Answered step by step

Verified Expert Solution

Question

1 Approved Answer

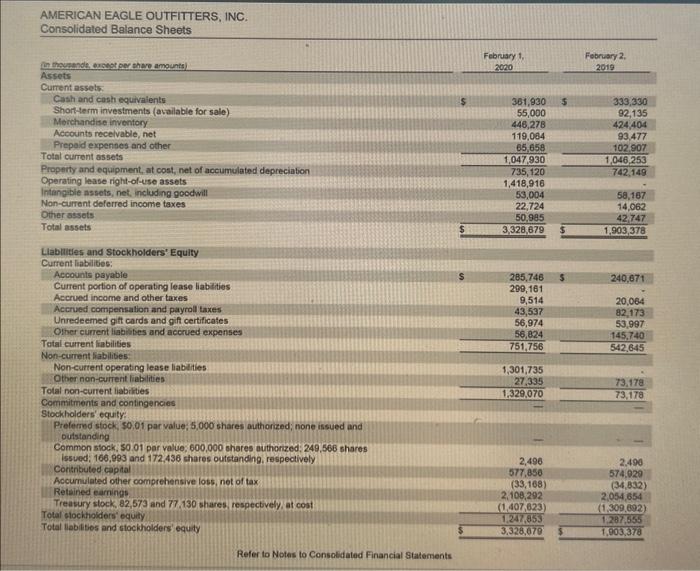

question is last photo AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets Llablittes and Stockholders' Equity Current liabilibes: Accounts payable Current portion of operating lease liabities

