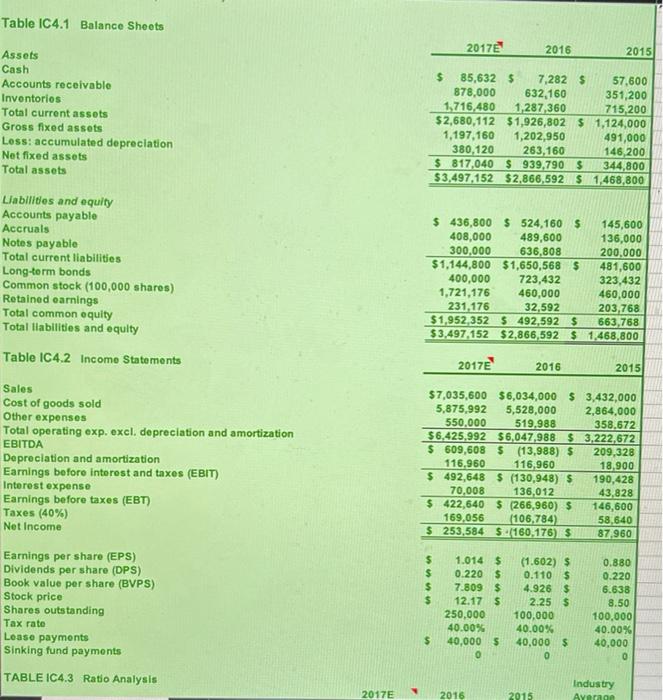

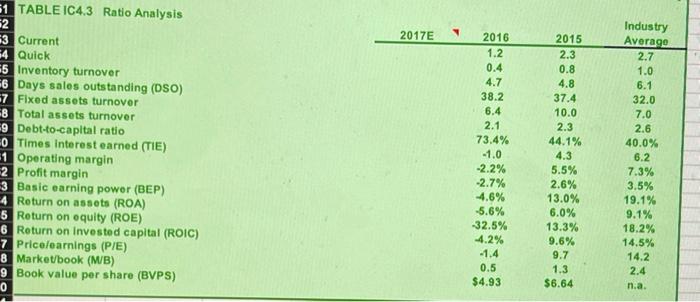

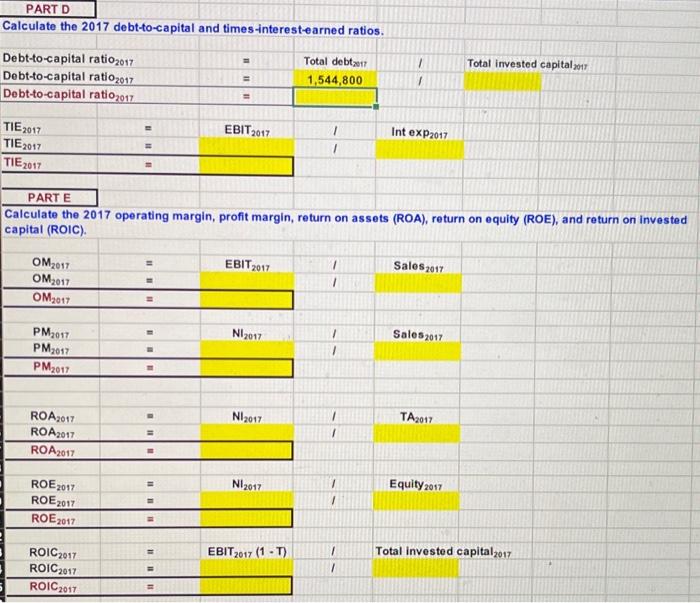

Table IC4.1 Balance Sheets 2017 2016 2015 Assets Cash Accounts receivable Inventorios Total current assets Gross fixed assets Loss: accumulated depreciation Net fixed assets Total assets $ 85,632 $ 7,282 $ 57,600 878,000 632,160 351,200 1,716,480 1,287,360 715,200 $2,680,112 $1,926,802 $ 1,124,000 1,197,160 1,202,950 491,000 380,120 263,160 146,200 $ 817,040 $ 939,790 $ 344,800 $3,497,152 $2.866,592 $ 1,468,800 Liabilides and equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Common stock (100,000 shares) Retained earnings Total common equity Total liabilities and equity Table IC4.2 Income Statements $ 436,800 $ 524,160 $ 145,600 408,000 489,600 136,000 300,000 636,808 200,000 $1,144,800 $1,650,568 $ 481,600 400,000 723,432 323,432 1,721,176 460,000 460,000 231,176 32,592 203,768 $1,952,352 5492,592 $ 663 768 $3,497,152 $2.866,592 $ 1,468,800 2017 2016 2015 Sales Cost of goods sold Other expenses Total operating exp. excl. depreciation and amortization EBITDA Depreciation and amortization Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (40%) Net Income $7,035,600 $6,034,000 $3,432,000 5,875,992 5,528,000 2,864,000 550.000 519,988 358.672 $6,425,992 $6,047,988 $ 3,222,672 $ 609,608 $ (13,988) $ 209,328 116.960 116,960 18,900 $ 492,648 $ (130,948) $ 190,428 70.008 136,012 43,828 $ 422,640 $ (266,960) $ 146,600 169,056 (106,784) 58,640 $ 253,584 $160,176) $ 87,960 Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Stock price Shares outstanding Tax rate Lease payments