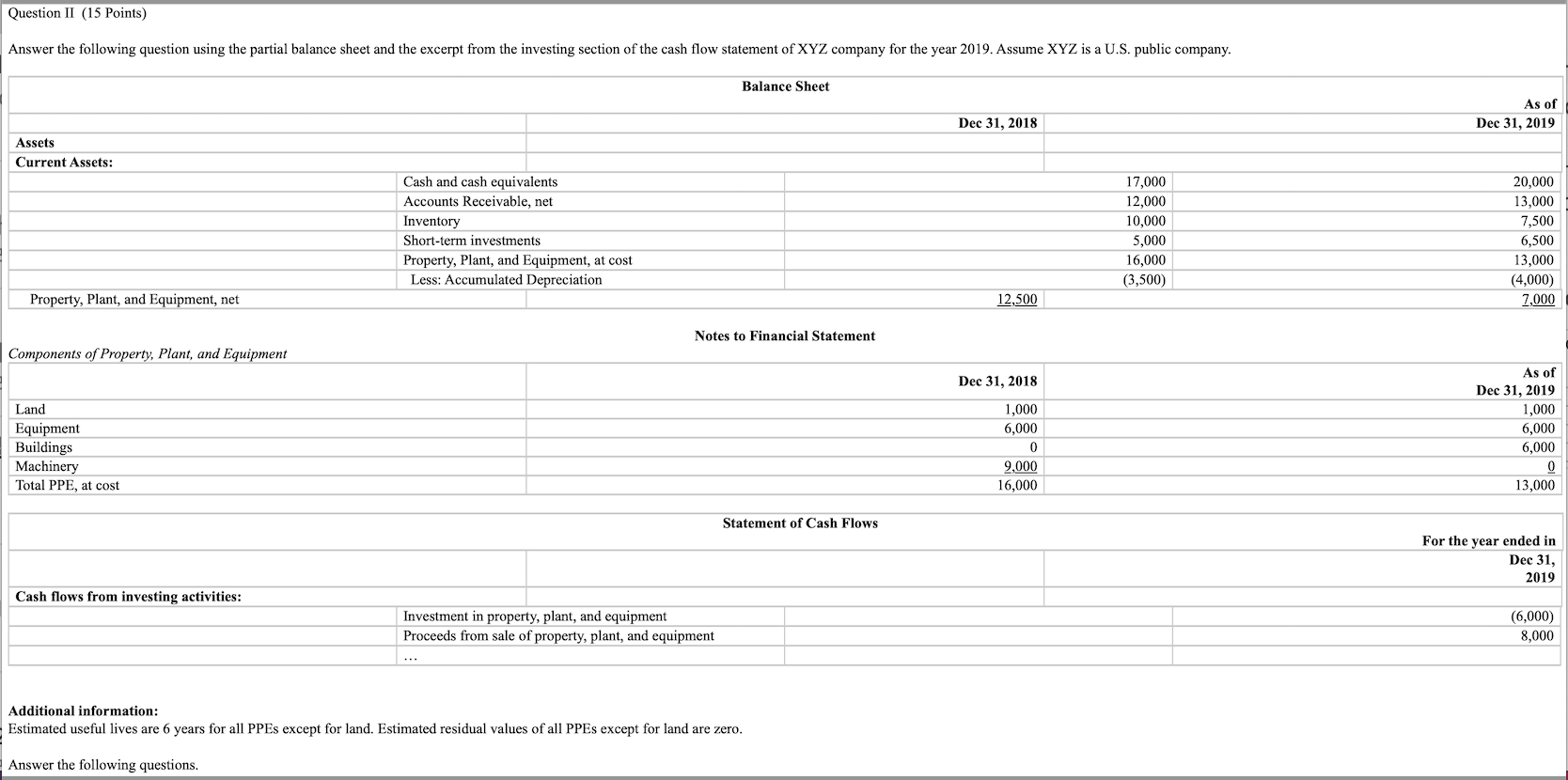

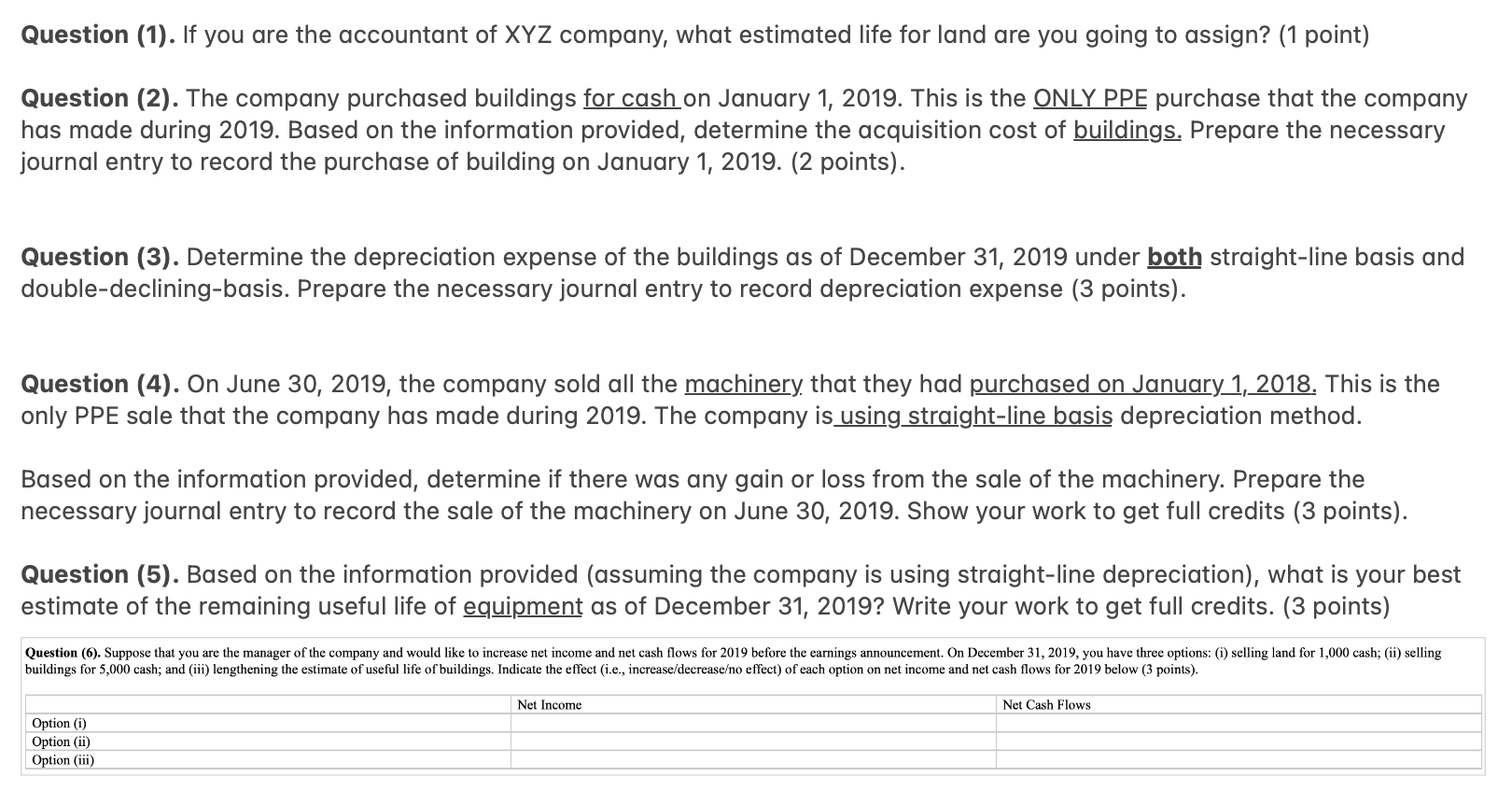

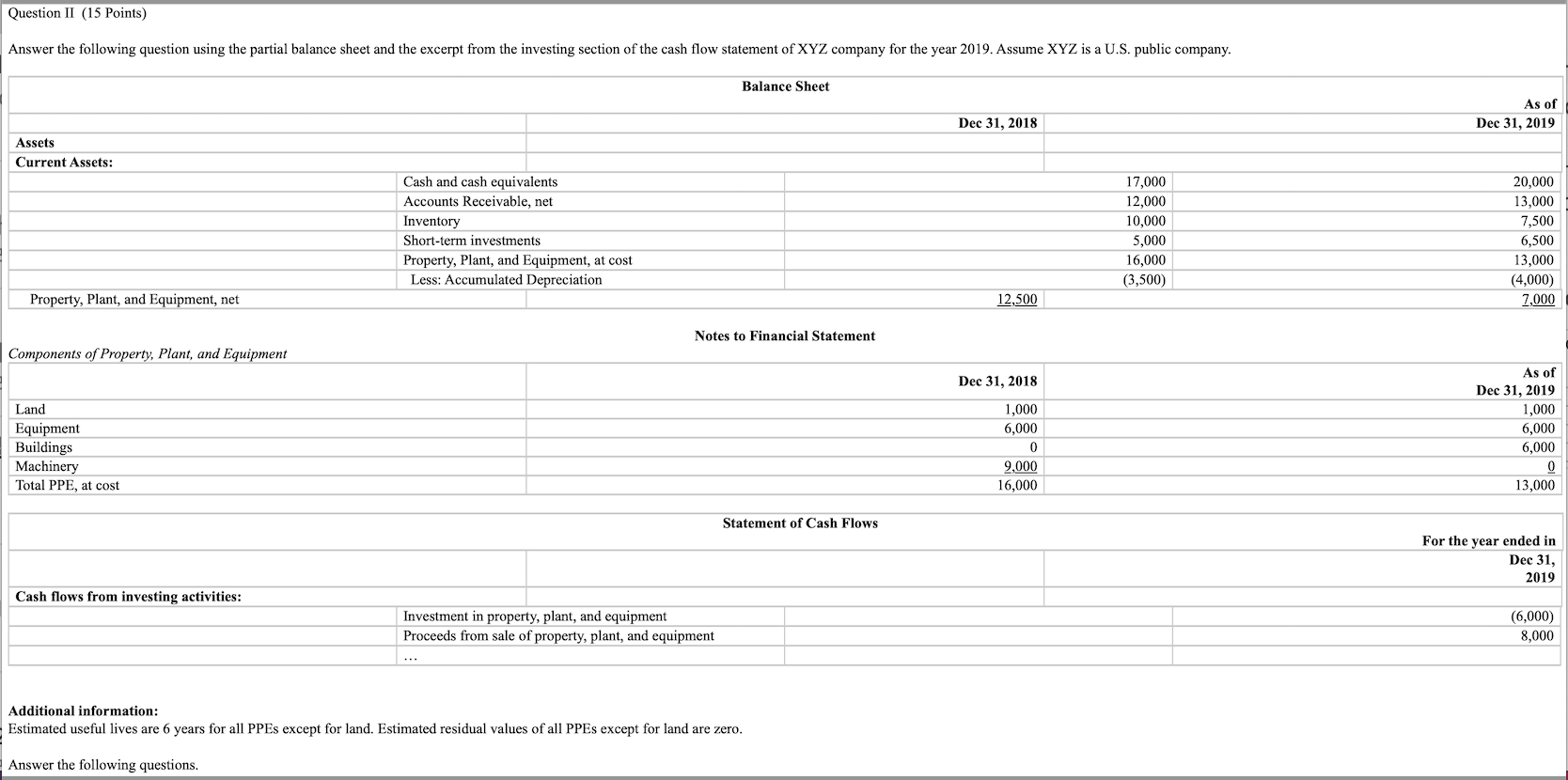

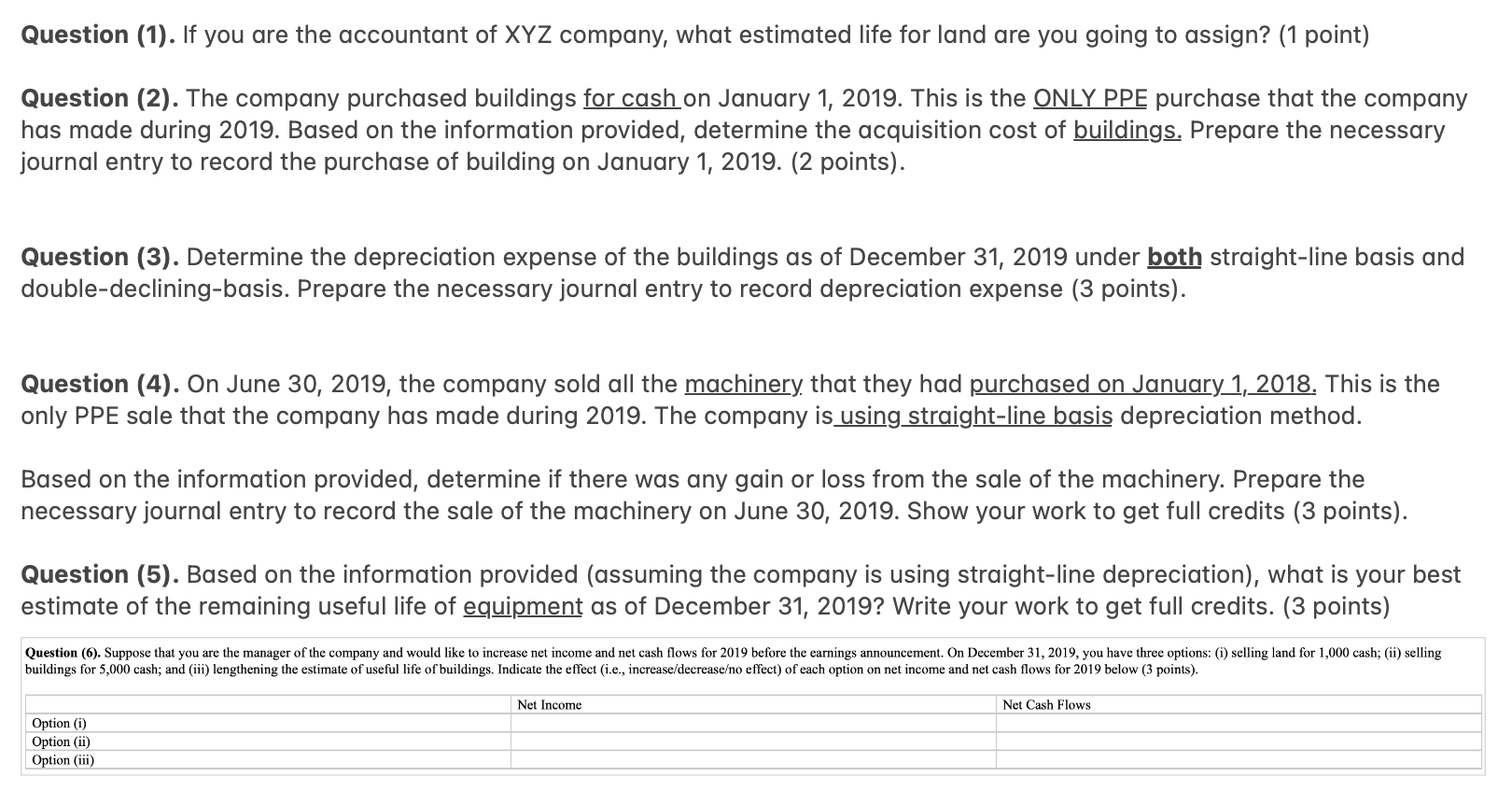

Question II (15 Points) Answer the following question using the partial balance sheet and the excerpt from the investing section of the cash flow statement of XYZ company for the year 2019. Assume XYZ is a U.S. public company. Balance Sheet As of Dec 31, 2019 Dec 31, 2018 Assets Current Assets: Cash and cash equivalents Accounts Receivable, net Inventory Short-term investments Property, Plant, and Equipment, at cost Less: Accumulated Depreciation 17,000 12,000 10,000 5,000 16,000 (3,500) 20,000 13,000 7,500 6,500 13,000 (4,000) 7,000 Property, Plant, and Equipment, net 12,500 Notes to Financial Statement Components of Property, Plant, and Equipment