Answered step by step

Verified Expert Solution

Question

1 Approved Answer

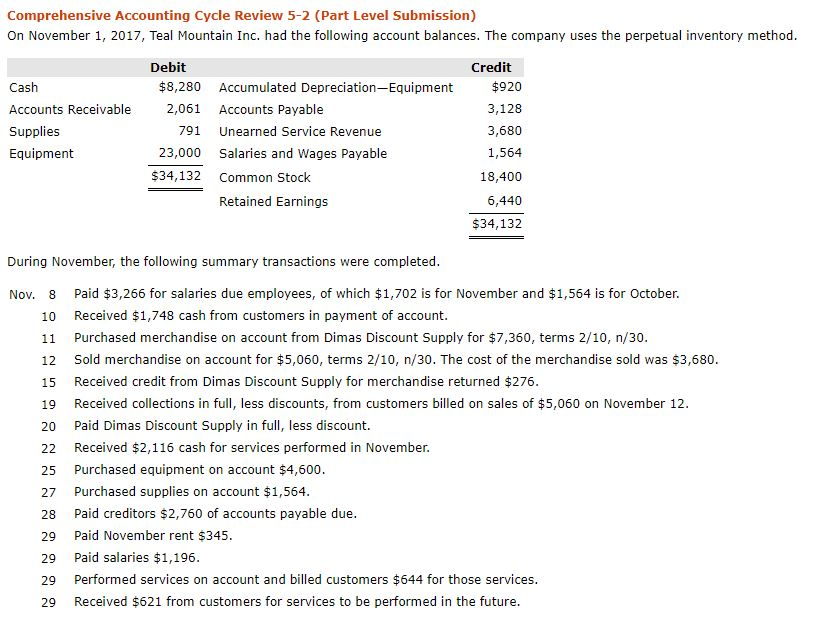

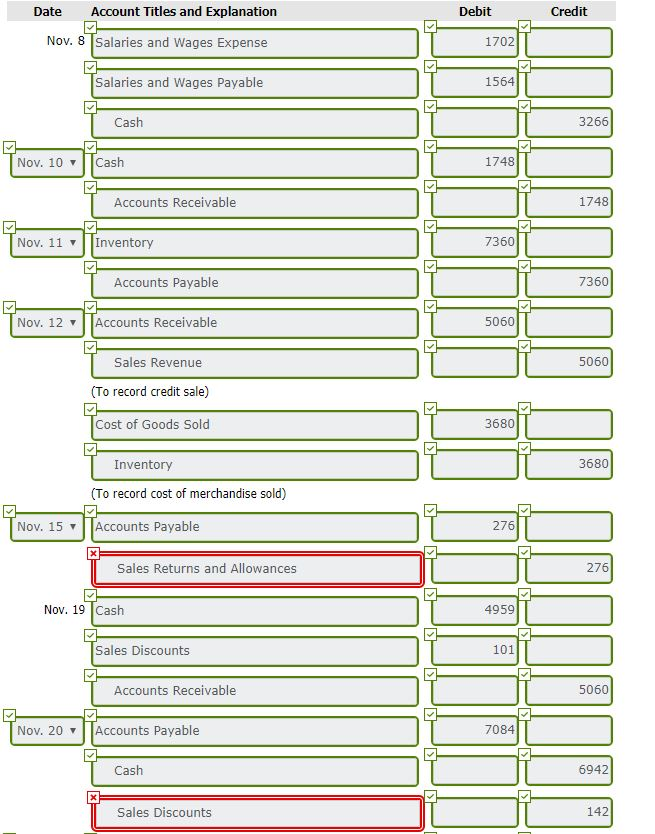

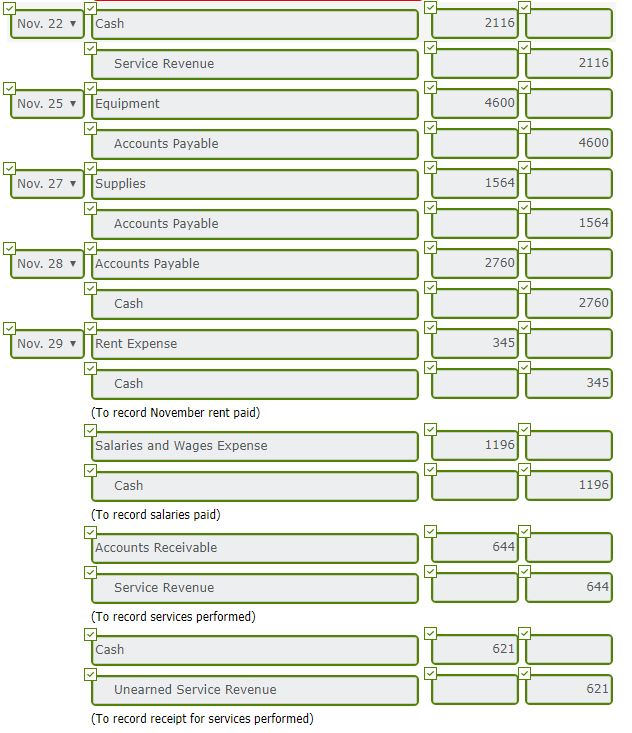

(question is last 3 pictures, next two are context) Comprehensive Accounting Cycle Review 5-2 (Part Level Submission) On November 1, 2017, Teal Mountain Inc. had

