Question

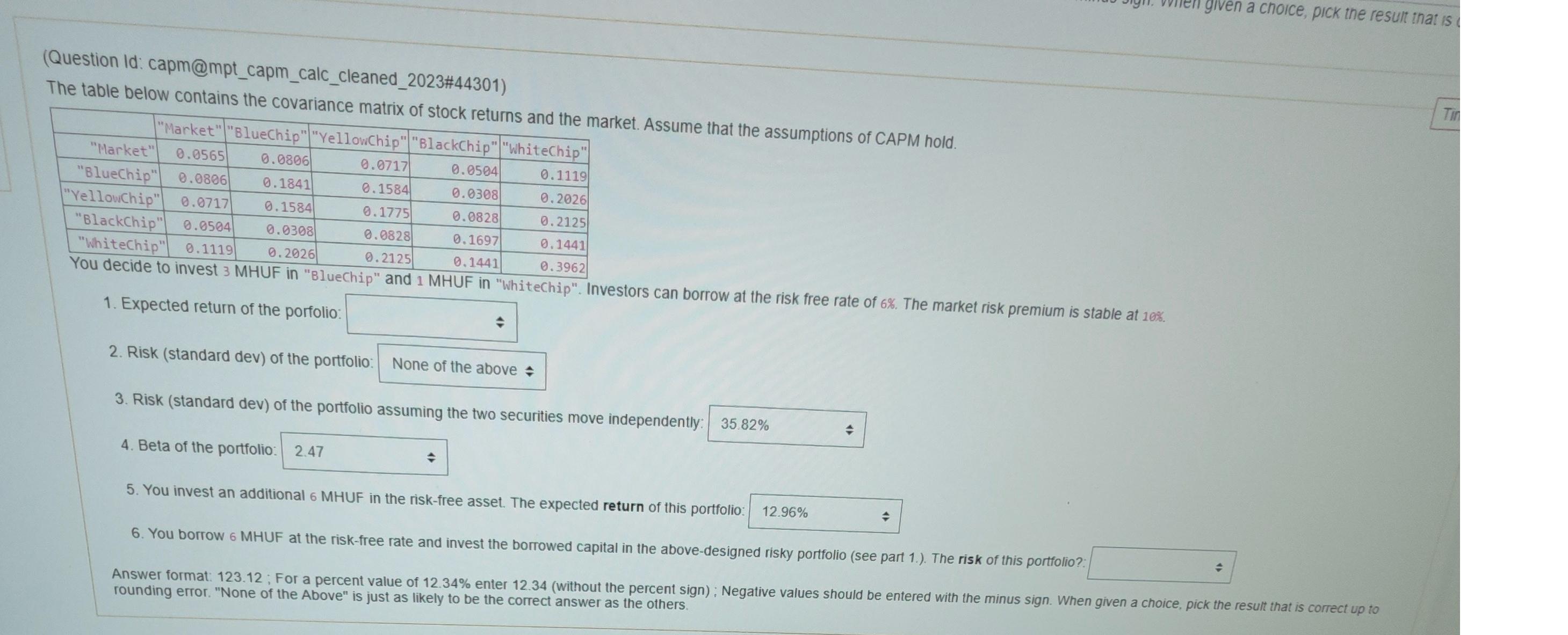

(Question Id: capm@mpt_capm_calc_cleaned_2023#44301) The table below contains the covariance matrix of stock returns and the market. Assume that the assumptions of CAPM hold. table[[,Market,BlueChip,YellowChip,BlackChip,WhiteChip],[Market,0.0565,0.0806,0.0717,0.0504,0.1119],[BlueChip,0.0806,0.1841,0.1584,0.0308,0.2026],[YellowChip,0.0717,0.1584,0.1775,0.0828,0.2125],[BlackChip,0.0504,0.0308,0.0828,0.1697,0.1441],[WhiteChip,0.1119,0.2026,0.2125,0.1441,0.3962]] You

(Question Id: capm@mpt_capm_calc_cleaned_2023#44301)\ The table below contains the covariance matrix of stock returns and the market. Assume that the assumptions of CAPM hold.\ \\\\table[[,"Market","BlueChip","YellowChip","BlackChip","WhiteChip"],["Market",0.0565,0.0806,0.0717,0.0504,0.1119],["BlueChip",0.0806,0.1841,0.1584,0.0308,0.2026],["YellowChip",0.0717,0.1584,0.1775,0.0828,0.2125],["BlackChip",0.0504,0.0308,0.0828,0.1697,0.1441],["WhiteChip",0.1119,0.2026,0.2125,0.1441,0.3962]]\ You decide to invest 3 MHUF in "Bluechip" and 1 MHUF in "whitechip". Investors can borrow at the risk free rate of

6%. The market risk premium is stable at

10%.\ Expected return of the porfolio\ Risk (standard dev) of the portfolio: None of the above

hat(v)\ Risk (standard dev) of the portfolio assuming the two securities move independently:\ Beta of the portfolio:\ You invest an additional 6 MHUF in the risk-free asset. The expected return of this portfolio:

12.96%\ You borrow 6 MHUF at the risk-free rate and invest the borrowed capital in the above-designed risky portfolio (see part 1.). The risk of this portfolio?\ Answer format: 123.12 ; For a percent value of

12.34%enter 12.34 (without the percent sign); Negative values should be entered with the minus sign. When given a choice, pick the result that is correct up to rounding error. "None of the Above" is just as likely to be the correct answer as the others.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started