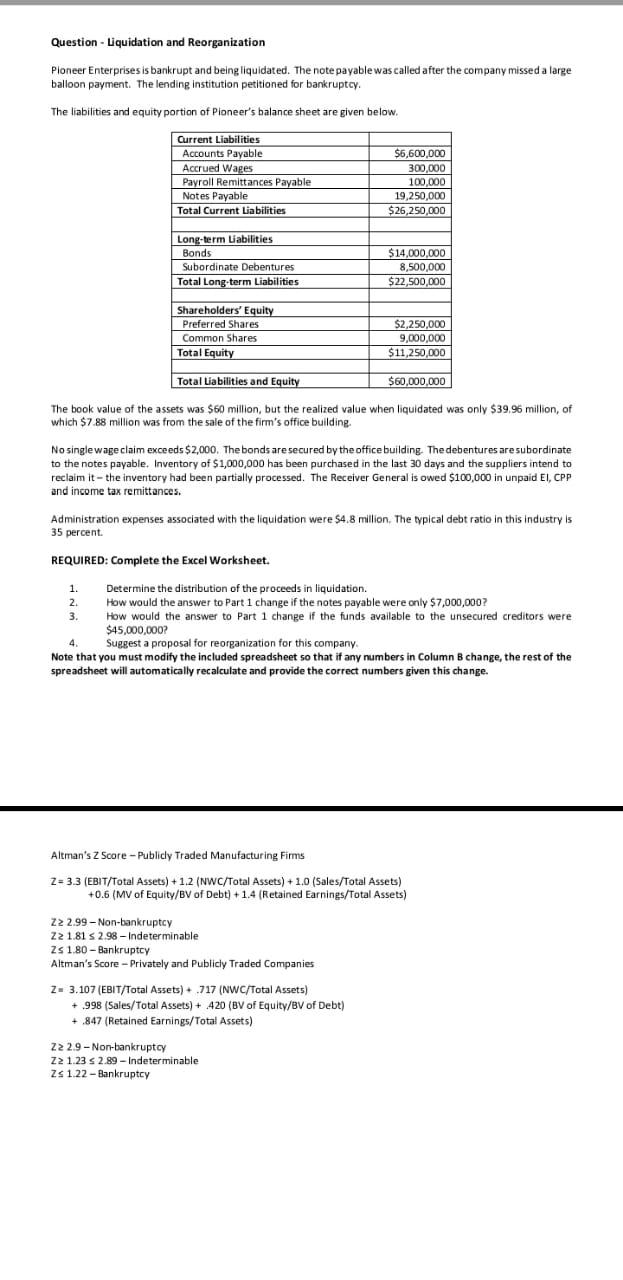

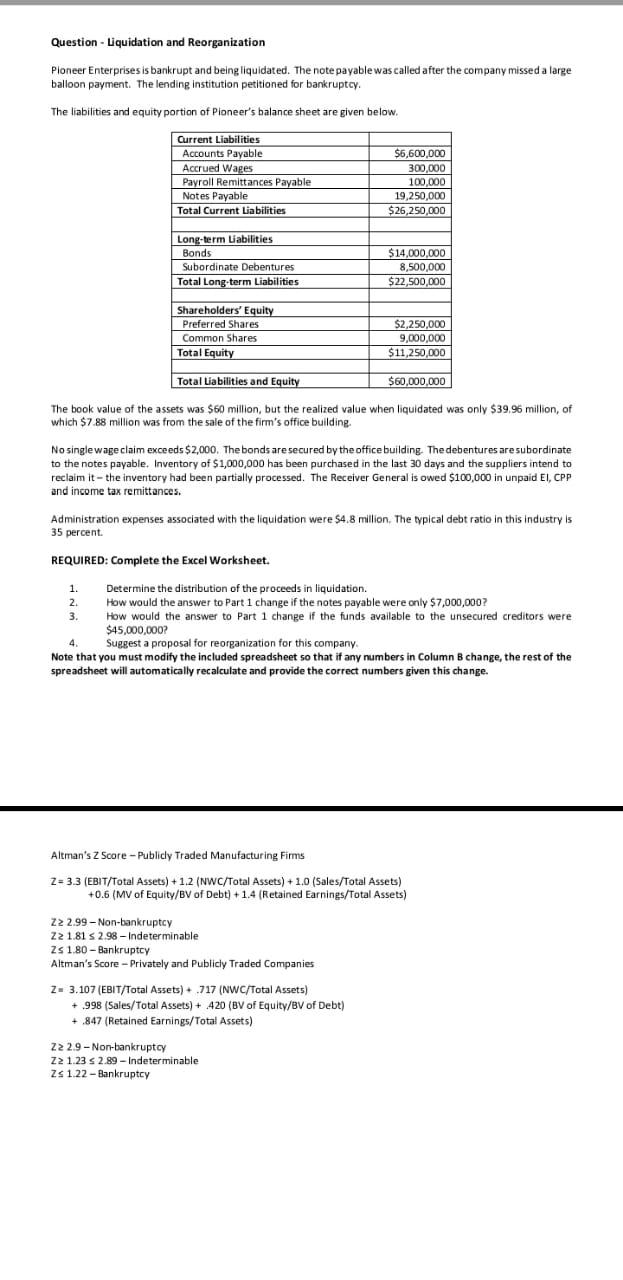

Question - Liquidation and Reorganization Pioneer Enterprises is bankrupt and being liquidated. The note payable was called after the company missed a large balloon payment. The lending Institution petitioned for bankruptcy. The liabilities and equity portion of Pioneer's balance sheet are given below. Current Liabilities Accounts Payable Accrued Wages Payroll Remittances Payable Notes Payable Total Current Liabilities $6,600,000 300,000 100.000 19,250.000 $26,250,000 Long-term Liabilities Bonds Subordinate Debentures Total Long-term Liabilities $14.000.000 8,500,000 $22,500,000 Shareholders' Equity ' Preferred Shares Common Shares Total Equity $2,250.000 9,000,000 $11,250,000 Total Liabilities and Equity $60,000,000 $ The book value of the assets was $60 million, but the realized value when liquidated was only $39.96 million, of which $7 88 million was from the sale of the firm's office building. No single wage claim exceeds $2,000. The bonds are secured by the office building. The debentures are subordinate to the notes payable. Inventory of $1,000,000 has been purchased in the last 30 days and the suppliers intend to reclaim it-the inventory had been partially processed. The Receiver General is owed $100,000 in unpaid El CPP and income tax remittances. . Administration expenses associated with the liquidation were $4.8 million. The typical debt ratio in this industry is 35 percent REQUIRED: Complete the Excel Worksheet. 1 1. Determine the distribution of the proceeds in liquidation. 2. How would the answer to Part 1 change if the notes payable were only $7,000,000? 3. How would the answer to Part 1 change if the funds available to the unsecured creditors were $45,000,000? 4 Suggest a proposal for reorganization for this company Note that you must modify the included spreadsheet so that if any numbers in Column B change, the rest of the spreadsheet will automatically recalculate and provide the correct numbers given this change. Altman's Z Score - Publicly Traded Manufacturing Firms Z= 3.3 (EBIT/Total Assets) + 1.2 (NWC/Total Assets) + 1.0 (Sales/Total Assets) +0.6 (MV of Equity/BV of Debt) + 1.4 (Retained Earnings/Total Assets) 22 2.99 - Non-bankruptcy 22 1.81 2.98 - Indeterminable Zs 1.80 - Bankruptcy Altman's Score - Privately and publicly Traded Companies 2- 3.107 (EBIT/Total Assets) + .717 (NWC/Total Assets) +998 (Sales/Total Assets) + .420 (BV of Equity/BV of Debt) + .847 (Retained Earnings/Total Assets) Z22.9-Non-bankruptcy Z2 1.23 s 