Answered step by step

Verified Expert Solution

Question

1 Approved Answer

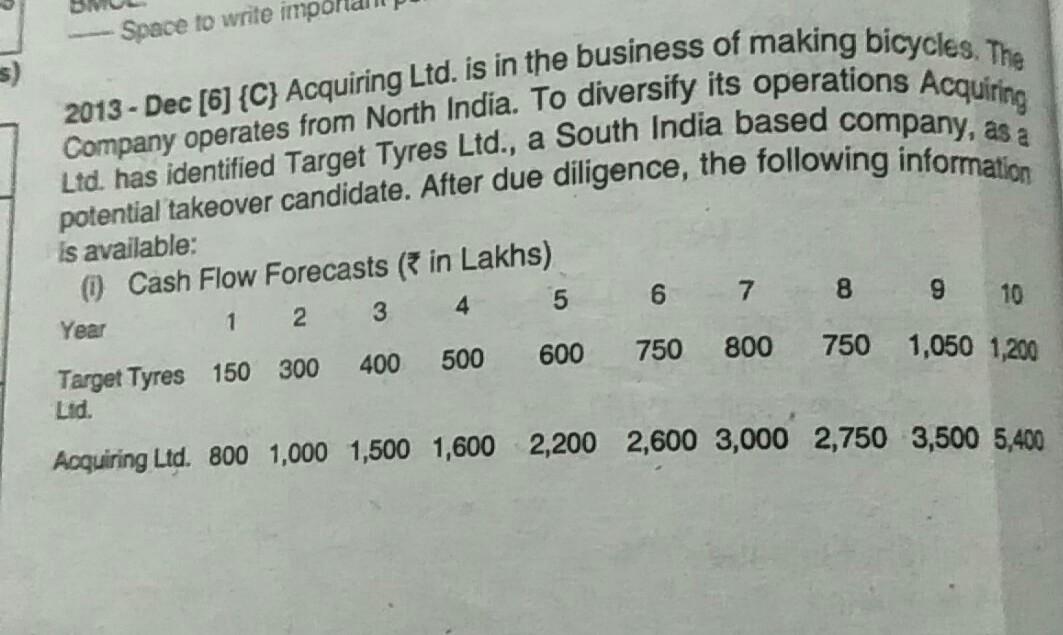

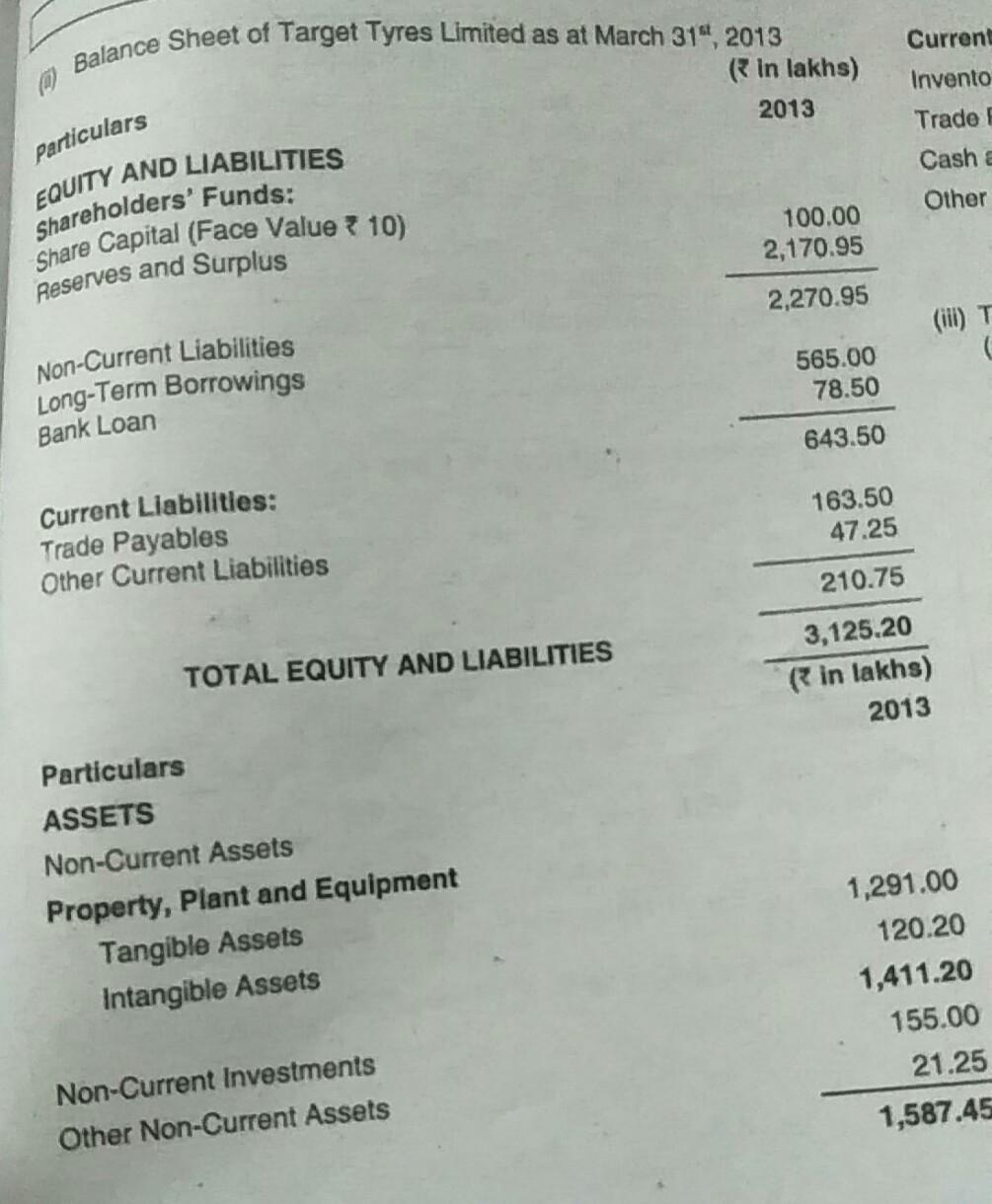

