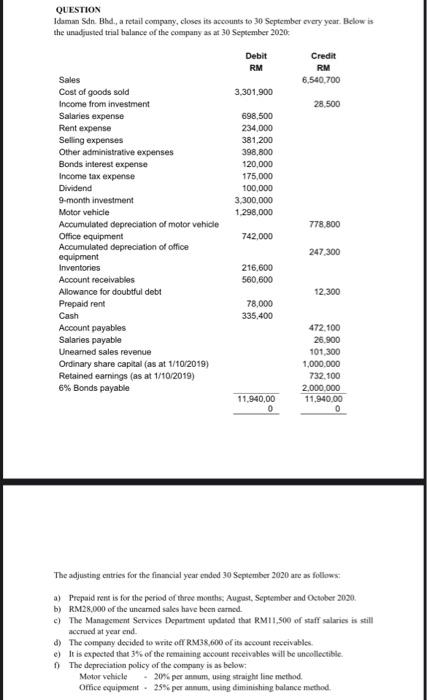

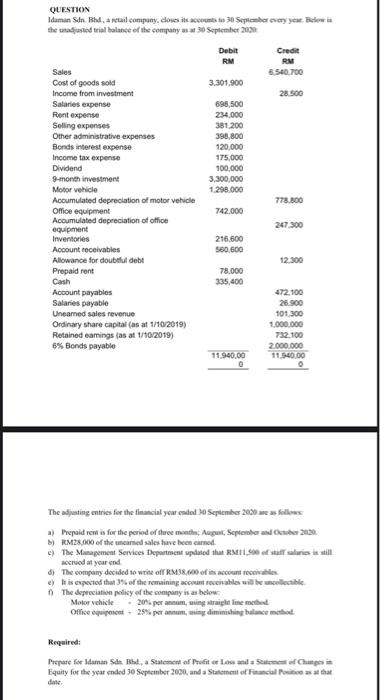

QUESTION Idaman Sdn. Bhd., a retail company, closes its accounts to 30 September every year. Below is the unadjusted trial balance of the company as at 30 September 2020 Debit Credit RM RM 6,540.700 3,301,900 28.500 698,500 Sales Cost of goods sold Income from investment Salaries expense Rent expense Selling expenses Other administrative expenses Bonds interest expense 234.000 381,200 398,800 120,000 Income tax expense 175,000 Dividend 100,000 3.300.000 9-month investment Motor vehicle 1.298,000 778.800 Accumulated depreciation of motor vehicle Office equipment 742,000 Accumulated depreciation of office 247.300 equipment Inventories 216,600 Account receivables 560,600 Allowance for doubtful debt 12.300 78,000 335.400 Prepaid rent Cash Account payables Salaries payable Uneamed sales revenue Ordinary share capital (as at 1/10/2019) Retained earnings (as at 1/10/2019) 6% Bonds payable 472.100 26.900 101,300 1,000,000 732.100 2.000.000 11.940,00 11,940,00 0 b) RM28.000 of the uncamed sales have been carned The adjusting entries for the financial year ended 30 September 2020 are as follow .) Prepaid rent is for the period of three months, August, September and October 2020, The Management Services Department updated that RM11.500 of staff salaries is still accrued at year end d) The company decided to write of RM38.600 of its account receivables e) It is expected that 3% of the remaining account receivables will be uncollectible The depreciation policy of the company is as below: Motor vehicle - 20% per annum, using straight line method. Office equipment. 25% per annum, using diminishing balance method. QUESTION Idaman Sdn Bhd, a retail company, doses com to 30 September you Bowl the adjusted trial balance of the companys 30 September 2002 Debit RM Credit RM 6.540.700 Sales Cost of goods sold Income from investment 3.301,900 28.500 696,500 234.000 381.200 398,800 120,000 Salaries expense Rent expense Selling expenses Other administrative expenses Bonds interest expense Income tax expense Dividend 9- month investment Motor vehicle Accumulated depreciation of motor vehicle Office equipment Accumulated depreciation of office equipment Inventories Account receivables Allowance for doubtlul debt Prepaid rent 175,000 100,000 3.300,000 1.200.000 778.800 742.000 247.300 216,600 560.600 12.300 78.000 Cash 335.400 Account payables Salaries payable Unearned sales revenue Ordinary share capital (as at 1/10/2019) Retained eamings (as at 1/10/2019) 6% Bonds payable 472.100 26.500 101.300 1.000.000 732.100 2.000.000 11.540.00 11.940.00 0 The adjusting entries for the financial year ended 30 September 2000 es Salles accrued at your end Prepaid rent is for the period of the month Augnt, September Oktober 200 ) RM28.000 of the named sales have been card c) The Management Services Department updated that RM1.0 of studies will d) The company decided to write of RM3,000 of its account receivables e) It is expected that 3% of the remaining account receivables will be collectible The depreciation policy of the company is as below Motor vehicle. 20. per annum,wing straight le method Office equipment - 25% per annum, in diminishing balance method Required: Prepare for Idaman Sn. Bhd, a Statement of Profit London Changin Equity for the year ended 30 September 2000, and a Statement of Financial stat date