Answered step by step

Verified Expert Solution

Question

1 Approved Answer

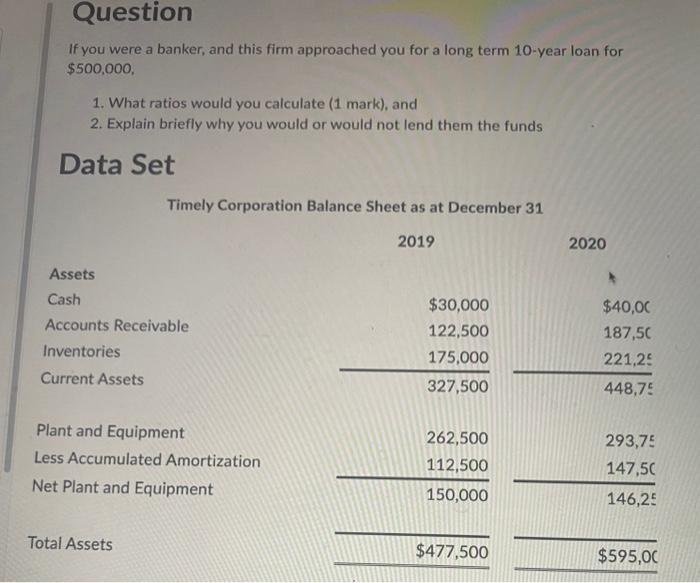

Question If you were a banker, and this firm approached you for a long term 10-year loan for $500,000, 1. What ratios would you calculate

Question If you were a banker, and this firm approached you for a long term 10-year loan for $500,000, 1. What ratios would you calculate (1 mark), and 2. Explain briefly why you would or would not lend them the funds Data Set Assets Cash Timely Corporation Balance Sheet as at December 31 Accounts Receivable Inventories Current Assets Plant and Equipment Less Accumulated Amortization Net Plant and Equipment Total Assets 2019 $30,000 122,500 175,000 327,500 262,500 112,500 150,000 $477,500 2020 A $40,00 187,50 221,25 448,75 293,75 147,50 146,25 $595,00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started