Question:

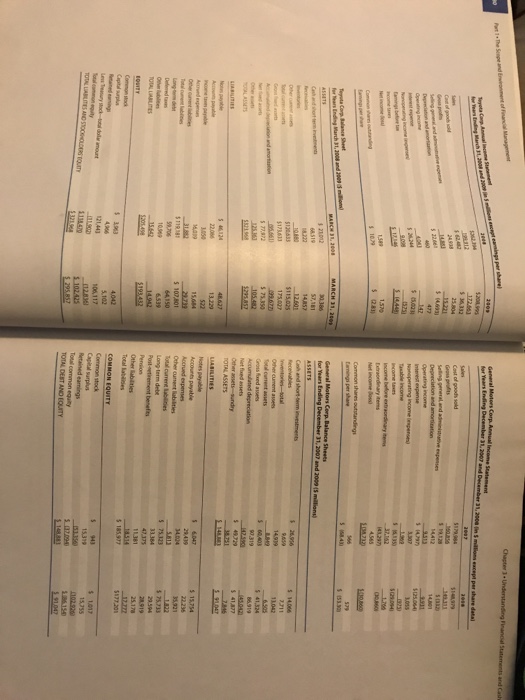

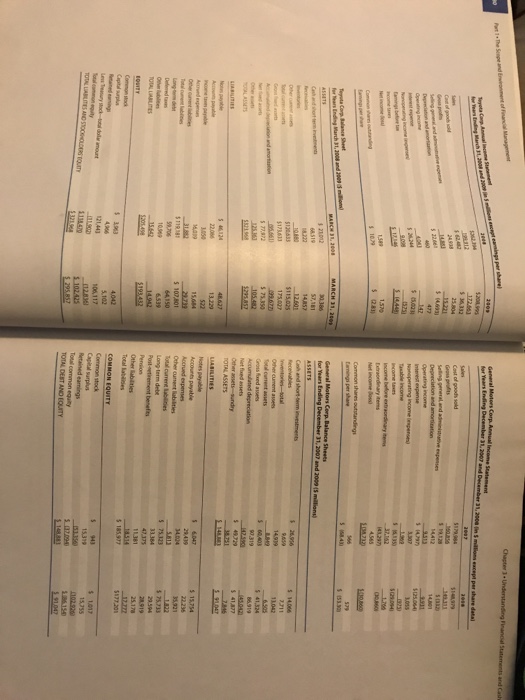

In 2009, the auto industry was being devastated by the economic downturn. General Motors filed for bankruptcy and was renamed Motors Liquidation, an event that could not have been imagined in prior times. Toyota, historically a tough competitor for Detroit, was beginning to be affected as well, but not nearly to the same extent as GM. Below are the financial statements for the two firms. GM's fiscal year ends on December 31; thus, the statements are for the end-of-year for 2007 and 2008. Toyota, on the other hand, has a March 31 fiscal year; therefore the statements are for fiscal years 2008 and 2009. As a result, Toyota's financials are three months later than the financials for General Motors.

a. Prepare a common-sized income statement and common-sized balance sheet for each firm for both years.

b. How much profit (loss) was each company making per dollar of sales? To what would you attribute any differences?

c. What differences do you notice in the common-sized balance sheets that could account for the problems of GM relative to Toyota?

d. Conduct an internet search on the two firms to gain additional insights as to causes of the financial differences between the firms in 2008 and continuing into 2009.

e. How are the two companies doing financially today?

This is the information from General Motors and Toyota

on its bank loans. Als stockholders. aperise was $100,000, and the firm paid $150,000 in interest o, the corporation paid $25,000 in the form of dividends to its own common Calculate the corporation's tax liability Mini Case In 2009, the auto industry was being devastated by the economic downturn. General Motors filed for bankruptcy and was renamed Motors Liquidation, an event that could not have been imagined in prior times. Toyota, historically a tough competitor for Detroit, was beginning to be affected as well, but not nearly to the same extent as GM. Below are the financial statements for the two firms. GM's fiscal year ends on December 31; thus, the statements are for the end-of-year for 2007 and 2008. Toyota, on the other hand, has a March 31 fiscal year; therefore the statements are for fiscal years 2008 and 2009. As a result, Toyota's financials are three months later than the financials for General Motors. a. Prepare a common-sized income statement and common-sized balance sheet for each firm b. How much profit (loss) was each company making per dollar of sales? To what would you c. What differences do you notice in the common-sized balance sheets that could account for d. Conduct an Internet search on the two firms to gain additional insights as to causes of the e. How are the two companies doing financially today? for both years. attribute any differences? the problems of GM relative to Toyota? financial differences between the firms in 2008 and continuing into 2009. on its bank loans. Als stockholders. aperise was $100,000, and the firm paid $150,000 in interest o, the corporation paid $25,000 in the form of dividends to its own common Calculate the corporation's tax liability Mini Case In 2009, the auto industry was being devastated by the economic downturn. General Motors filed for bankruptcy and was renamed Motors Liquidation, an event that could not have been imagined in prior times. Toyota, historically a tough competitor for Detroit, was beginning to be affected as well, but not nearly to the same extent as GM. Below are the financial statements for the two firms. GM's fiscal year ends on December 31; thus, the statements are for the end-of-year for 2007 and 2008. Toyota, on the other hand, has a March 31 fiscal year; therefore the statements are for fiscal years 2008 and 2009. As a result, Toyota's financials are three months later than the financials for General Motors. a. Prepare a common-sized income statement and common-sized balance sheet for each firm b. How much profit (loss) was each company making per dollar of sales? To what would you c. What differences do you notice in the common-sized balance sheets that could account for d. Conduct an Internet search on the two firms to gain additional insights as to causes of the e. How are the two companies doing financially today? for both years. attribute any differences? the problems of GM relative to Toyota? financial differences between the firms in 2008 and continuing into 2009