question is last photo

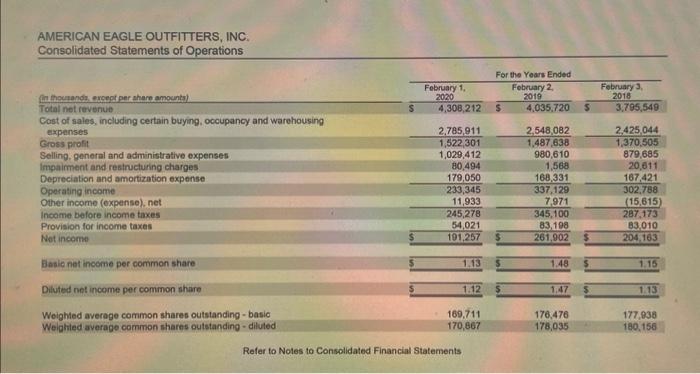

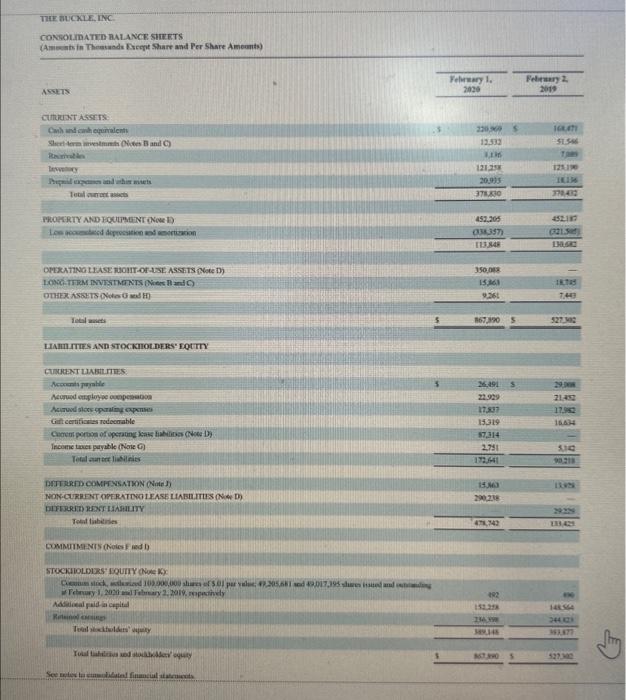

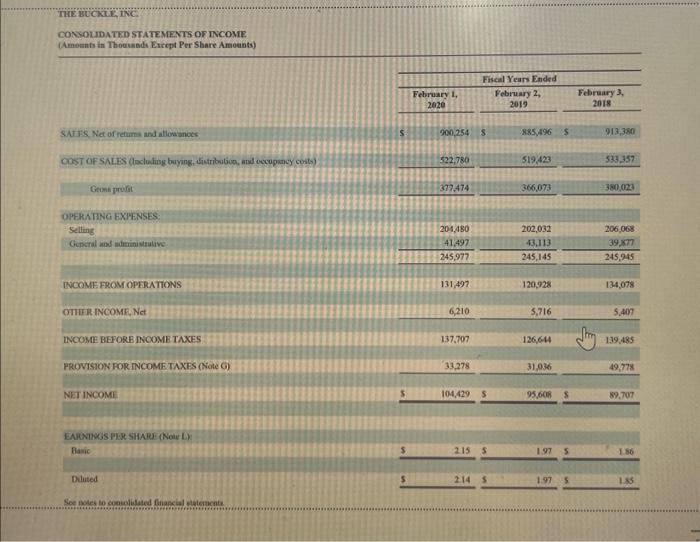

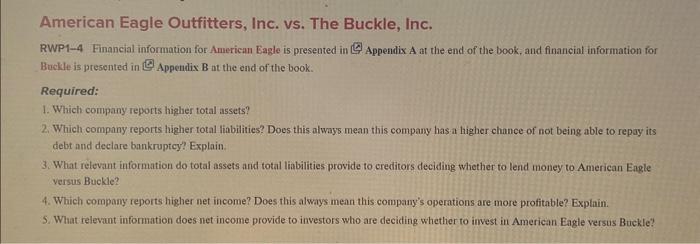

AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets Llablittes and Stockholders' Equity Current liabilibes: Accounts payable Current portion of operating lease liabities Accrued income and other taxes Accrued compensalion and payroll taxes Unredeemed gitt cards and gift certificates Olher cument liabilites and accrued expenses Total current liabilities Non-cument Kabilibes: Non-curtent operating lease liabilities Other non-current liablities Total non-current liabrities Commitments and contingencies Stockholders' equity? Preferred stock, 50,01 par value, 5,000 shares authorized; none issued and outstanding Common stock, 50.01 per value: 600,000 shares authonzed: 249,566 shares Issued: 166,993 and 172,436 shares outstanding, respectively Contributed capial Accumilated other comprehensive loss, not of tax Retained earnings. Treasury stock, 82,573 and 77,130 shares, respectively, at cost Total stochtiolders' equily Total liabilises and stocliolders' equty Refer to Notes to Consolidated Financial Statements AMERICAN EAGLE OUTFITTERS, INC: Consolidated Statements of Operations Reter to Notes to Conspidated Financia statements THE BUCCLE, TMC. CONQOUMATri BALANCE StIETS (Amsints in Themuade Esrept Share and Fer Share Ameunts) cuthust Acissts: HAIH ITES AND STOCKHOt nERS' DOtTr CUCKRST LWBT IIIES. TiE BUCOTE INC CONSOLDATED STATEMENTS OF INCOME (Amemnfs in Thousads Etrept Per Share Amonets) American Eagle Outfitters, Inc. vs. The Buckle, Inc. RWP1-4 Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Bucke is presented in Appendix B at the end of the book. Required: 1. Which company reports higher total assets? 2. Which company reports higher total liabilities? Does this always mean this company has a higher chance of not being able to repay its debt and declare bankruptcy? Explain. 3. What relevant information do total assets and total liabilities provide to creditors deciding whether to lend money to American Eagle versus Buckle? 4. Which company reports higher net income? Does this always mean this company's operations are more profitable? Explain. 5. What relevint information does net income provide to investors who are deciding whether to invest in American Eagle versus Buckle Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started