Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question No. 04 a. Directors of Keangnam Construction Company is considering acquiring shares of Pearl Harbor Company. Keangnam is a large listed company with a

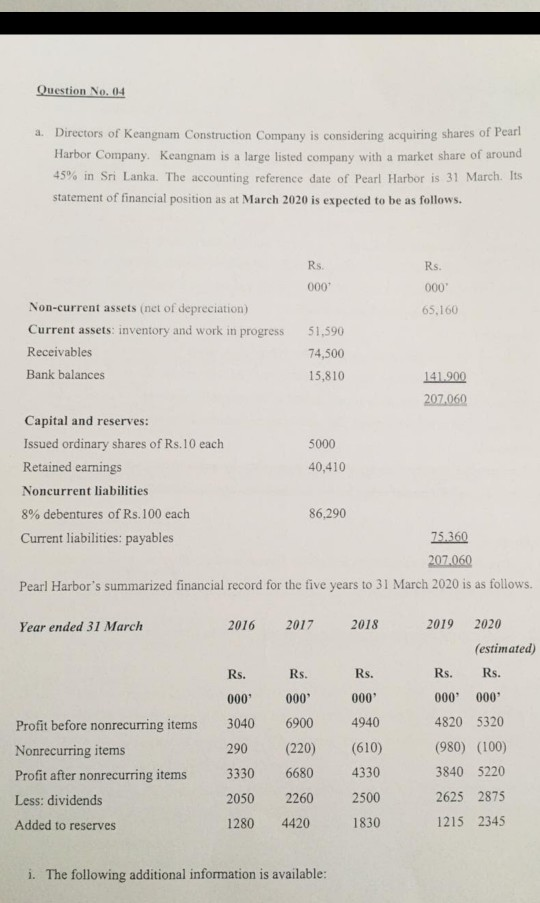

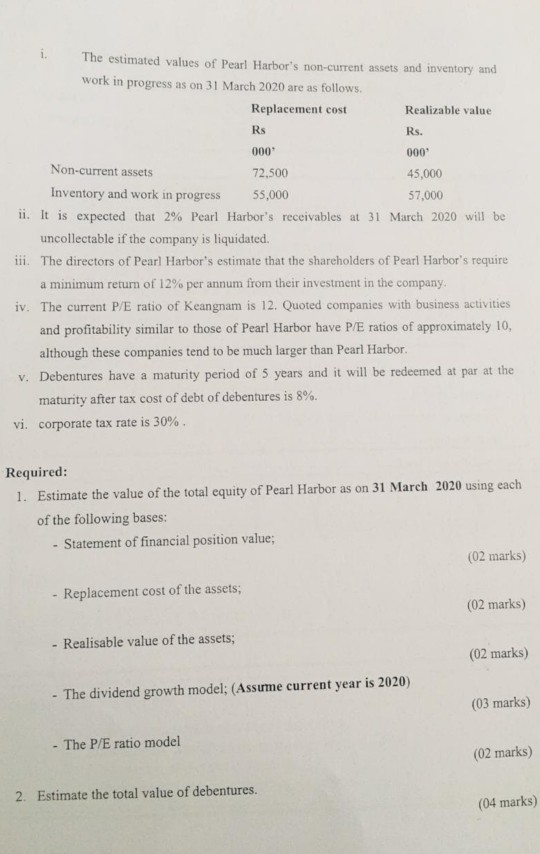

Question No. 04 a. Directors of Keangnam Construction Company is considering acquiring shares of Pearl Harbor Company. Keangnam is a large listed company with a market share of around 45% in Sri Lanka. The accounting reference date of Pearl Harbor is 31 March. Its statement of financial position as at March 2020 is expected to be as follows. Rs. Rs. 000 000 Non-current assets (net of depreciation) 65,160 Current assets: inventory and work in progress 51,590 Receivables 74,500 Bank balances 15,810 141.900 207,060 Capital and reserves: Issued ordinary shares of Rs.10 each 5000 Retained earnings 40,410 Noncurrent liabilities 8% debentures of Rs.100 each 86,290 Current liabilities: payables 75.360 207.060 Pearl Harbor's summarized financial record for the five years to 31 March 2020 is as follows. Year ended 31 March 2016 2017 2018 2019 2020 (estimated) Rs. Rs. Rs. Rs. 000 000 000 000' 4940 3040 Rs. 000 6900 (220) 6680 4820 5320 Profit before nonrecurring items Nonrecurring items Profit after nonrecurring items Less: dividends Added to reserves 290 (980) (100) 3840 5220 3330 (610) 4330 2500 1830 2050 2260 2625 2875 1280 4420 1215 2345 i. The following additional information is available: 1. Rs The estimated values of Pearl Harbor's non-current assets and inventory and work in progress as on 31 March 2020 are as follows. Replacement cost Realizable value Rs. 000 000 Non-current assets 72,500 45,000 Inventory and work in progress 55,000 57,000 ii. It is expected that 2% Pearl Harbor's receivables at 31 March 2020 will be uncollectable if the company is liquidated. iii. The directors of Pearl Harbor's estimate that the shareholders of Pearl Harbor's require a minimum return of 12% per annum from their investment in the company. iv. The current P/E ratio of Keangnam is 12. Quoted companies with business activities and profitability similar to those of Pearl Harbor have P/E ratios of approximately 10, although these companies tend to be much larger than Pearl Harbor. v. Debentures have a maturity period of 5 years and it will be redeemed at par at the maturity after tax cost of debt of debentures is 8%. vi. corporate tax rate is 30%. Required: 1. Estimate the value of the total equity of Pearl Harbor as on 31 March 2020 using each of the following bases: - Statement of financial position value; (02 marks) - Replacement cost of the assets; (02 marks) Realisable value of the assets; (02 marks) The dividend growth model; (Assume