Question

Analysis and Interpretation of Profitability Income Statement and Balance Sheet for Costco Wholesale Corporation follow Required a. Compute net operating profit after tax (NOPAT) for

Analysis and Interpretation of Profitability

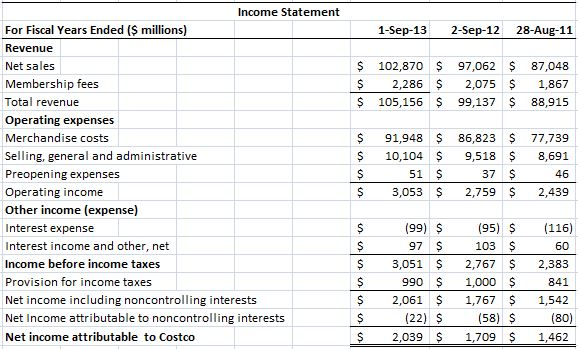

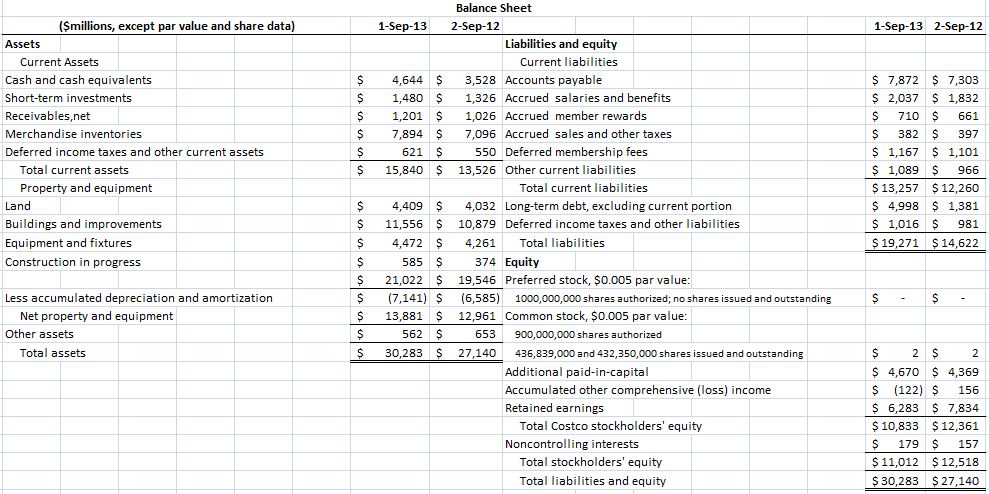

Income Statement and Balance Sheet for Costco Wholesale Corporation follow

Required

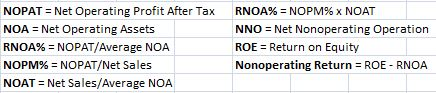

a. Compute net operating profit after tax (NOPAT) for 2013. Assume that the combined federal and state statutory tax rate is 37%.

b. Compute net operating assets (NOA) for 2013 and 2012.

c. Compute and disaggregate Costcos RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2013; confirm that RNOA = NOPM * NOAT. Comment on NOPM and NOAT estimates for Costco in comparison to those for Wal-Mart calculated earlier in this module. Wal-Mart NOPM = 4.06% and NOAT = 3.73.

d. Compute net operating obligations (NNO) for 2013 and 2012. Confirm the relation: NOA = NNO + Stockholders equity (ROE) for 2013.

e. Compute return on equity (ROE) for 2013.

f. Infer the non-operating return component of ROE for 2013.

g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costcos use of equity capital?

Please answer all parts of the question. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started