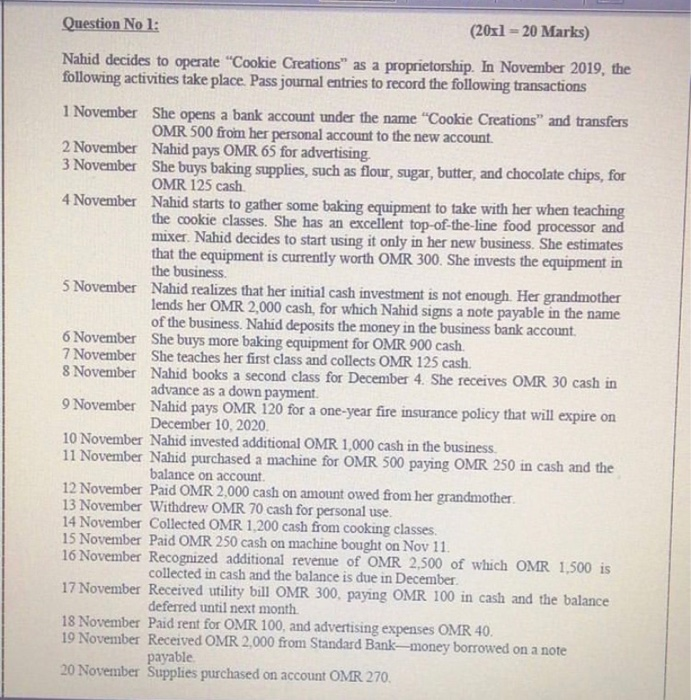

Question No 1: (20xl = 20 Marks) Nahid decides to operate "Cookie Creations" as a proprietorship. In November 2019, the following activities take place. Pass journal entries to record the following transactions 1 November She opens a bank account under the name "Cookie Creations" and transfers OMR 500 from her personal account to the new account. 2 November Nahid pays OMR 65 for advertising 3 November She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for OMR 125 cash 4 November Nahid starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer. Nahid decides to start using it only in her new business. She estimates that the equipment is currently worth OMR 300. She invests the equipment in the business 5 November Nahid realizes that her initial cash investment is not enough. Her grandmother lends her OMR 2,000 cash, for which Nahid signs a note payable in the name of the business. Nahid deposits the money in the business bank account. 6 November She buys more baking equipment for OMR 900 cash. 7 November She teaches her first class and collects OMR 125 cash. 8 November Nahid books a second class for December 4. She receives OMR 30 cash in advance as a down payment. 9 November Nahid pays OMR 120 for a one-year fire insurance policy that will expire on December 10, 2020 10 November Nahid invested additional OMR 1,000 cash in the business. 11 November Nahid purchased a machine for OMR 500 paying OMR 250 in cash and the balance on account 12 November Paid OMR 2,000 cash on amount owed from her grandmother 13 November Withdrew OMR 70 cash for personal use. 14 November Collected OMR 1,200 cash from cooking classes. 15 November Paid OMR 250 cash on machine bought on Nov 11 16 November Recognized additional revenue of OMR 2,500 of which OMR 1,500 is collected in cash and the balance is due in December 17 November Received utility bill OMR 300, paying OMR 100 in cash and the balance deferred until next month 18 November Paid rent for OMR 100, and advertising expenses OMR 40. 19 November Received OMR 2,000 from Standard Bank-money borrowed on a note payable 20 November Supplies purchased on account OMR 270