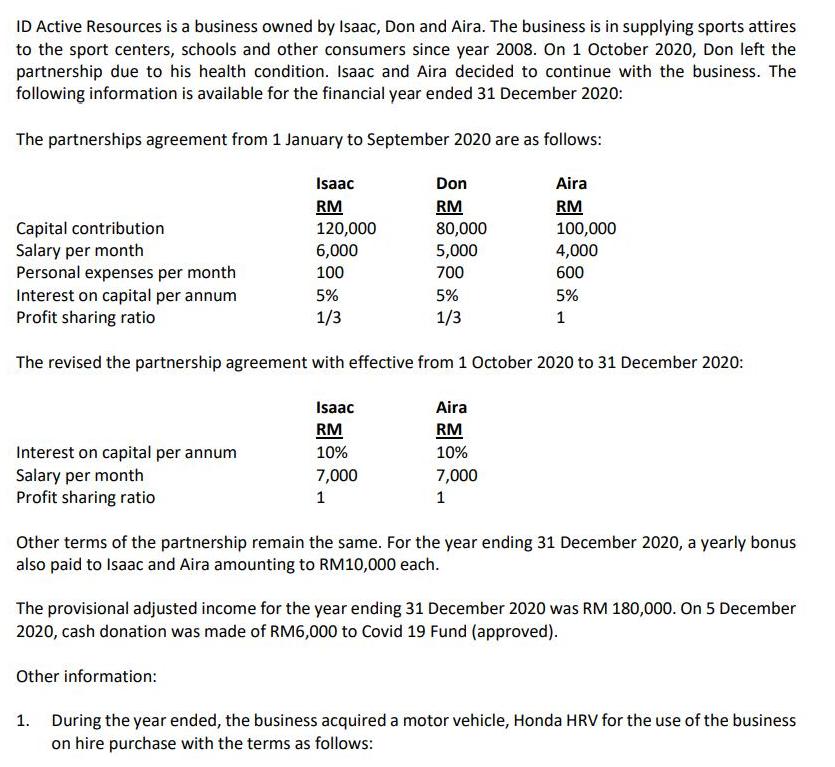

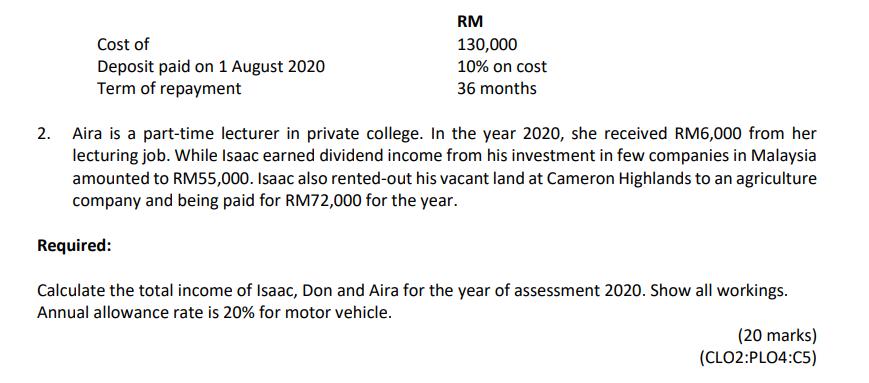

ID Active Resources is a business owned by Isaac, Don and Aira. The business is in supplying sports attires to the sport centers, schools and other consumers since year 2008. On 1 October 2020, Don left the partnership due to his health condition. Isaac and Aira decided to continue with the business. The following information is available for the financial year ended 31 December 2020: The partnerships agreement from 1 January to September 2020 are as follows: Isaac Don Aira RM 120,000 RM 80,000 RM Capital contribution Salary per month Personal expenses per month Interest on capital per annum Profit sharing ratio 100,000 6,000 5,000 4,000 100 700 600 5% 5% 5% 1/3 1/3 1 The revised the partnership agreement with effective from 1 October 2020 to 31 December 2020: Isaac Aira RM RM Interest on capital per annum Salary per month Profit sharing ratio 10% 10% 7,000 7,000 1 1 Other terms of the partnership remain the same. For the year ending 31 December 2020, a yearly bonus also paid to Isaac and Aira amounting to RM10,000 each. The provisional adjusted income for the year ending 31 December 2020 was RM 180,000. On 5 December 2020, cash donation was made of RM6,000 to Covid 19 Fund (approved). Other information: 1. During the year ended, the business acquired a motor vehicle, Honda HRV for the use of the business on hire purchase with the terms as follows: RM Cost of 130,000 Deposit paid on 1 August 2020 Term of repayment 10% on cost 36 months 2. Aira is a part-time lecturer in private college. In the year 2020, she received RM6,000 from her lecturing job. While Isaac earned dividend income from his investment in few companies in Malaysia amounted to RM55,000. Isaac also rented-out his vacant land at Cameron Highlands to an agriculture company and being paid for RM72,000 for the year. Required: Calculate the total income of Isaac, Don and Aira for the year of assessment 2020. Show all workings. Annual allowance rate is 20% for motor vehicle. (20 marks) (CLO2:PLO4:C5)

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Ju cone Statement Particul are RM Particalaza RM 180 000 TO Cosh Donation Goo0 income TO Moto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started