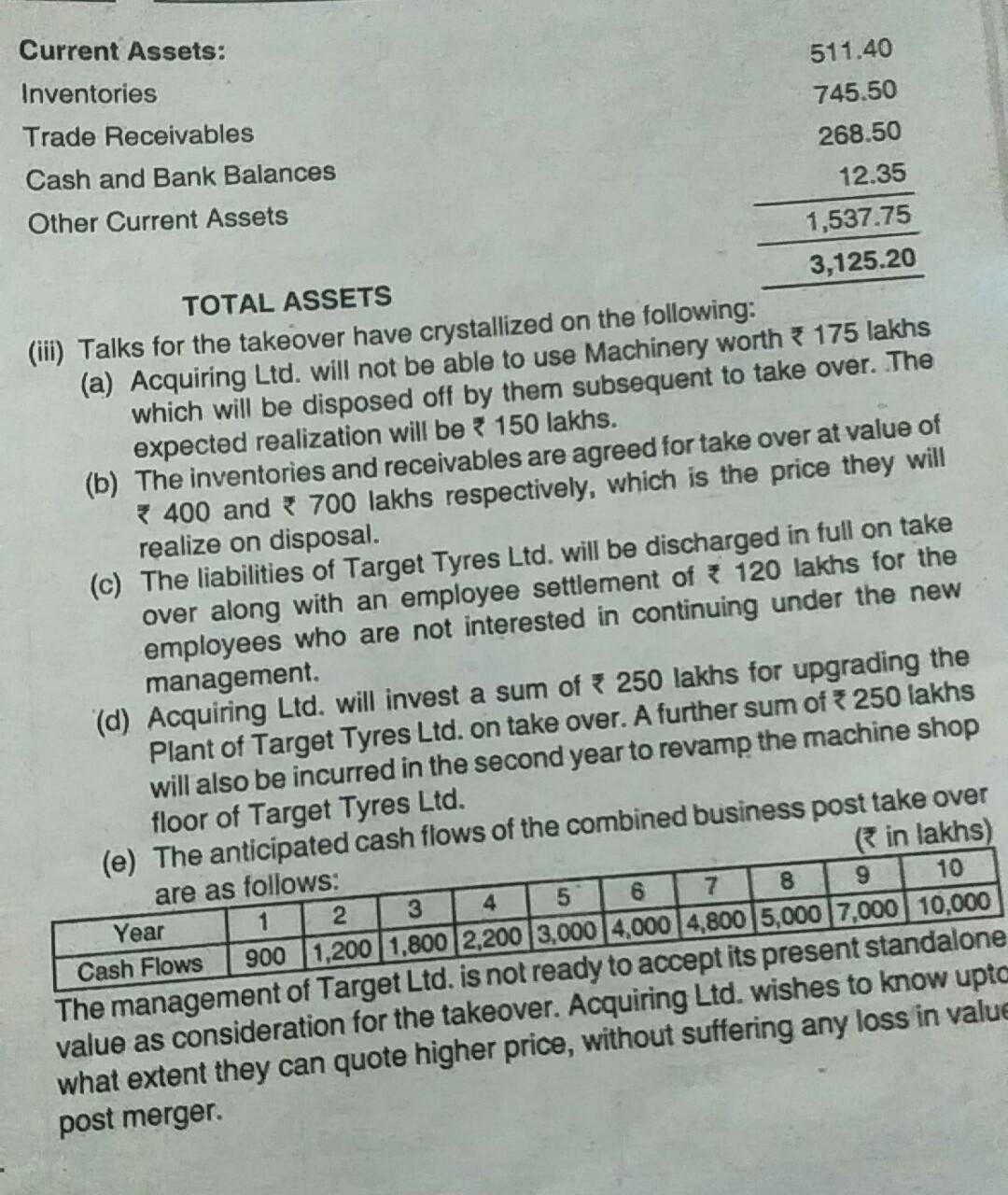

question is complete Space to write impol 2013 - Dec [6] {C} Acquiring Ltd. is in the business of making bicycles. The Ltd. has identified

