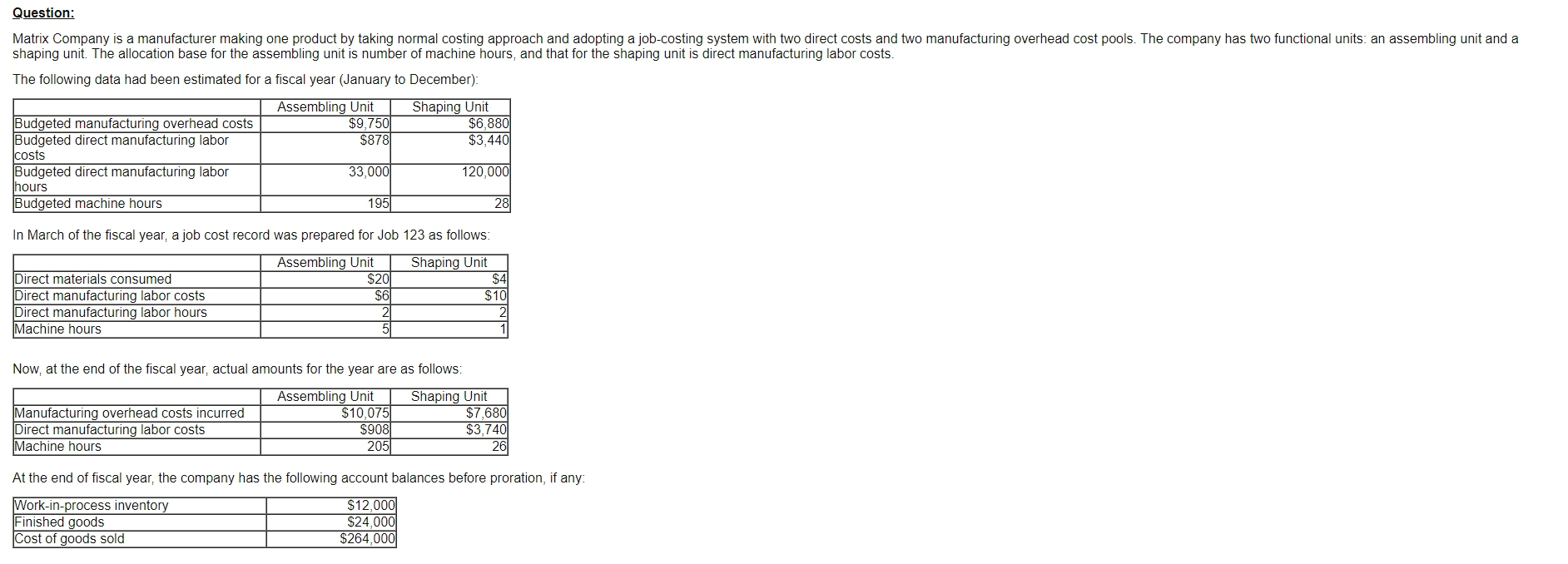

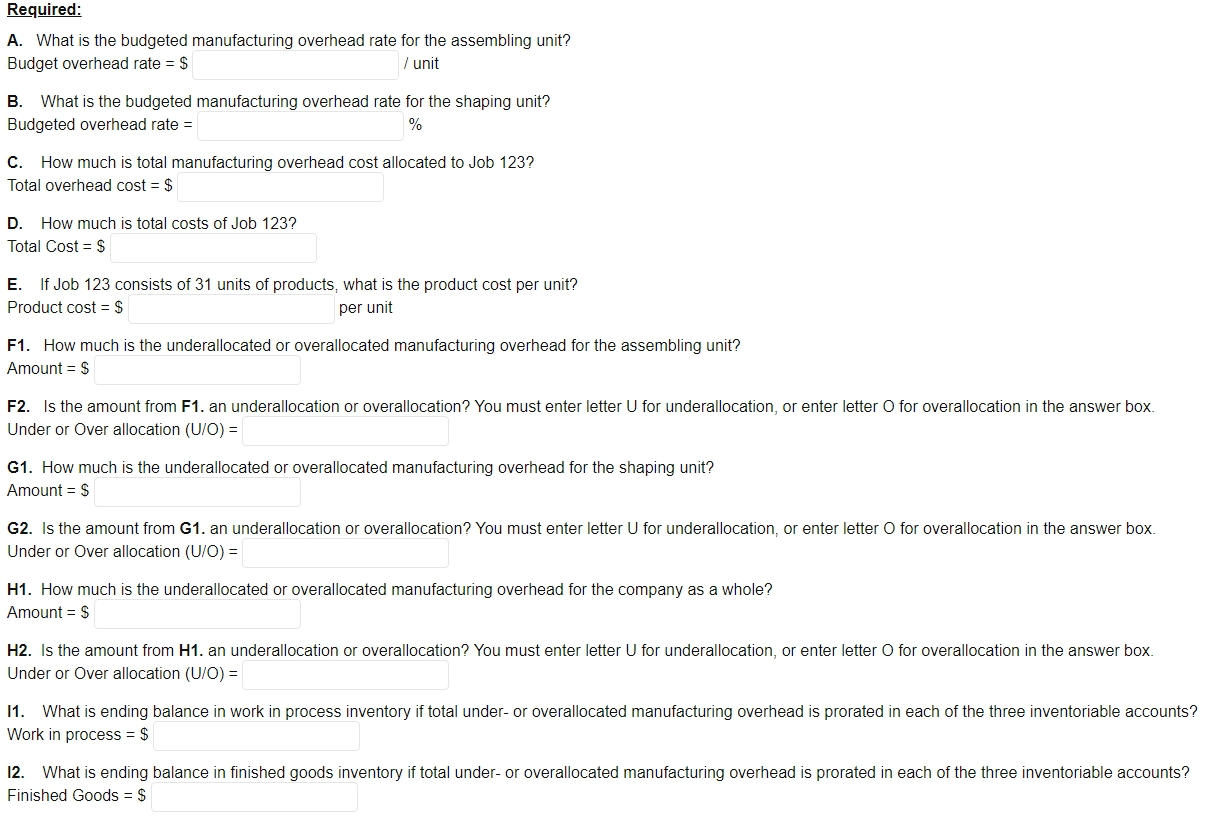

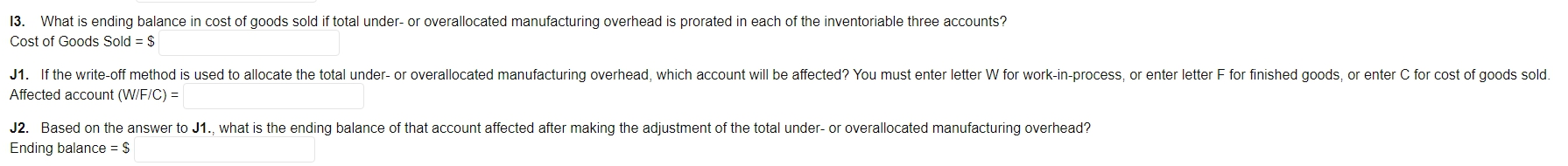

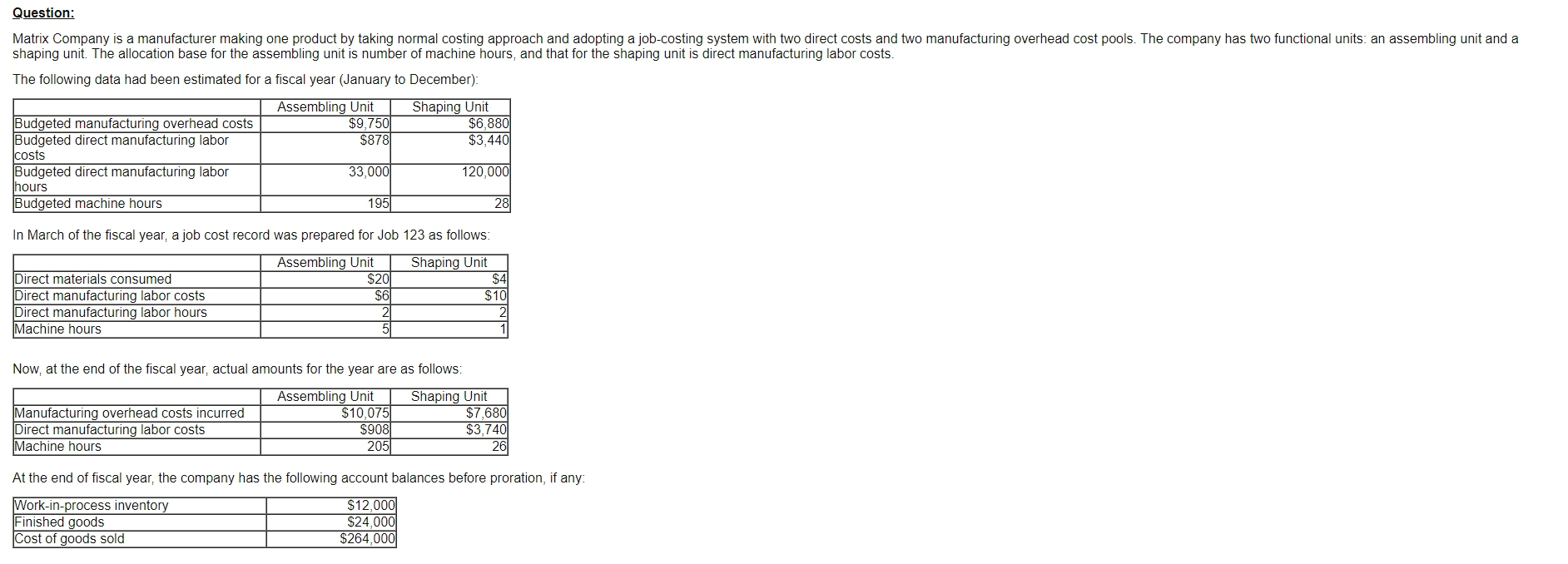

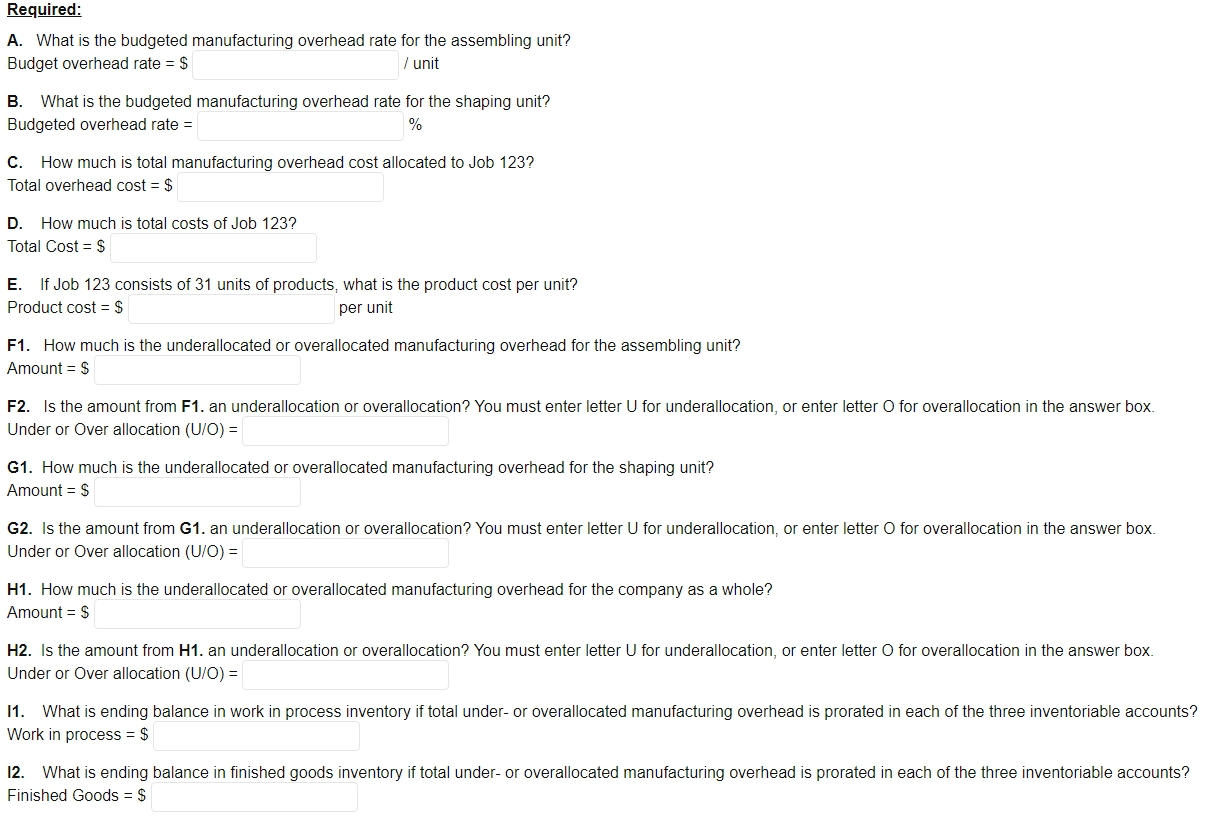

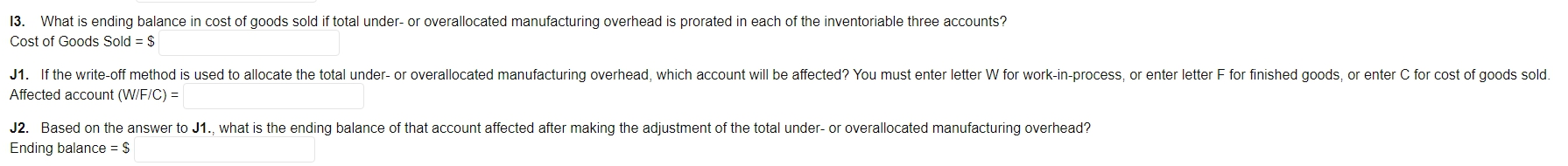

Question: Matrix Company is a manufacturer making one product by taking normal costing approach and adopting a job-costing system with two direct costs and two manufacturing overhead cost pools. The company has two functional units: an assembling unit and a shaping unit. The allocation base for the assembling unit is number of machine hours, and that for the shaping unit is direct manufacturing labor costs. The following data had been estimated for a fiscal year (January to December): Assembling Unit $9,7501 $878 Shaping Unit $6,880 $3,440 Budgeted manufacturing overhead costs Budgeted direct manufacturing labor costs Budgeted direct manufacturing labor hours Budgeted machine hours 33,000 120,000 195 28 In March of the fiscal year, a job cost record