Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: - Make Balance Sheet and Statement of Cost of Goods Sold like exhibit 1 and 2, examples for exhibi1 and 2 then the questions

Question:

- Make Balance Sheet and Statement of Cost of Goods Sold like exhibit 1 and 2, examples for exhibi1 and 2 then the questions are in the picture above

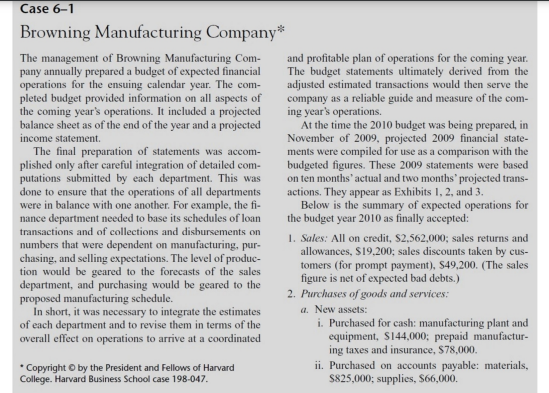

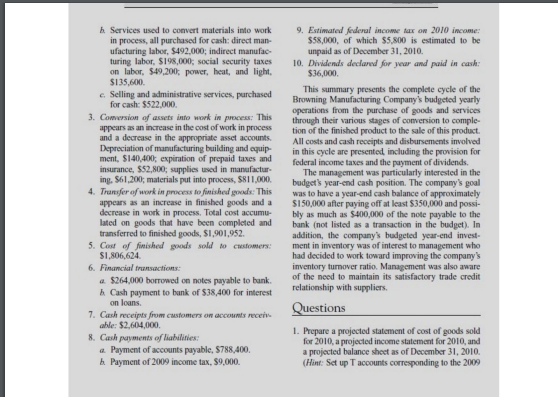

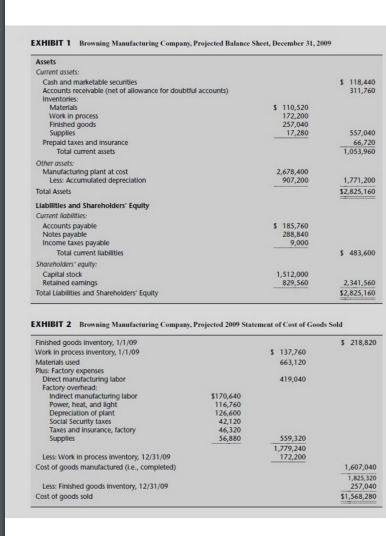

Case 6-1 Browning Manufacturing Company* The management of Browning Manufacturing Com- and profitable plan of operations for the coming year. pany annually prepared a budget of expected financial The budget statements ultimately derived from the operations for the ensuing calendar year. The com- adjusted estimated transactions would then serve the pleted budget provided information on all aspects of company as a reliable guide and measure of the com- the coming year's operations. It included a projected ing year's operations. balance sheet as of the end of the year and a projected At the time the 2010 budget was being prepared, in income statement November of 2009, projected 2009 financial state- The final preparation of statements was accom- ments were compiled for use as a comparison with the plished only after careful integration of detailed com- budgeted figures. These 2009 statements were based putations submitted by each department. This was on ten months'actual and two months' projected trans- done to ensure that the operations of all departments actions. They appear as Exhibits 1, 2, and 3. were in balance with one another. For example, the fi- Below is the summary of expected operations for nance department needed to base its schedules of loan the budget year 2010 as finally accepted: transactions and of collections and disbursements on numbers that were dependent on manufacturing, pur- 1. Sales: All on credit, $2,562,000; sales returns and chasing, and selling expectations. The level of produc- allowances, $19.200; sales discounts taken by cus- tion would be geared to the forecasts of the sales tomers (for prompt payment), S49,200. (The sales department, and purchasing would be geared to the figure is net of expected bad debts.) proposed manufacturing schedule. 2. Purchases of goods and services: In short, it was necessary to integrate the estimates a. New assets: of each department and to revise them in terms of the i. Purchased for cash: manufacturing plant and overall effect on operations to arrive at a coordinated equipment, S144,000; prepaid manufactur- ing taxes and insurance, S78,000 * Copyright by the President and Fellows of Harvard ii. Purchased on accounts payable: materials, College. Harvard Business School case 198-047. $825,000; supplies, $66,000. h Services used to convert materials into work in process, all purchased for cash: direct man ufacturing labor, $492,000; indirect manufac turing labor, S198,000; social security taxes on labor, $49,200 power, heat, and light, $135,600 c. Selling and administrative services, purchased for cash: $522,000 3. Conversion of assets into work in process: This appears as an increase in the cost of work in process and a decrease in the appropriate asset accounts. Depreciation of manufacturing building and equip ment, $140,400; expiration of prepaid taxes and insurance, $52,800; supplies used in manufactur ing. 561,200; materials put into process, 5811,000 4. Transfer of work in process to finished goods: This appears as an increase in finished goods and a decrease in work in process. Total cost accumu- lated on goods that have been completed and transferred to finished goods, $1,901,952. 5. Cost of finished goods sold to restomers: $1,806,624 6. Financial transactions a $264,000 borrowed on notes payable to bunk. h Cash payment to bunk of $38,400 for interest on loans 7. Cash receipts from customers on accounts receive ahle: $2,604,000 8. Cash payments of liabilities: a Payment of accounts payable, $788.400 b. Payment of 2009 income tax, 89.000. 9. Estimated federal income tax on 2010 income: $58,000, of which $5,800 is estimated to be unpaid as of December 31, 2010, 10. Dividends declared for your and paid in cash: $36,000 This summary presents the complete cycle of the Browning Manufacturing Company's budgeted yearly operations from the purchase of goods and services through their various stages of conversion to comple- tion of the finished product to the sale of this product All costs and cash receipts and disbursements involved in this cycle are presented, including the provision for federal income taxes and the payment of dividends. The management was particularly interested in the budget's year-end cash position. The company's goal was to have a year-end cash balance of approximately $150,000 after paying off at least $350,000 and possi- bly as much as $400,000 of the note payable to the bank (not listed as a transaction in the budget). In addition, the company's budgeted year-end invest- ment in inventory was of interest to management who had decided to work toward improving the company inventory turnover ratio. Management was also aware of the need to maintain its satisfactory trade credit relationship with suppliers. Questions 