question is complete

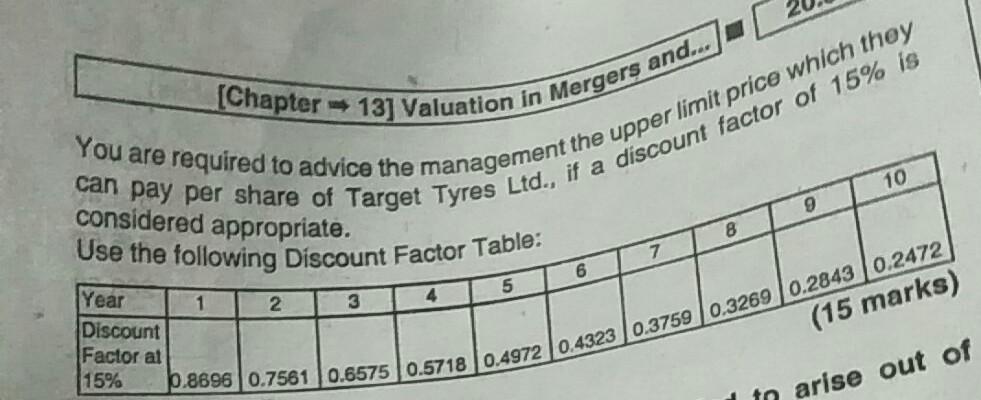

Space to write impol 2013 - Dec [6] {C} Acquiring Ltd. is in the business of making bicycles. The Ltd. has identified Target Tyres Ltd., a South India based company, as a Company operates from North India. To diversify its operations Acquiring potential takeover candidate. After due diligence, the following information is available: (Cash Flow Forecasts ( in Lakhs) 3 5 6 7 9 10 4 2 Year 1 500 600 750 800 750 400 1,050 1,200 Target Tyres 150 300 Lid. Acquiring Ltd. 800 1,000 1,500 1,600 2,200 2,600 3,000 2,750 3,500 5,400 Current Balance Sheet of Target Tyres Limited as at March 31, 2013 in lakhs) 2013 Invento Particulars Trade E Cash & Other EQUITY AND LIABILITIES Shareholders' Funds: Share Capital (Face Value 10) 100.00 2,170.95 Reserves and Surplus 2,270.95 (ill) T Non-Current Liabilities Long-Term Borrowings 565.00 78.50 Bank Loan 643.50 163.50 47.25 Current Liabilities: Trade Payables Other Current Liabilities 210.75 TOTAL EQUITY AND LIABILITIES 3,125.20 ( in lakhs) 2013 Particulars ASSETS Non-Current Assets Property, Plant and Equipment Tangible Assets Intangible Assets 1,291.00 120.20 1,411.20 155.00 21.25 1,587.45 Non-Current Investments Other Non-Current Assets Current Assets: Inventories Trade Receivables Cash and Bank Balances Other Current Assets 511.40 745.50 268.50 12.35 1,537.75 TOTAL ASSETS 3,125.20 (iii) Talks for the takeover have crystallized on the following: (a) Acquiring Ltd. will not be able to use Machinery worth * 175 lakhs which will be disposed off by them subsequent to take over. The expected realization will be 150 lakhs. (b) The inventories and receivables are agreed for take over at value of 400 and 700 lakhs respectively, which is the price they will realize on disposal. (c) The liabilities of Target Tyres Ltd. will be discharged in full on take over along with an employee settlement of 120 lakhs for the employees who are not interested in continuing under the new management (d) Acquiring Ltd. will invest a sum of 250 lakhs for upgrading the Plant of Target Tyres Ltd. on take over. A further sum of 250 lakhs will also be incurred in the second year to revamp the machine shop floor of Target Tyres Ltd. (e) The anticipated cash flows of the combined business post take over are as follows: (in lakhs) Year 5 6 9 10 Cash Flows 900 1,200 1,800 2,200 3,000 4,000 4,800 5,000 7,000 10,000 The management of Target Ltd. is not ready to accept its present standalone value as consideration for the takeover. Acquiring Ltd. wishes to know upta what extent they can quote higher price, without suffering any loss in value post merger. 7 8 4 3 1 2 (Chapter 13] Valuation in Mergers and... You are required to advice the management the upper limit price which they can pay per share of Target Tyres Ltd., if a discount factor of 15% is 10 9 considered appropriate. 