was prepared for Job 123 as follows: Assembling Unit $20 $6 21 51 Shaping Unit $4 $10 Direct materials consumed Direct manufacturing labor costs Direct manufacturing labor hours Machine hours Now, at the end of the fiscal year, actual amounts for the year are as follows: Assembling Unit Shaping Unit Manufacturing overhead costs incurred $10,075 $7,680 Direct manufacturing labor costs $908 $3,7401 Machine hours 2051 26 At the end of fiscal year, the company has the following account balances before proration, if any. Work-in-process inventory $12,000 Finished goods $24,000 Cost of goods sold $264,000 Required: A. What is the budgeted manufacturing overhead rate for the assembling unit? Budget overhead rate = $ / unit B. What is the budgeted manufacturing overhead rate for the shaping unit? Budgeted overhead rate = C. How much is total manufacturing overhead cost allocated to Job 123? Total overhead cost = $ D. How much is total costs of Job 123? Total Cost = $ E. If Job 123 consists of 31 units of products, what is the product cost per unit? Product cost = $ per unit F1. How much is the underallocated or overallocated manufacturing overhead for the assembling unit? Amount = S F2. Is the amount from F1. an underallocation or overallocation? You must enter letter U for underallocation, or enter letter O for overallocation in the answer box. Under or Over allocation (U/O) = G1. How much is the underallocated or overallocated manufacturing overhead for the shaping unit? Amount = $ G2. Is the amount from G1. an underallocation or overallocation? You must enter letter U for underallocation, or enter letter O for overallocation in the answer box. Under or Over allocation (U/O) = H1. How much is the underallocated or overallocated manufacturing overhead for the company as a whole? Amount = $ H2. Is the amount from H1. an underallocation or overallocation? You must enter letter U for underallocation, or enter letter O for overallocation in the answer box. Under or Over allocation (U/O) = 11. What is ending balance in work in process inventory if total under-or overallocated manufacturing overhead is prorated in each of the three inventoriable accounts? Work in process = $ 12. What is ending balance in finished goods inventory if total under- or overallocated manufacturing overhead is prorated in each of the three inventoriable accounts? Finished Goods = $ 13. What is ending balance in cost of goods sold if total under-or overallocated manufacturing overhead is prorated in each of the inventoriable three accounts? Cost of Goods Sold = $ J1. If the write-off method is used to allocate the total under-or overallocated manufacturing overhead, which account will be affected? You must enter letter W for work-in-process, or enter letter F for finished goods, or enter C for cost of goods sold. Affected account (W/F/C) = J2. Based on the answer to J1., what is the ending balance of that account affected after making the adjustment of the total under-or overallocated manufacturing overhead? Ending balance = $