Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question III Griselda Corporation provided the following share information for the current year, 2 0 2 3 . Brent and Date 1 / 1 -

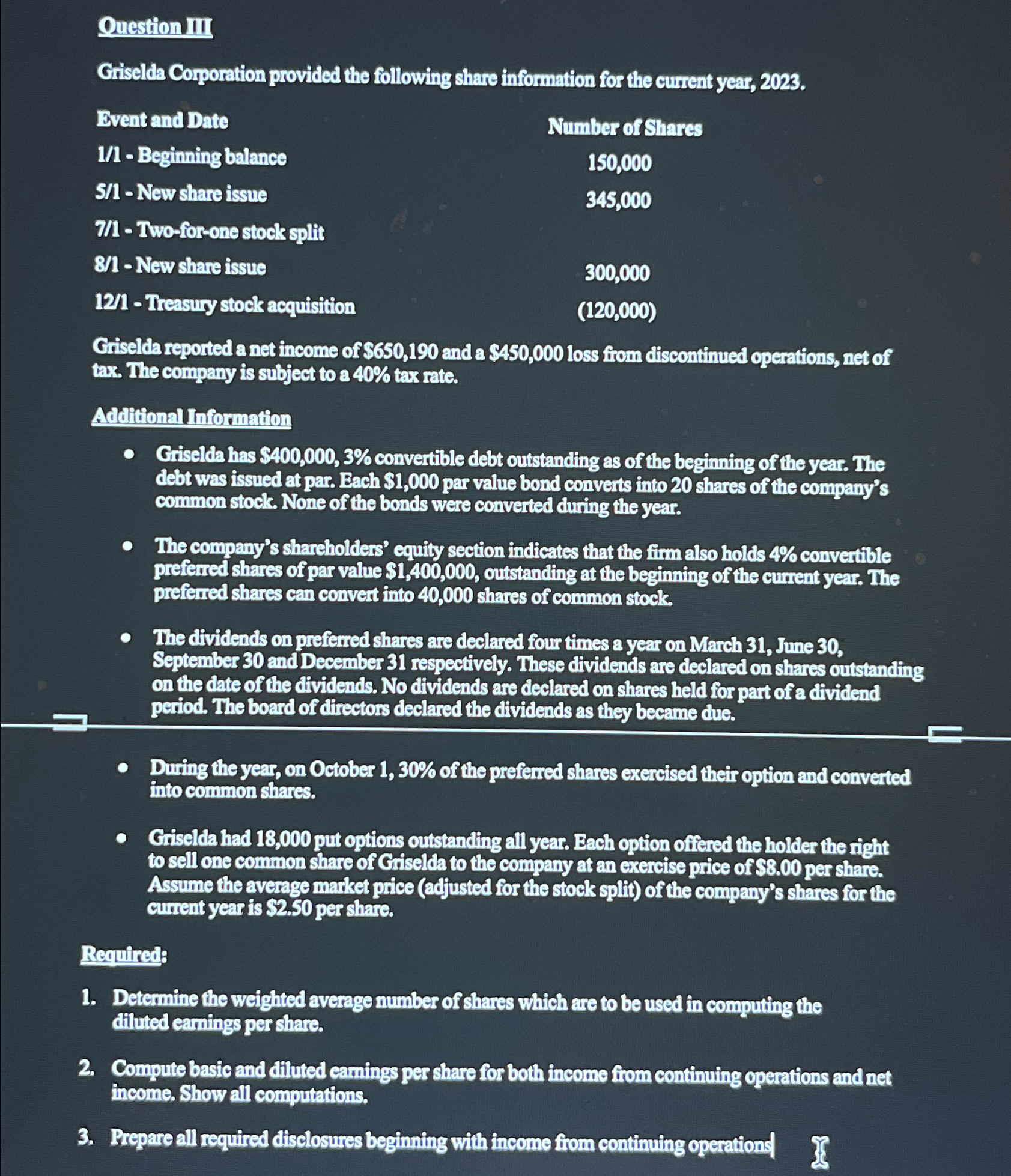

Question III

Griselda Corporation provided the following share information for the current year,

Brent and Date

Beginning balance

New share issue

T Twoforone stock split

New share issue

Treasury stock acquisition

Number of Shares

Griselda reported a net income of $ and a $ loss from discontinued operations, net of tax. The company is subject to tax rate.

Additional Information

Griselda has $ convertible debt outstanding as of the beginning of the year. The debt was issued at par. Each $ par value bond converts into shares of the company's common stock. None of the bonds were converted during the year.

The company's shareholders' equity section indicates that the firm also holds convertible preferred shares of par value $ outstanding at the beginning of the current year. The prefered shares can convert into shares of common stock.

The dividends on preferred shares are declared four times a year on March June September and December respectively. These dividends are declared on shares outstanding on the date of the dividends. No dividends are declared on shares held for part of a dividend period. The board of directors declared the dividends as they became due.

During the year, on October of the prefered shares exercised their option and converted into common shares.

Griselda had put options outstanding all year. Each option offered the holder the right to sell one common share of Griselda to the company at an exercise price of $ per share. Assume the average market price adjusted for the stock split of the company's shares for the current year is $ per share.

Required:

Determine the weighted average number of shares which are to be used in computing the diluted earnings per share.

Compute basic and diluted camings per share for both income from continuing operations and net income. Show all computations.

Prepare all required disclosures beginning with income from continuing operationd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started