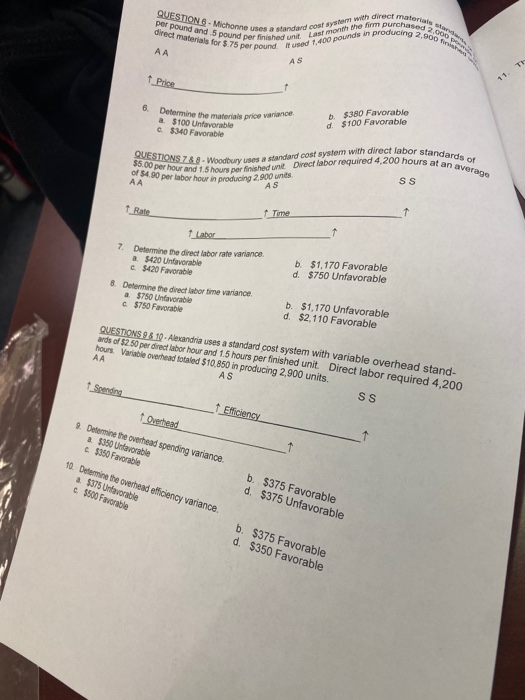

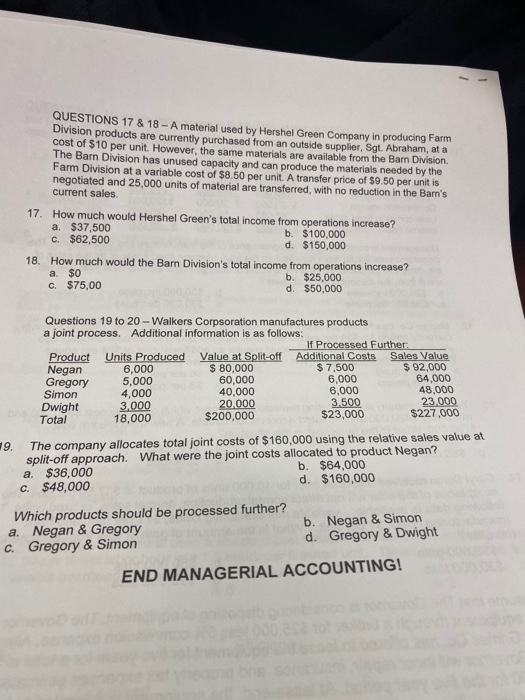

QUESTION - Michonneus direct materials for $.75 per po Ads in producing 2.90.000 Pound hochonneuses a standard costs at the firm purchase stem with direct mater per finished unit Last monin Per pound used 1.400 pounds producing 2 AS Price 6 price variance Determine the a $100 Unavorable $340 Favorable $380 Favorable d. $100 Favorable QUESTIONS 7 & 8 - Wood uns at an average $500 NSZ88. Woodbury uses a standard cost system with direct labor stan of hour and 1.5 hours or finished unit Direct labor required 4.200 hours atards or AA 30 per tabor how in producing 2,900 unids SS AS Rate _ Time 7. Determine the direct laborate variance a $420 Unfavorable S420 Favorable $1,170 Favorable d. $750 Unfavorable & Determine the direct labor time variance a $750 Unfavorable $750 Favorable b. $1,170 Unfavorable d. $2,110 Favorable QUESTIONS 98 10. Alecandria uses a standard cost system with variable overhead stand- ards of $250 per direct labor hour and 1.5 hours per finished unit. Direct labor required 4,200 hours. Variable overhead totaled $10,850 in producing 2.900 units. AS producing 2.900 un Direct laborerhead stand Spending SS Efficiency Overhead 9. Determine the overhead spending variance $350 Untevorable c$350 Favorable 10. Determine the overhead efficiency variance a $375 Unfavorable c5500 Favorable b. $375 Favorable d. $375 Unfavorable b. $375 Favorable d. $350 Favorable QUESTIONS 17 & 18 - A material used by Hershel Green Company in producing Farm Division products are currently purchased from an outside supplier, Sgt. Abraham, at a cost of $10 per unit. However, the same materials are available from the Barn Division The Barn Division has unused capacity and can produce the materials needed by the Farm Division at a variable cost of $8.50 per unit. A transfer price of $9.50 per unit is negotiated and 25,000 units of material are transferred, with no reduction in the Barn's current sales. 17 How much would Hershel Green's total income from operations increase? a. $37,500 b. $100,000 c. $62,500 d. $150,000 18. How much would the Barn Division's total income from operations increase? b. $25,000 c. $75,00 d. $50,000 a. $0 Questions 19 to 20 - Walkers Corpsoration manufactures products a joint process. Additional information is as follows: If Processed Further: Product Units Produced Value at Split-off Additional Costs Sales Value Negan 6,000 $ 80,000 $7,500 $ 92,000 Gregory 5,000 60,000 6.000 64,000 Simon 4,000 40,000 6,000 48,000 Dwight 3.000 20.000 3.500 23.000 Total 18,000 $200,000 $23,000 $227,000 19. The company allocates total joint costs of $160,000 using the relative sales value at split-off approach. What were the joint costs allocated to product Negan? a. $36,000 b. $64,000 c. $48,000 d. $160,000 Which products should be processed further? a. Negan & Gregory C. Gregory & Simon b. Negan & Simon d. Gregory & Dwight END MANAGERIAL ACCOUNTING