Answered step by step

Verified Expert Solution

Question

1 Approved Answer

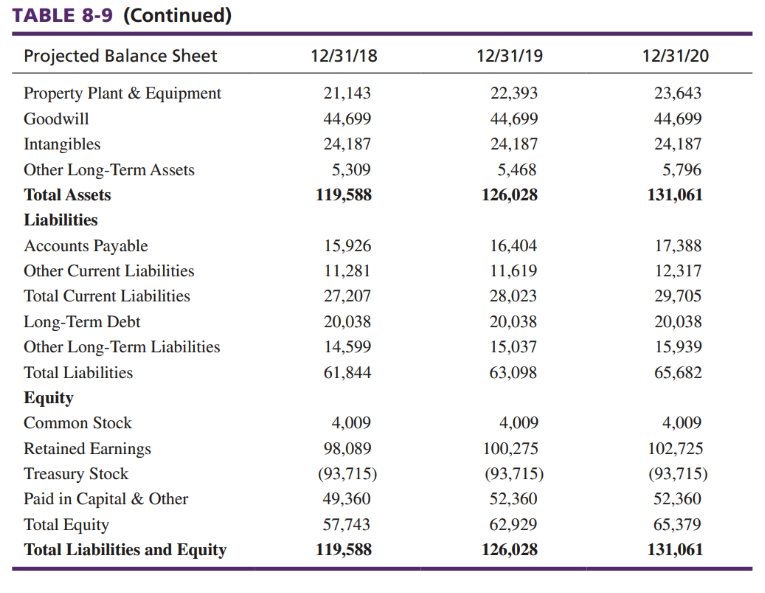

Question - Method 4 Outstanding Shares Method = Number of Shares Outstanding X Stock Price = TABLE 8-9 (Continued) Projected Balance Sheet 12/31/18 12/31/19 12/31/20

Question - Method 4 Outstanding Shares Method = Number of Shares Outstanding X Stock Price =

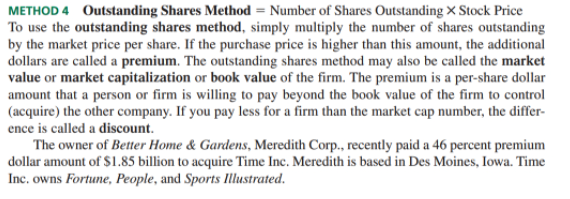

TABLE 8-9 (Continued) Projected Balance Sheet 12/31/18 12/31/19 12/31/20 21,143 44,699 24,187 5,309 119,588 22,393 44,699 24,187 5,468 126,028 23,643 44,699 24,187 5,796 131,061 Property Plant & Equipment Goodwill Intangibles Other Long-Term Assets Total Assets Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Equity Common Stock Retained Earnings Treasury Stock Paid in Capital & Other Total Equity Total Liabilities and Equity 15,926 11,281 27,207 20,038 14,599 61,844 16,404 11,619 28,023 20,038 15,037 63,098 17,388 12,317 29,705 20,038 15,939 65,682 4,009 98,089 (93,715) 49,360 57,743 119,588 4,009 100,275 (93,715) 52,360 62,929 126,028 4,009 102,725 (93,715) 52,360 65,379 131,061 METHOD 4 Outstanding Shares Method = Number of Shares Outstanding Stock Price To use the outstanding shares method, simply multiply the number of shares outstanding by the market price per share. If the purchase price is higher than this amount, the additional dollars are called a premium. The outstanding shares method may also be called the market value or market capitalization or book value of the firm. The premium is a per-share dollar amount that a person or firm is willing to pay beyond the book value of the firm to control (acquire) the other company. If you pay less for a firm than the market cap number, the differ- ence is called a discount. The owner of Better Home & Gardens, Meredith Corp., recently paid a 46 percent premium dollar amount of $1.85 billion to acquire Time Inc. Meredith is based in Des Moines, Iowa. Time Inc. owns Fortune, People, and Sports Illustrated. TABLE 8-9 (Continued) Projected Balance Sheet 12/31/18 12/31/19 12/31/20 21,143 44,699 24,187 5,309 119,588 22,393 44,699 24,187 5,468 126,028 23,643 44,699 24,187 5,796 131,061 Property Plant & Equipment Goodwill Intangibles Other Long-Term Assets Total Assets Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Equity Common Stock Retained Earnings Treasury Stock Paid in Capital & Other Total Equity Total Liabilities and Equity 15,926 11,281 27,207 20,038 14,599 61,844 16,404 11,619 28,023 20,038 15,037 63,098 17,388 12,317 29,705 20,038 15,939 65,682 4,009 98,089 (93,715) 49,360 57,743 119,588 4,009 100,275 (93,715) 52,360 62,929 126,028 4,009 102,725 (93,715) 52,360 65,379 131,061 METHOD 4 Outstanding Shares Method = Number of Shares Outstanding Stock Price To use the outstanding shares method, simply multiply the number of shares outstanding by the market price per share. If the purchase price is higher than this amount, the additional dollars are called a premium. The outstanding shares method may also be called the market value or market capitalization or book value of the firm. The premium is a per-share dollar amount that a person or firm is willing to pay beyond the book value of the firm to control (acquire) the other company. If you pay less for a firm than the market cap number, the differ- ence is called a discount. The owner of Better Home & Gardens, Meredith Corp., recently paid a 46 percent premium dollar amount of $1.85 billion to acquire Time Inc. Meredith is based in Des Moines, Iowa. Time Inc. owns Fortune, People, and Sports IllustratedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started