Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Prepare a bank reconciliation statement at 1 December. b) Update the cash book for December. c) Prepare a bank reconciliation statement at 31 December.

a) Prepare a bank reconciliation statement at 1 December.

b) Update the cash book for December.

c) Prepare a bank reconciliation statement at 31 December.

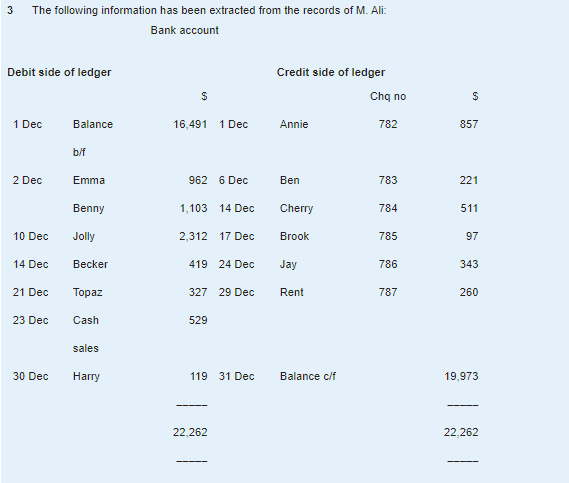

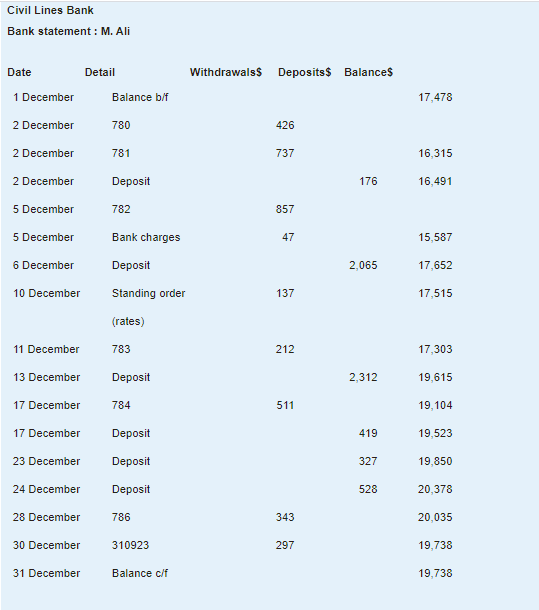

3 The following information has been extracted from the records of M. Ali: Bank account Debit side of ledger Credit side of ledger Chq no $ S 1 Dec Balance 16,491 1 Dec Annie 782 857 b/f 2 Dec Emma 962 6 Dec Ben 783 221 Benny 1,103 14 Dec Cherry 784 511 10 Dec Jolly 2,312 17 Dec Brook 785 97 14 Dec Becker 419 24 Dec Jay 786 343 21 Dec Topaz 327 29 Dec Rent 787 260 23 Dec Cash 529 sales 30 Dec Harry 119 31 Dec Balance c/f 19,973 22.262 22,262 ----- Civil Lines Bank Bank statement : M. Ali Date Detail Withdrawals$ Deposits $ Balance 1 December Balance b/f 17,478 2 December 780 426 2 December 781 737 16,315 2 December Deposit 176 16,491 5 December 782 857 5 December Bank charges 47 15,587 6 December Deposit 2.065 17,652 10 December Standing order 137 17,515 (rates) 11 December 783 212 17,303 13 December Deposit 2,312 19,615 17 December 784 511 19,104 17 December Deposit 419 19,523 23 December Deposit 327 19,850 24 December Deposit 528 20,378 28 December 786 343 20.035 30 December 310923 297 19,738 31 December Balance c/f 19,738Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started