Answered step by step

Verified Expert Solution

Question

1 Approved Answer

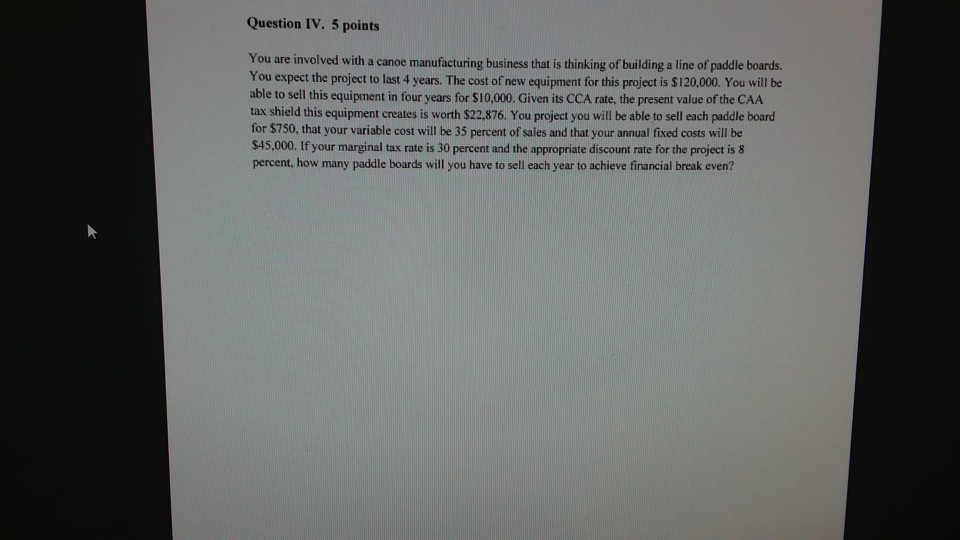

Question IV. 5 points You are involved with a canoe manufacturing business that is thinking of building a line of paddle boards. You expect the

Question IV. 5 points You are involved with a canoe manufacturing business that is thinking of building a line of paddle boards. You expect the project to last 4 years. The cost of new equipment for this project is $120,000. You will be able to sell this equipment in four years for $10,000. Given its CCA rate, the present value of the CAA tax shield this equipment for $750, that your variable cost will be 35 percent of sales and that your annual fixed costs will be S45,000. If your marginal tax rate is 30 percent and the appropriate discount rate for the project is 8 percent, how many paddle boards will you have to sell each year to achieve financial break even? creates is worth $22,876. You project you will be able to sell each paddle board

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started