(question is last 3 pictures, next two are context)

(question is last 3 pictures, next two are context)

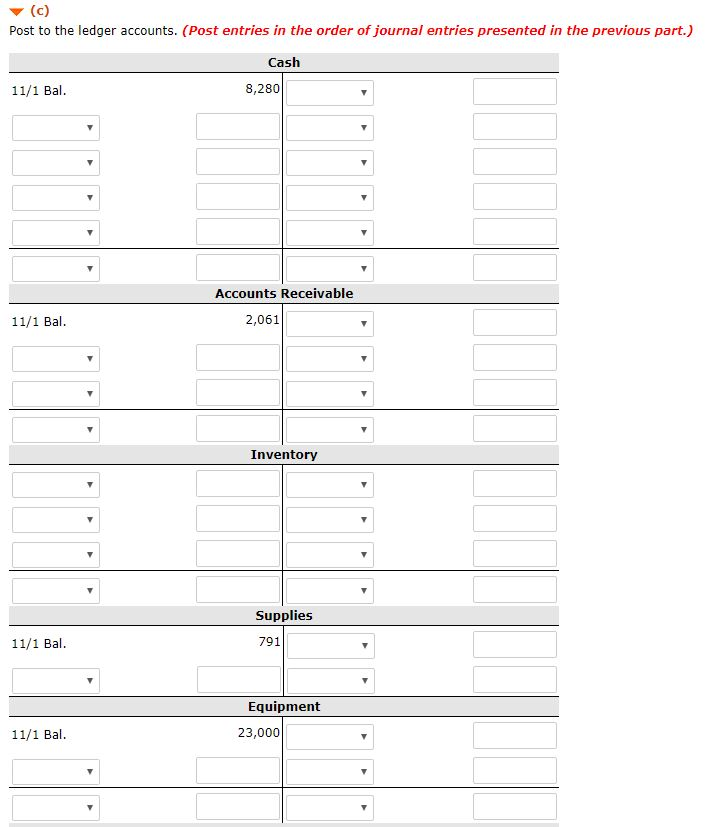

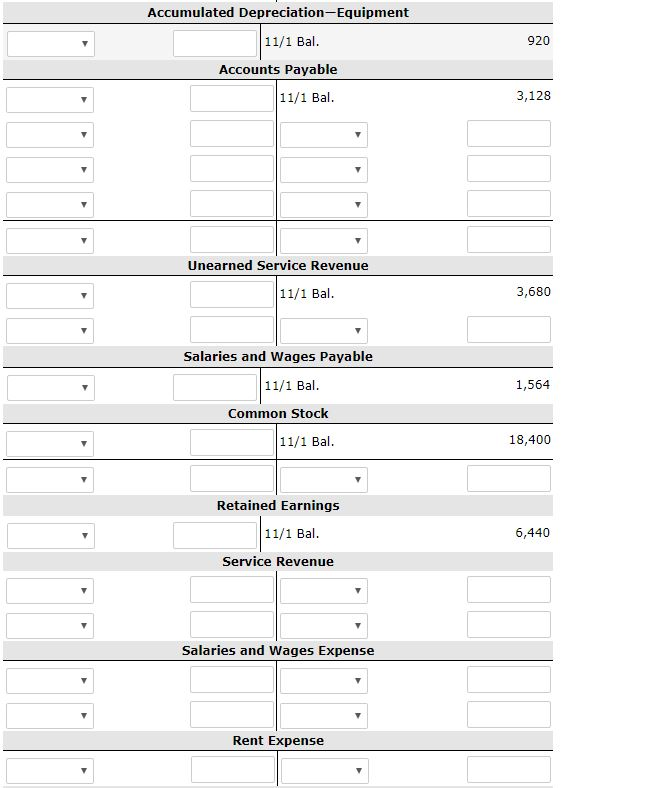

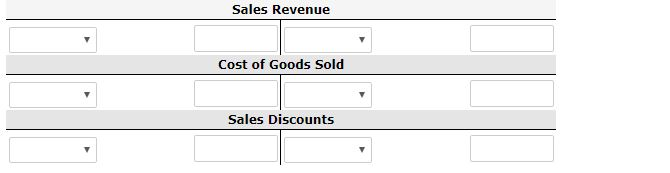

Comprehensive Accounting Cycle Review 5-2 (Part Level Submission) On November 1, 2017, Teal Mountain Inc. had the following account balances. The company uses the perpetual inventory method Debit Credit $920 3,128 3,680 1,564 18,400 6,440 $34,132 $8,280 Accumulated Depreciation Equipment Cash Accounts Receivable Supplies Equipment 2,061 Accounts Payable 791 Unearned Service Revenue 23,000 Salaries and Wages Payable $34,132 Common Stock Retained Earnings During November, the following summary transactions were completed 8 10 11 12 15 19 20 22 25 27 28 29 29 29 29 Paid $3,266 for salaries due employees, of which $1,702 is for November and $1,564 is for October. Received $1,748 cash from customers in payment of account Purchased merchandise on account from Dimas Discount Supply for $7,360, terms 2/10, n/30 Sold merchandise on account for $5,060, terms 2/10, n/30. The cost of the merchandise sold was $3,680 Received credit from Dimas Discount Supply for merchandise returned $276 Received collections in full, less discounts, from customers billed on sales of $5,060 on November 12 Paid Dimas Discount Supply in full, less discount. Received $2,116 cash for services performed in November Purchased equipment on account $4,600 Purchased supplies on account $1,564 Paid creditors $2,760 of accounts payable due Paid November rent $345 Paid salaries $1,196 Performed services on account and billed customers $644 for those services Received $621 from customers for services to be performed in the future Nov. Date Account Titles and Explanation Debit Credit Nov. 8 Salaries and Wages Expense 1702 Salaries and Wages Payable 1564 Cash 3266 Nov. 10 Cash 1748 Accounts Receivable 1748 Nov. 11 Inventory 7360 Accounts Payable 7360 Nov. 12 Accounts Receivable 5060 Sales Revenue 5060 (To record credit sale) Cost of Goods Sold 3680 Inventory 3680 To record cost of merchandise sold) Nov. 15 Accounts Payable 276 Sales Returns and Allowances 276 Nov. 19 Cash 4959 Sales Discounts 101 Accounts Receivable 5060 Nov. 20 Accounts Payable 7084 Cash 6942 Sales Discounts 142 Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous part.) Cash 11/1 Bal 8,280 Accounts Receivable 11/1 Bal 2,061 Inventory Supplies 11/1 Bal 791 Equipment 11/1 Bal 23,000 Accumulated Depreciation-Equipment 11/1 Bal 920 Accounts Payable 11/1 Bal 3,128 Unearned Service Revenue 11/1 Bal 3,680 Salaries and Wages Payable 11/1 Bal 1,564 Common Stock 11/1 Bal 18,400 