Answered step by step

Verified Expert Solution

Question

1 Approved Answer

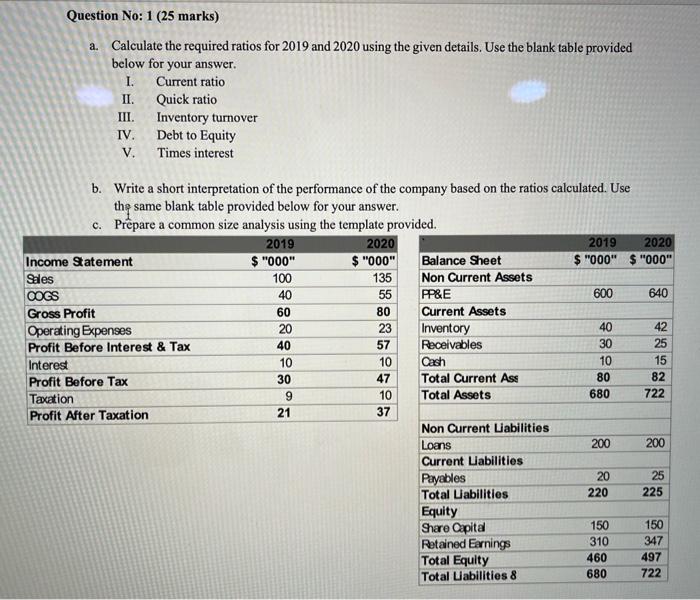

Question No: 1 (25 marks) a. Calculate the required ratios for 2019 and 2020 using the given details. Use the blank table provided below

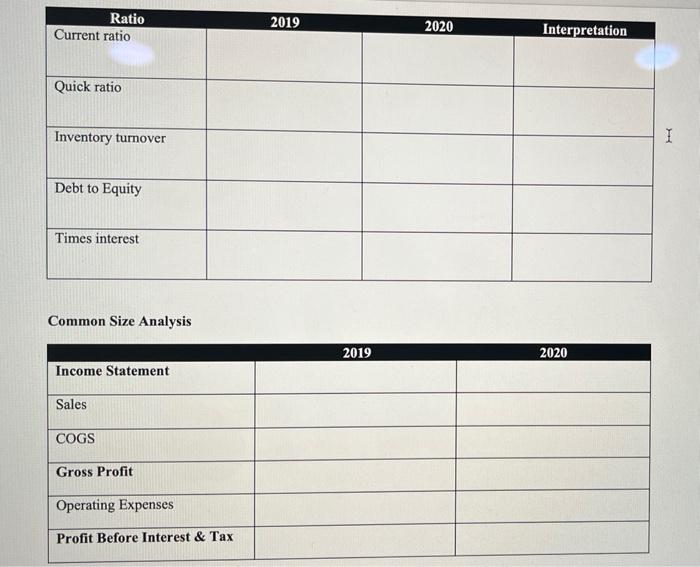

Question No: 1 (25 marks) a. Calculate the required ratios for 2019 and 2020 using the given details. Use the blank table provided below for your answer. I. Current ratio II. Quick ratio III. Inventory turnover IV. Debt to Equity V. Times interest b. Write a short interpretation of the performance of the company based on the ratios calculated. Use the same blank table provided below for your answer. c. Prepare a common size analysis using the template provided. Income Statement 2019 $ "000" 2020 2019 2020 $"000" Balance Sheet $ "000" $"000" Sales 100 135 Non Current Assets COGS 40 55 PP&E 600 640 Gross Profit 60 80 Current Assets Operating Expenses 20 23 Inventory 40 42 Profit Before Interest & Tax 40 57 Receivables 30 25 Interest 10 10 Cash 10 15 Profit Before Tax 30 47 Total Current Ass 80 82 Taxation 9 10 Total Assets 680 722 Profit After Taxation 21 37 Non Current Liabilities Loans 200 200 Current Liabilities Payables 20 25 Total Liabilities 220 225 Equity Share Capital 150 150 Retained Earnings 310 347 Total Equity 460 497 Total Liabilities & 680 722 Ratio Current ratio Quick ratio Inventory turnover Debt to Equity Times interest Common Size Analysis Income Statement Sales COGS Gross Profit Operating Expenses Profit Before Interest & Tax 2019 2020 Interpretation 2019 2020 I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started