Answered step by step

Verified Expert Solution

Question

1 Approved Answer

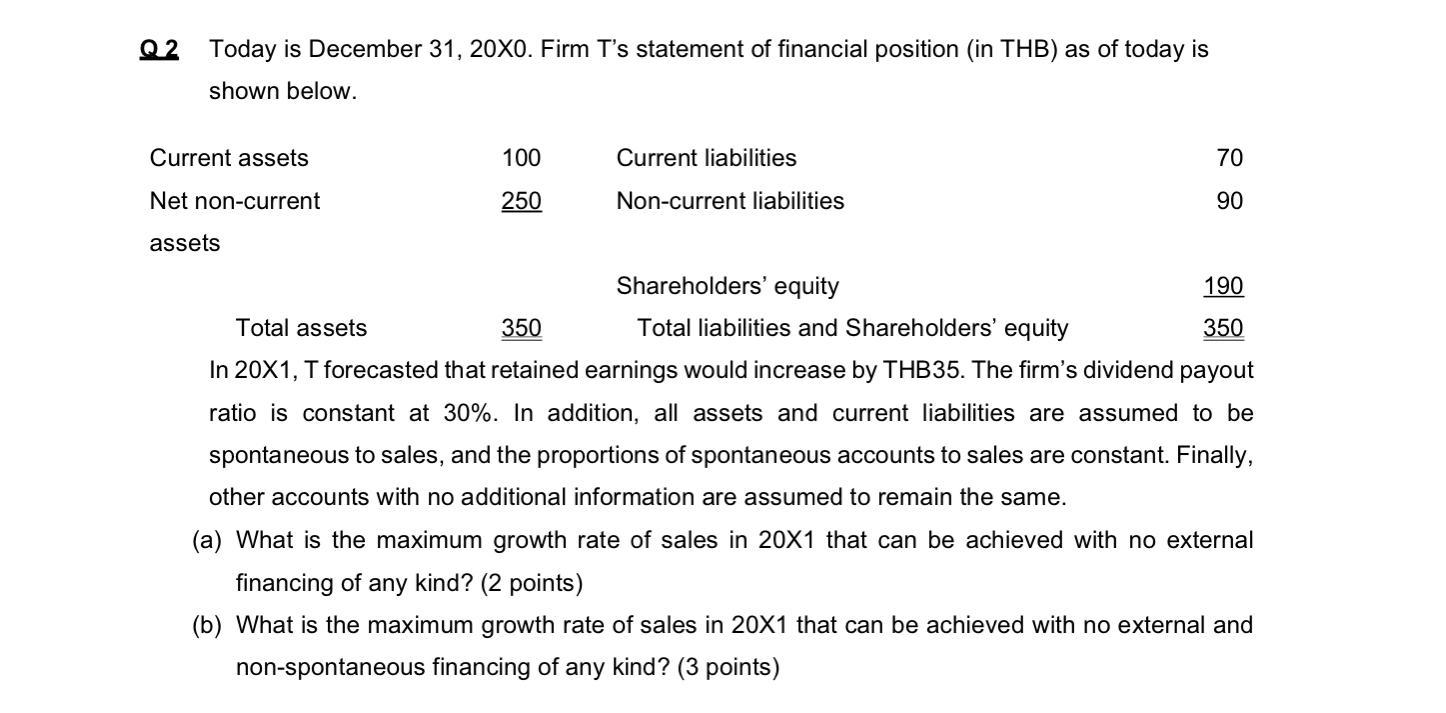

Q2 Today is December 31, 20X0. Firm T's statement of financial position (in THB) as of today is shown below. Current assets Net non-current

Q2 Today is December 31, 20X0. Firm T's statement of financial position (in THB) as of today is shown below. Current assets Net non-current assets 100 250 Current liabilities Non-current liabilities 70 90 190 Shareholders' equity 350 Total assets 350 Total liabilities and Shareholders' equity In 20X1, T forecasted that retained earnings would increase by THB35. The firm's dividend payout ratio is constant at 30%. In addition, all assets and current liabilities are assumed to be spontaneous to sales, and the proportions of spontaneous accounts to sales are constant. Finally, other accounts with no additional information are assumed to remain the same. (a) What is the maximum growth rate of sales in 20X1 that can be achieved with no external financing of any kind? (2 points) (b) What is the maximum growth rate of sales in 20X1 that can be achieved with no external and non-spontaneous financing of any kind? (3 points)

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Sales in 20X1 must be less than or equal to Current ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started