Retained Earnings 11/1 Bal 6,440 Service Revenue Salaries and Wages Expense Rent Expense Comprehensive Accounting Cycle Review 5-2 (Part Level Submission) On November 1, 2017, Teal Mountain Inc. had the following account balances. The company uses the perpetual inventory method Debit Credit $920 3,128 3,680 1,564 18,400 6,440 $34,132 $8,280 Accumulated Depreciation Equipment Cash Accounts Receivable Supplies Equipment 2,061 Accounts Payable 791 Unearned Service Revenue 23,000 Salaries and Wages Payable $34,132 Common Stock Retained Earnings During November, the following summary transactions were completed 8 10 11 12 15 19 20 22 25 27 28 29 29 29 29 Paid $3,266 for salaries due employees, of which $1,702 is for November and $1,564 is for October. Received $1,748 cash from customers in payment of account Purchased merchandise on account from Dimas Discount Supply for $7,360, terms 2/10, n/30 Sold merchandise on account for $5,060, terms 2/10, n/30. The cost of the merchandise sold was $3,680 Received credit from Dimas Discount Supply for merchandise returned $276 Received collections in full, less discounts, from customers billed on sales of $5,060 on November 12 Paid Dimas Discount Supply in full, less discount. Received $2,116 cash for services performed in November Purchased equipment on account $4,600 Purchased supplies on account $1,564 Paid creditors $2,760 of accounts payable due Paid November rent $345 Paid salaries $1,196 Performed services on account and billed customers $644 for those services Received $621 from customers for services to be performed in the future Nov. Date Account Titles and Explanation Debit Credit Nov. 8 Salaries and Wages Expense 1702 Salaries and Wages Payable 1564 Cash 3266 Nov. 10 Cash 1748 Accounts Receivable 1748 Nov. 11 Inventory 7360 Accounts Payable 7360 Nov. 12 Accounts Receivable 5060 Sales Revenue 5060 (To record credit sale) Cost of Goods Sold 3680 Inventory 3680 To record cost of merchandise sold) Nov. 15 Accounts Payable 276 Sales Returns and Allowances 276 Nov. 19 Cash 4959 Sales Discounts 101 Accounts Receivable 5060 Nov. 20 Accounts Payable 7084 Cash 6942 Sales Discounts 142 Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous part.) Cash 11/1 Bal 8,280 Accounts Receivable 11/1 Bal 2,061 Inventory Supplies 11/1 Bal 791 Equipment 11/1 Bal 23,000 Accumulated Depreciation-Equipment 11/1 Bal 920 Accounts Payable 11/1 Bal 3,128 Unearned Service Revenue 11/1 Bal 3,680 Salaries and Wages Payable 11/1 Bal 1,564 Common Stock 11/1 Bal 18,400 Retained Earnings 11/1 Bal 6,440 Service Revenue Salaries and Wages Expense Rent Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started