2.89 - Indeterminable Zs 1.22 - Bankruptcy Question - Liquidation and Reorganization Pioneer Enterprises is bankrupt and being liquidated. The note payable was called after the company missed a large balloon payment. The lending Institution petitioned for bankruptcy. The liabilities and equity portion of Pioneer's balance sheet are given below. Current Liabilities Accounts Payable Accrued Wages Payroll Remittances Payable Notes Payable Total Current Liabilities $6,600,000 300,000 100.000 19,250.000 $26,250,000 Long-term Liabilities Bonds Subordinate Debentures Total Long-term Liabilities $14.000.000 8,500,000 $22,500,000 Shareholders' Equity ' Preferred Shares Common Shares Total Equity $2,250.000 9,000,000 $11,250,000 Total Liabilities and Equity $60,000,000 $ The book value of the assets was $60 million, but the realized value when liquidated was only $39.96 million, of which $7 88 million was from the sale of the firm's office building. No single wage claim exceeds $2,000. The bonds are secured by the office building. The debentures are subordinate to the notes payable. Inventory of $1,000,000 has been purchased in the last 30 days and the suppliers intend to reclaim it-the inventory had been partially processed. The Receiver General is owed $100,000 in unpaid El CPP and income tax remittances. . Administration expenses associated with the liquidation were $4.8 million. The typical debt ratio in this industry is 35 percent REQUIRED: Complete the Excel Worksheet. 1 1. Determine the distribution of the proceeds in liquidation. 2. How would the answer to Part 1 change if the notes payable were only $7,000,000? 3. How would the answer to Part 1 change if the funds available to the unsecured creditors were $45,000,000? 4 Suggest a proposal for reorganization for this company Note that you must modify the included spreadsheet so that if any numbers in Column B change, the rest of the spreadsheet will automatically recalculate and provide the correct numbers given this change. Altman's Z Score - Publicly Traded Manufacturing Firms Z= 3.3 (EBIT/Total Assets) + 1.2 (NWC/Total Assets) + 1.0 (Sales/Total Assets) +0.6 (MV of Equity/BV of Debt) + 1.4 (Retained Earnings/Total Assets) 22 2.99 - Non-bankruptcy 22 1.81 2.98 - Indeterminable Zs 1.80 - Bankruptcy Altman's Score - Privately and publicly Traded Companies 2- 3.107 (EBIT/Total Assets) + .717 (NWC/Total Assets) +998 (Sales/Total Assets) + .420 (BV of Equity/BV of Debt) + .847 (Retained Earnings/Total Assets) Z22.9-Non-bankruptcy Z2 1.23 s 2.89 - Indeterminable Zs 1.22 - Bankruptcy