Dec 31, 2018 Land Equipment Buildings Machinery Total PPE, at cost 1,000 6,000 0 9,000 16,000 As of Dec 31, 2019 1,000 6,000 6,000 0 13,000 Statement of Cash Flows For the year ended in Dec 31, 2019 Cash flows from investing activities: Investment in property, plant, and equipment Proceeds from sale of property, plant, and equipment (6,000) 8,000 Additional information: Estimated useful lives are 6 years for all PPEs except for land. Estimated residual values of all PPEs except for land are zero. Answer the following questions. Question (1). If you are the accountant of XYZ company, what estimated life for land are you going to assign? (1 point) Question (2). The company purchased buildings for cash on January 1, 2019. This is the ONLY PPE purchase that the company has made during 2019. Based on the information provided, determine the acquisition cost of buildings. Prepare the necessary journal entry to record the purchase of building on January 1, 2019. (2 points). Question (3). Determine the depreciation expense of the buildings as of December 31, 2019 under both straight-line basis and double-declining-basis. Prepare the necessary journal entry to record depreciation expense (3 points). Question (4). On June 30, 2019, the company sold all the machinery that they had purchased on January 1, 2018. This is the only PPE sale that the company has made during 2019. The company is using straight-line basis depreciation method. Based on the information provided, determine if there was any gain or loss from the sale of the machinery. Prepare the necessary journal entry to record the sale of the machinery on June 30, 2019. Show your work to get full credits (3 points). Question (5). Based on the information provided (assuming the company is using straight-line depreciation), what is your best estimate of the remaining useful life of equipment as of December 31, 2019? Write your work to get full credits. (3 points) Question (6). Suppose that you are the manager of the company and would like to increase net income and net cash flows for 2019 before the earnings announcement. On December 31, 2019, you have three options: (1) selling land for 1,000 cash; (ii) selling buildings for 5,000 cash; and (iii) lengthening the estimate of useful life of buildings. Indicate the effect (i.e., increase/decreaseo effect) of each option on net income and net cash flows for 2019 below (3 points). Net Income Net Cash Flows Option (i) Option (ii) Option (iii)