Answered step by step

Verified Expert Solution

Question

1 Approved Answer

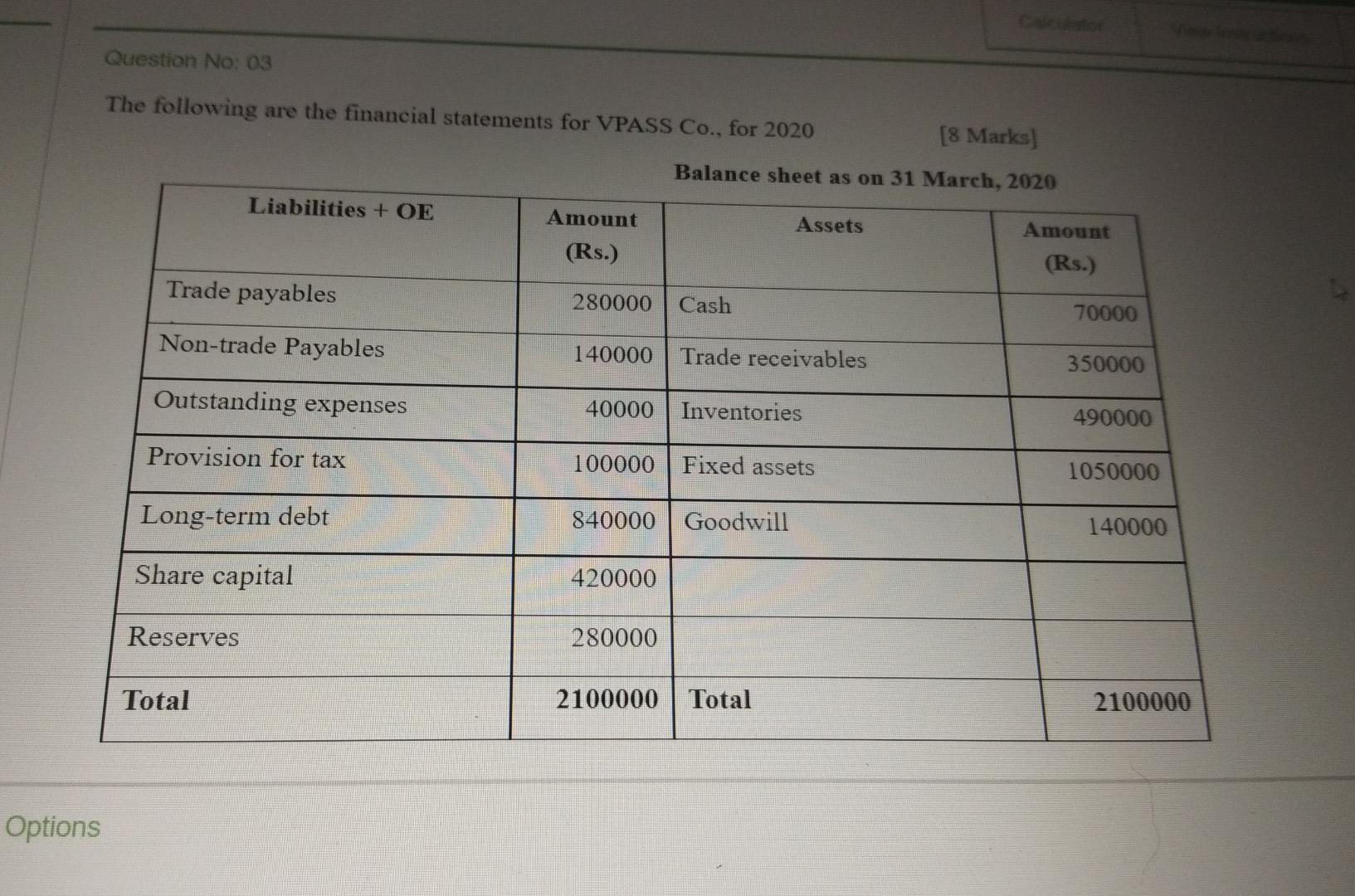

Question No: 03 The following are the financial statements for VPASS Co., for 2020 [8 Marks] Balance sheet as on 31 March, 2020 Liabilities +

