Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question in in the picture You observe that the price of a stock is $100 while the price of a call option at $100 is

Question in in the picture

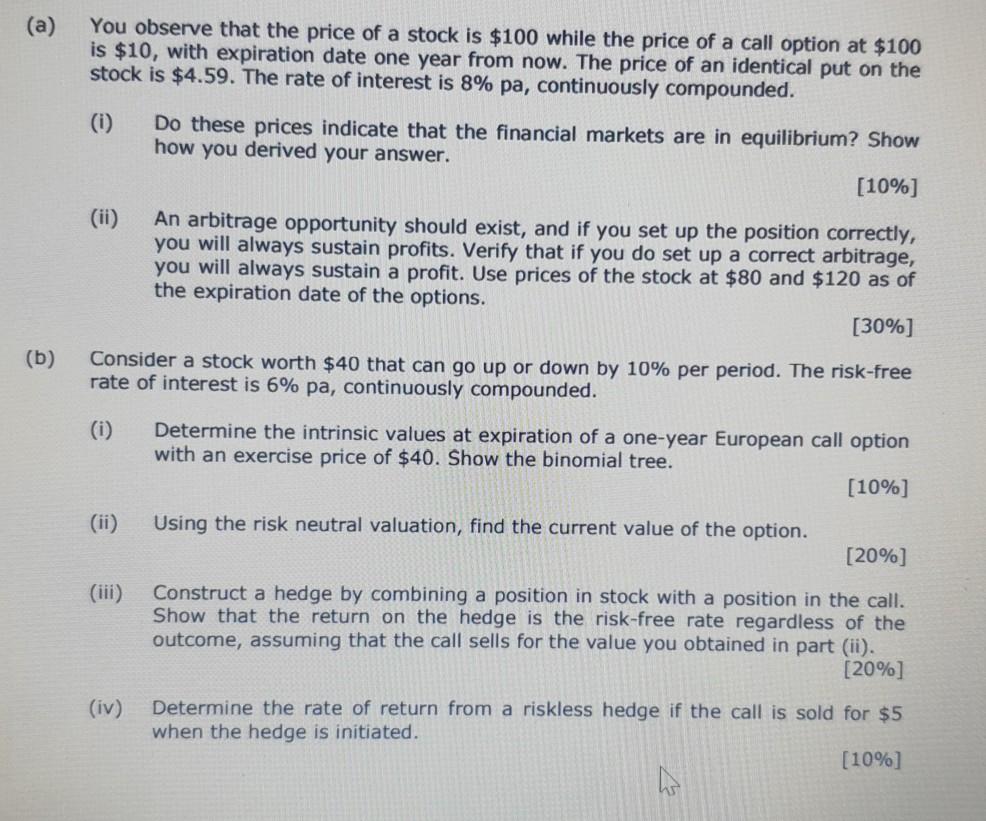

You observe that the price of a stock is $100 while the price of a call option at $100 is $10, with expiration date one year from now. The price of an identical put on the stock is $4.59. The rate of interest is 8% pa, continuously compounded. (1) Do these prices indicate that the financial markets are in equilibrium? Show how you derived your answer. [10%] An arbitrage opportunity should exist, and if you set up the position correctly, you will always sustain profits. Verify that if you do set up a correct arbitrage, you will always sustain a profit. Use prices of the stock at $80 and $120 as of the expiration date of the options. [30%) (b) Consider a stock worth $40 that can go up or down by 10% per period. The risk-free rate of interest is 6% pa, continuously compounded. (i) Determine the intrinsic values at expiration of a one-year European call option with an exercise price of $40. Show the binomial tree. (10%) (ii) Using the risk neutral valuation, find the current value of the option. [20%] (iii) Construct a hedge by combining a position in stock with a position in the call. Show that the return on the hedge is the risk-free rate regardless of the outcome, assuming that the call sells for the value you obtained in part (ii). [20%] (iv) Determine the rate of return from a riskless hedge if the call is sold for $5 when the hedge is initiated. [10%] You observe that the price of a stock is $100 while the price of a call option at $100 is $10, with expiration date one year from now. The price of an identical put on the stock is $4.59. The rate of interest is 8% pa, continuously compounded. (1) Do these prices indicate that the financial markets are in equilibrium? Show how you derived your answer. [10%] An arbitrage opportunity should exist, and if you set up the position correctly, you will always sustain profits. Verify that if you do set up a correct arbitrage, you will always sustain a profit. Use prices of the stock at $80 and $120 as of the expiration date of the options. [30%) (b) Consider a stock worth $40 that can go up or down by 10% per period. The risk-free rate of interest is 6% pa, continuously compounded. (i) Determine the intrinsic values at expiration of a one-year European call option with an exercise price of $40. Show the binomial tree. (10%) (ii) Using the risk neutral valuation, find the current value of the option. [20%] (iii) Construct a hedge by combining a position in stock with a position in the call. Show that the return on the hedge is the risk-free rate regardless of the outcome, assuming that the call sells for the value you obtained in part (ii). [20%] (iv) Determine the rate of return from a riskless hedge if the call is sold for $5 when the hedge is initiated. [10%]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started