Sinking fund payments $ $ $ $ 1.014 $ 0.220 $ 7.809 $ 12.17 $ 250,000 40.00% 40,000 $ (1.602) $ 0.110 S 4.926 $ 2.25 $ 100,000 40.00% 40,000 $ 0 0.880 0.220 6.638 8.50 100,000 40.00% 40,000 0 $ TABLE IC4.3 Ratio Analysis 2017E Industry Average 2016 2015 2017E Industry Average 2.7 1.0 6.1 32.0 7.0 2.6 31 TABLE IC4.3 Ratio Analysis 2 3 Current 54 Quick 55 Inventory turnover 6 Days sales outstanding (DSO) 7 Fixed assets turnover 8 Total assets turnover -9 Debt-to-capital ratio 0 Times Interest earned (TIE) 1 Operating margin 2 Profit margin 3 Basic earning power (BEP) 4 Return on assets (ROA) 5 Return on equity (ROE) 6 Return on invested capital (ROIC) 7 Price/earnings (P/E) 8 Market/book (MB) 9 Book value per share (BVPS) 2016 1.2 0.4 4.7 38.2 6.4 2.1 73.4% -1.0 -2.2% -2.7% -4.6% -5.6% -32.5% -4.2% -1.4 0.5 $4.93 2015 2.3 0.8 4.8 37.4 10.0 2.3 44.1% 4.3 5.5% 2.6% 13.0% 6.0% 13.3% 9.6% 9.7 1.3 $6.64 40.0% 6.2 7.3% 3.5% 19.1% 9.1% 18.2% 14.5% 14.2 2.4 nia. 0 PART D Calculate the 2017 debt-to-capital and times-interest-earned ratios. / Total invested capital 2011 Debt-to-capital ratio2017 Debt-to-capital ratio2017 Debt-to-capital ratio2017 Total debt 2017 1,544,800 EBIT 2017 1 Int exp2017 TIE 2017 TIE 2017 TIE 2017 PARTE Calculate the 2017 operating margin, profit margin, return on assets (ROA), return on equity (ROE), and return on invested capital (ROIC). EBIT 2017 OM2017 OM2017 1 Sales 2017 OM2017 NI 2017 Sales 2017 PM2017 PM 2017 PM2017 Nl2017 TA2017 ROA2017 ROA2017 ROA2017 Nl2017 Equity 2017 ROE 2017 ROE 2017 ROE 2017 1 EBIT 2017 (1 -T) ROIC2017 ROIC2017 ROIC2017 1 1 Total invested capital2017