current year is 2020) (03 marks) - The P/E ratio model (02 marks) 2. Estimate the total value of debentures. (04 marks) Question No. 04 a. Directors of Keangnam Construction Company is considering acquiring shares of Pearl Harbor Company. Keangnam is a large listed company with a market share of around 45% in Sri Lanka. The accounting reference date of Pearl Harbor is 31 March. Its statement of financial position as at March 2020 is expected to be as follows. Rs. Rs. 000 000 Non-current assets (net of depreciation) 65,160 Current assets: inventory and work in progress 51,590 Receivables 74,500 Bank balances 15,810 141.900 207,060 Capital and reserves: Issued ordinary shares of Rs.10 each 5000 Retained earnings 40,410 Noncurrent liabilities 8% debentures of Rs.100 each 86,290 Current liabilities: payables 75.360 207.060 Pearl Harbor's summarized financial record for the five years to 31 March 2020 is as follows. Year ended 31 March 2016 2017 2018 2019 2020 (estimated) Rs. Rs. Rs. Rs. 000 000 000 000' 4940 3040 Rs. 000 6900 (220) 6680 4820 5320 Profit before nonrecurring items Nonrecurring items Profit after nonrecurring items Less: dividends Added to reserves 290 (980) (100) 3840 5220 3330 (610) 4330 2500 1830 2050 2260 2625 2875 1280 4420 1215 2345 i. The following additional information is available: 1. Rs The estimated values of Pearl Harbor's non-current assets and inventory and work in progress as on 31 March 2020 are as follows. Replacement cost Realizable value Rs. 000 000 Non-current assets 72,500 45,000 Inventory and work in progress 55,000 57,000 ii. It is expected that 2% Pearl Harbor's receivables at 31 March 2020 will be uncollectable if the company is liquidated. iii. The directors of Pearl Harbor's estimate that the shareholders of Pearl Harbor's require a minimum return of 12% per annum from their investment in the company. iv. The current P/E ratio of Keangnam is 12. Quoted companies with business activities and profitability similar to those of Pearl Harbor have P/E ratios of approximately 10, although these companies tend to be much larger than Pearl Harbor. v. Debentures have a maturity period of 5 years and it will be redeemed at par at the maturity after tax cost of debt of debentures is 8%. vi. corporate tax rate is 30%. Required: 1. Estimate the value of the total equity of Pearl Harbor as on 31 March 2020 using each of the following bases: - Statement of financial position value; (02 marks) - Replacement cost of the assets; (02 marks) Realisable value of the assets; (02 marks) The dividend growth model; (Assume current year is 2020) (03 marks) - The P/E ratio model (02 marks) 2. Estimate the total value of debentures. (04 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started