Question :

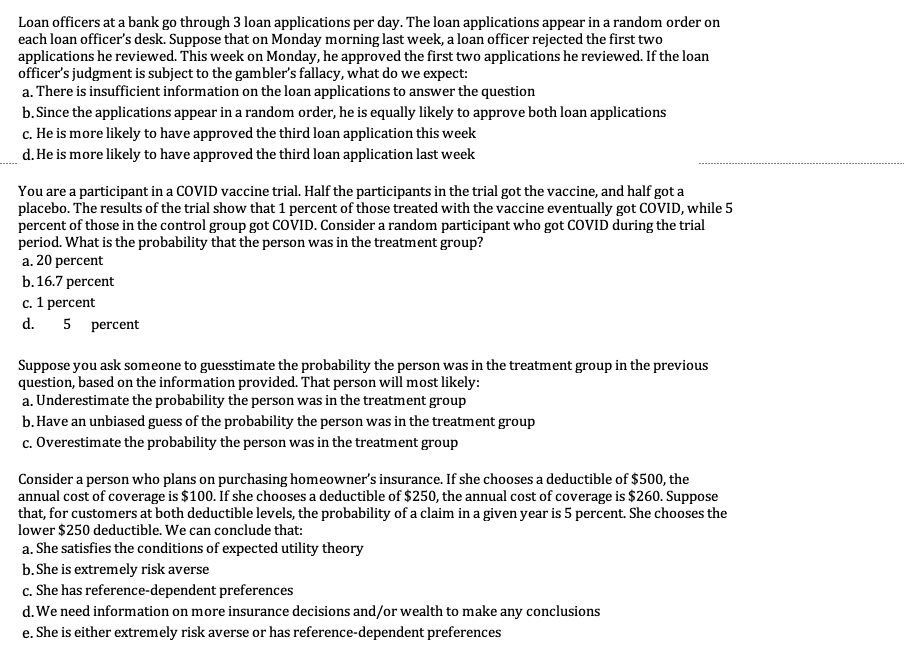

Loan officers at a bank go through 3 loan applications per day. The loan applications appear in a random order on each loan officer's desk. Suppose that on Monday morning last week, a loan officer rejected the first two applications he reviewed. This week on Monday, he approved the first two applications he reviewed. If the loan officer's judgment is subject to the gambler's fallacy, what do we expect: a. There is insufficient information on the loan applications to answer the question b. Since the applications appear in a random order, he is equally likely to approve both loan applications c. He is more likely to have approved the third loan application this week d. He is more likely to have approved the third loan application last week You are a participant in a COVID vaccine trial. Half the participants in the trial got the vaccine, and half got a placebo. The results of the trial show that 1 percent of those treated with the vaccine eventually got COVID, while 5 percent of those in the control group got COVID. Consider a random participant who got COVID during the trial period. What is the probability that the person was in the treatment group? a. 20 percent b. 16.7 percent c. 1 percent d. 5 percent Suppose you ask someone to guesstimate the probability the person was in the treatment group in the previous question, based on the information provided. That person will most likely: a. Underestimate the probability the person was in the treatment group b. Have an unbiased guess of the probability the person was in the treatment group c. Overestimate the probability the person was in the treatment group Consider a person who plans on purchasing homeowner's insurance. If she chooses a deductible of $500, the annual cost of coverage is $100. If she chooses a deductible of $250, the annual cost of coverage is $260. Suppose that, for customers at both deductible levels, the probability of a claim in a given year is 5 percent. She chooses the lower $250 deductible. We can conclude that: a. She satisfies the conditions of expected utility theory b. She is extremely risk averse c. She has reference-dependent preferences d. We need information on more insurance decisions and/or wealth to make any conclusions e. She is either extremely risk averse or has reference-dependent preferences