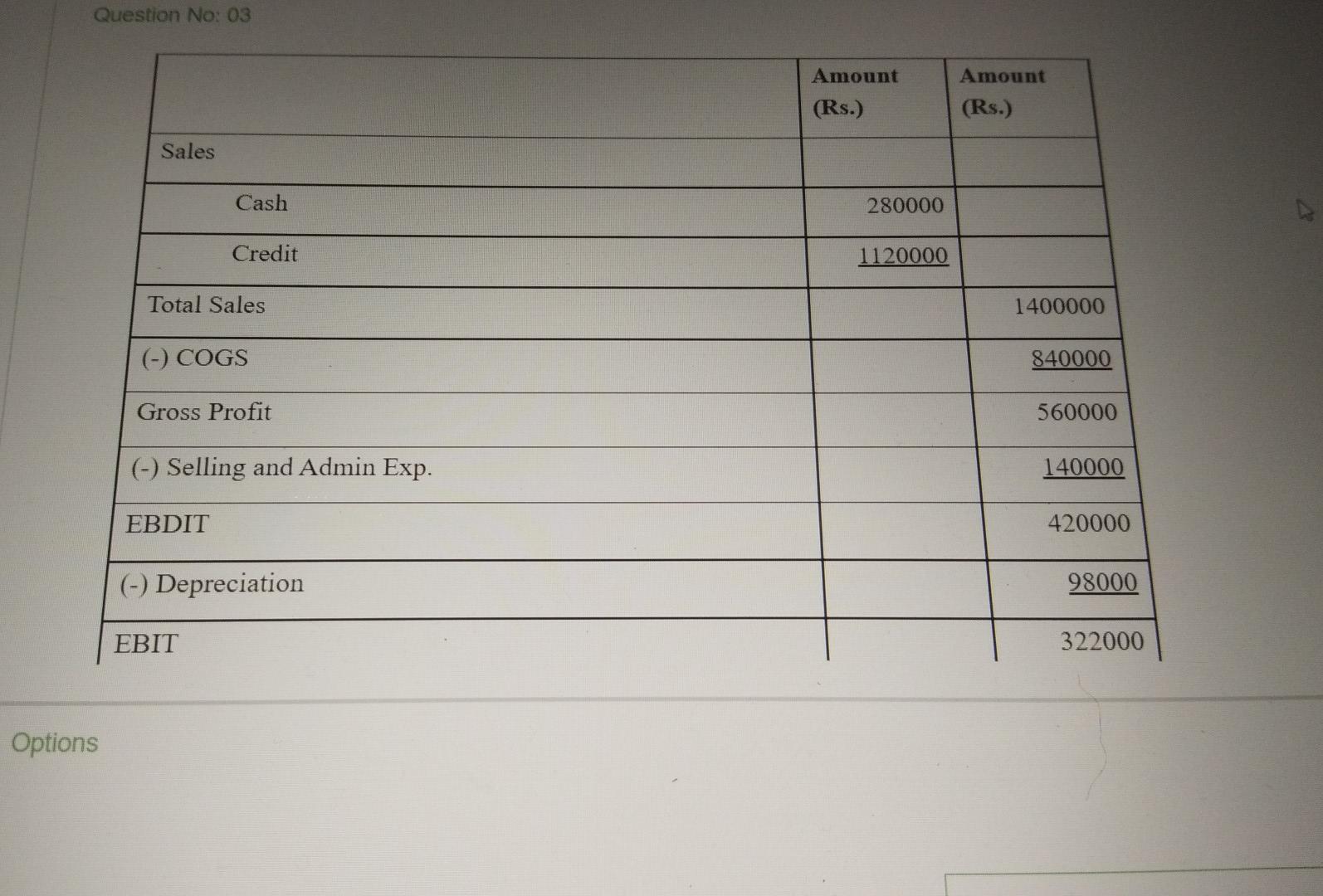

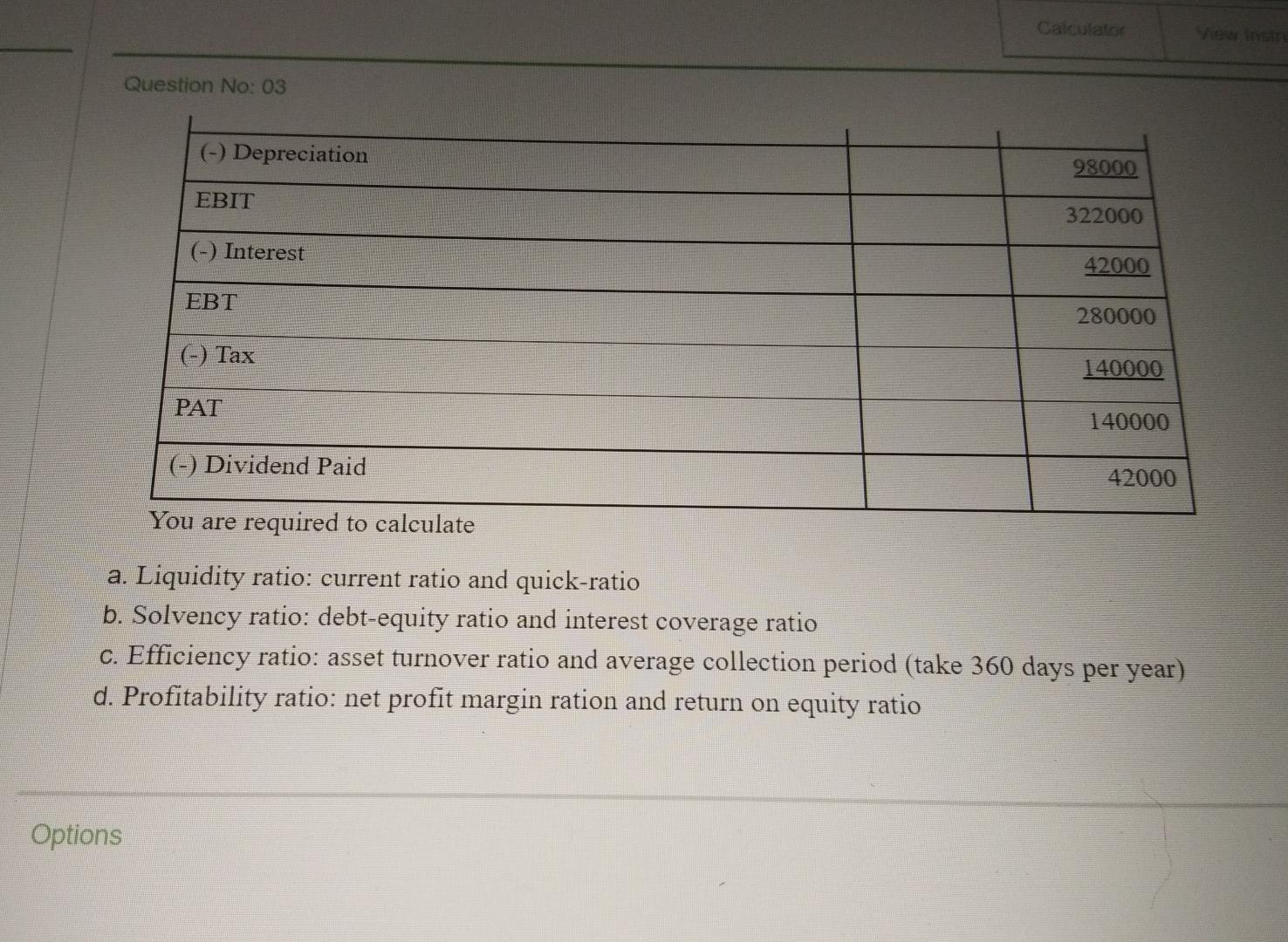

Question No: 03 The following are the financial statements for VPASS Co., for 2020 [8 Marks] Balance sheet as on 31 March, 2020 Liabilities + OE Assets Amount (Rs.) Amount (Rs.) Trade payables 280000 Cash 70000 Non-trade Payables 140000 Trade receivables 350000 Outstanding expenses 40000 Inventories 490000 Provision for tax 100000 Fixed assets 1050000 Long-term debt 840000 Goodwill 140000 Share capital 420000 Reserves 280000 Total 2100000 | Total 2100000 Options Question No: 03 Amount (Rs.) Amount (Rs.) Sales Cash 280000 Credit 1120000 Total Sales 1400000 (-) COGS 840000 Gross Profit 560000 (-) Selling and Admin Exp. 140000 EBDIT 420000 (-) Depreciation 98000 EBIT 322000 Options Calculat Question No: 03 (-) Depreciation 98000 EBIT 322000 (-) Interest 42000 EBT 280000 (-) Tax 140000 PAT 140000 (-) Dividend Paid 42000 You are required to calculate a. Liquidity ratio: current ratio and quick-ratio b. Solvency ratio: debt-equity ratio and interest coverage ratio c. Efficiency ratio: asset turnover ratio and average collection period (take 360 days per year) d. Profitability ratio: net profit margin ration and return on equity ratio Options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started