1. Prepare a projected statement of cost of goods sold for 2010, a projected income statement for 2010, and a projected balance sheet as of December 31, 2010, (Hint: Set up T accounts corresponding to the 2009 Case 6-1 Browning Manufacturing Company* The management of Browning Manufacturing Com- and profitable plan of operations for the coming year. pany annually prepared a budget of expected financial The budget statements ultimately derived from the operations for the ensuing calendar year. The com- adjusted estimated transactions would then serve the pleted budget provided information on all aspects of company as a reliable guide and measure of the com- the coming year's operations. It included a projected ing year's operations. balance sheet as of the end of the year and a projected At the time the 2010 budget was being prepared, in income statement November of 2009, projected 2009 financial state- The final preparation of statements was accom- ments were compiled for use as a comparison with the plished only after careful integration of detailed com- budgeted figures. These 2009 statements were based putations submitted by each department. This was on ten months'actual and two months' projected trans- done to ensure that the operations of all departments actions. They appear as Exhibits 1, 2, and 3. were in balance with one another. For example, the fi- Below is the summary of expected operations for nance department needed to base its schedules of loan the budget year 2010 as finally accepted: transactions and of collections and disbursements on numbers that were dependent on manufacturing, pur- 1. Sales: All on credit, $2,562,000; sales returns and chasing, and selling expectations. The level of produc- allowances, $19.200; sales discounts taken by cus- tion would be geared to the forecasts of the sales tomers (for prompt payment), S49,200. (The sales department, and purchasing would be geared to the figure is net of expected bad debts.) proposed manufacturing schedule. 2. Purchases of goods and services: In short, it was necessary to integrate the estimates a. New assets: of each department and to revise them in terms of the i. Purchased for cash: manufacturing plant and overall effect on operations to arrive at a coordinated equipment, S144,000; prepaid manufactur- ing taxes and insurance, S78,000 * Copyright by the President and Fellows of Harvard ii. Purchased on accounts payable: materials, College. Harvard Business School case 198-047. $825,000; supplies, $66,000. h Services used to convert materials into work in process, all purchased for cash: direct man ufacturing labor, $492,000; indirect manufac turing labor, S198,000; social security taxes on labor, $49,200 power, heat, and light, $135,600 c. Selling and administrative services, purchased for cash: $522,000 3. Conversion of assets into work in process: This appears as an increase in the cost of work in process and a decrease in the appropriate asset accounts. Depreciation of manufacturing building and equip ment, $140,400; expiration of prepaid taxes and insurance, $52,800; supplies used in manufactur ing. 561,200; materials put into process, 5811,000 4. Transfer of work in process to finished goods: This appears as an increase in finished goods and a decrease in work in process. Total cost accumu- lated on goods that have been completed and transferred to finished goods, $1,901,952. 5. Cost of finished goods sold to restomers: $1,806,624 6. Financial transactions a $264,000 borrowed on notes payable to bunk. h Cash payment to bunk of $38,400 for interest on loans 7. Cash receipts from customers on accounts receive ahle: $2,604,000 8. Cash payments of liabilities: a Payment of accounts payable, $788.400 b. Payment of 2009 income tax, 89.000. 9. Estimated federal income tax on 2010 income: $58,000, of which $5,800 is estimated to be unpaid as of December 31, 2010, 10. Dividends declared for your and paid in cash: $36,000 This summary presents the complete cycle of the Browning Manufacturing Company's budgeted yearly operations from the purchase of goods and services through their various stages of conversion to comple- tion of the finished product to the sale of this product All costs and cash receipts and disbursements involved in this cycle are presented, including the provision for federal income taxes and the payment of dividends. The management was particularly interested in the budget's year-end cash position. The company's goal was to have a year-end cash balance of approximately $150,000 after paying off at least $350,000 and possi- bly as much as $400,000 of the note payable to the bank (not listed as a transaction in the budget). In addition, the company's budgeted year-end invest- ment in inventory was of interest to management who had decided to work toward improving the company inventory turnover ratio. Management was also aware of the need to maintain its satisfactory trade credit relationship with suppliers. Questions 1. Prepare a projected statement of cost of goods sold for 2010, a projected income statement for 2010, and a projected balance sheet as of December 31, 2010, (Hint: Set up T accounts corresponding to the 2009Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started