8 7 6 4 5 Use the following Discount Factor Table: Year 1 2 3 Discount Factor at 15% 9.86960.7561 0.6575 0.5718 0.4972 / 0.4323 0.3759 0.3269 0.28430.2472 (15 marks) in arise out of Space to write impol 2013 - Dec [6] {C} Acquiring Ltd. is in the business of making bicycles. The Ltd. has identified Target Tyres Ltd., a South India based company, as a Company operates from North India. To diversify its operations Acquiring potential takeover candidate. After due diligence, the following information is available: (Cash Flow Forecasts ( in Lakhs) 3 5 6 7 9 10 4 2 Year 1 500 600 750 800 750 400 1,050 1,200 Target Tyres 150 300 Lid. Acquiring Ltd. 800 1,000 1,500 1,600 2,200 2,600 3,000 2,750 3,500 5,400 Current Balance Sheet of Target Tyres Limited as at March 31, 2013 in lakhs) 2013 Invento Particulars Trade E Cash & Other EQUITY AND LIABILITIES Shareholders' Funds: Share Capital (Face Value 10) 100.00 2,170.95 Reserves and Surplus 2,270.95 (ill) T Non-Current Liabilities Long-Term Borrowings 565.00 78.50 Bank Loan 643.50 163.50 47.25 Current Liabilities: Trade Payables Other Current Liabilities 210.75 TOTAL EQUITY AND LIABILITIES 3,125.20 ( in lakhs) 2013 Particulars ASSETS Non-Current Assets Property, Plant and Equipment Tangible Assets Intangible Assets 1,291.00 120.20 1,411.20 155.00 21.25 1,587.45 Non-Current Investments Other Non-Current Assets Current Assets: Inventories Trade Receivables Cash and Bank Balances Other Current Assets 511.40 745.50 268.50 12.35 1,537.75 TOTAL ASSETS 3,125.20 (iii) Talks for the takeover have crystallized on the following: (a) Acquiring Ltd. will not be able to use Machinery worth * 175 lakhs which will be disposed off by them subsequent to take over. The expected realization will be 150 lakhs. (b) The inventories and receivables are agreed for take over at value of 400 and 700 lakhs respectively, which is the price they will realize on disposal. (c) The liabilities of Target Tyres Ltd. will be discharged in full on take over along with an employee settlement of 120 lakhs for the employees who are not interested in continuing under the new management (d) Acquiring Ltd. will invest a sum of 250 lakhs for upgrading the Plant of Target Tyres Ltd. on take over. A further sum of 250 lakhs will also be incurred in the second year to revamp the machine shop floor of Target Tyres Ltd. (e) The anticipated cash flows of the combined business post take over are as follows: (in lakhs) Year 5 6 9 10 Cash Flows 900 1,200 1,800 2,200 3,000 4,000 4,800 5,000 7,000 10,000 The management of Target Ltd. is not ready to accept its present standalone value as consideration for the takeover. Acquiring Ltd. wishes to know upta what extent they can quote higher price, without suffering any loss in value post merger. 7 8 4 3 1 2 (Chapter 13] Valuation in Mergers and... You are required to advice the management the upper limit price which they can pay per share of Target Tyres Ltd., if a discount factor of 15% is 10 9 considered appropriate. 8 7 6 4 5 Use the following Discount Factor Table: Year 1 2 3 Discount Factor at 15% 9.86960.7561 0.6575 0.5718 0.4972 / 0.4323 0.3759 0.3269 0.28430.2472 (15 marks) in arise out ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started