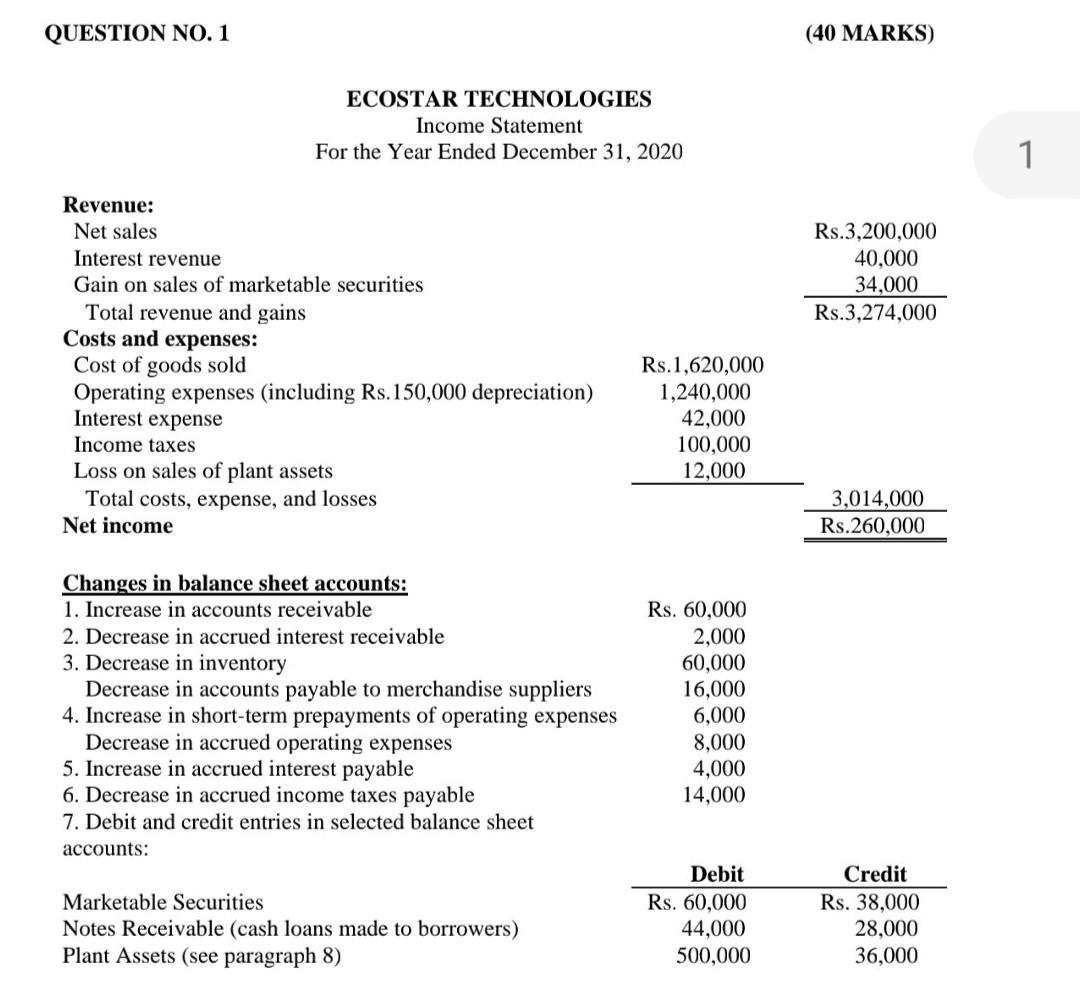

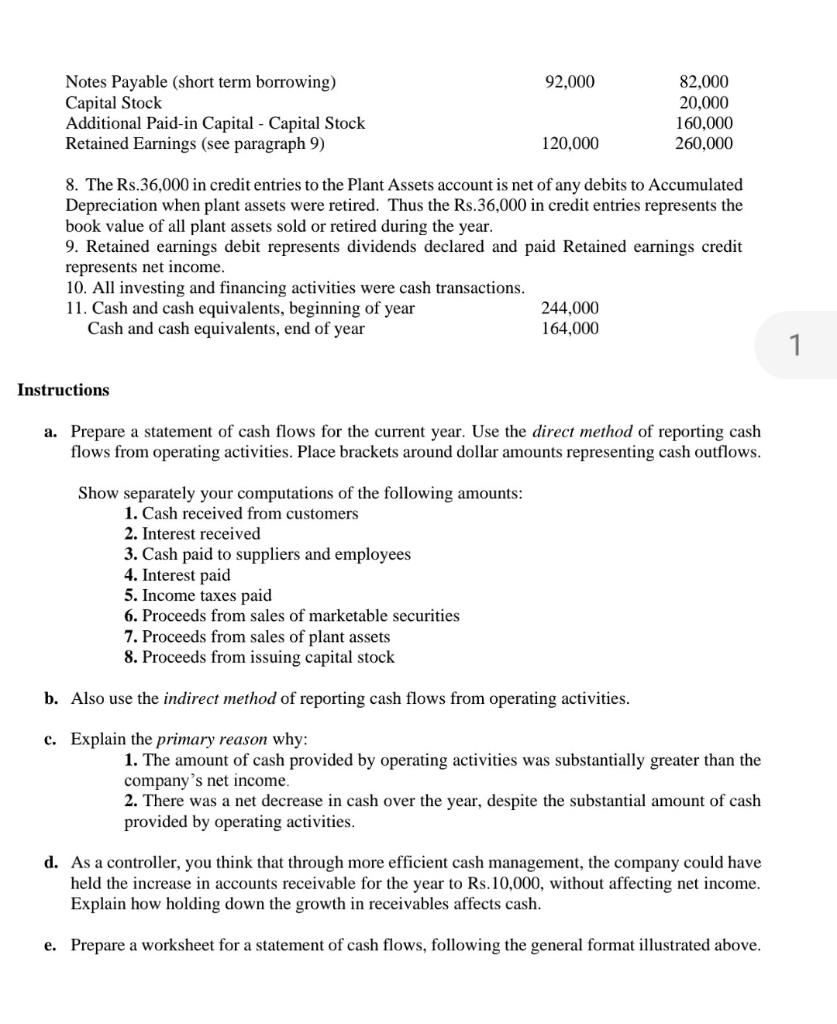

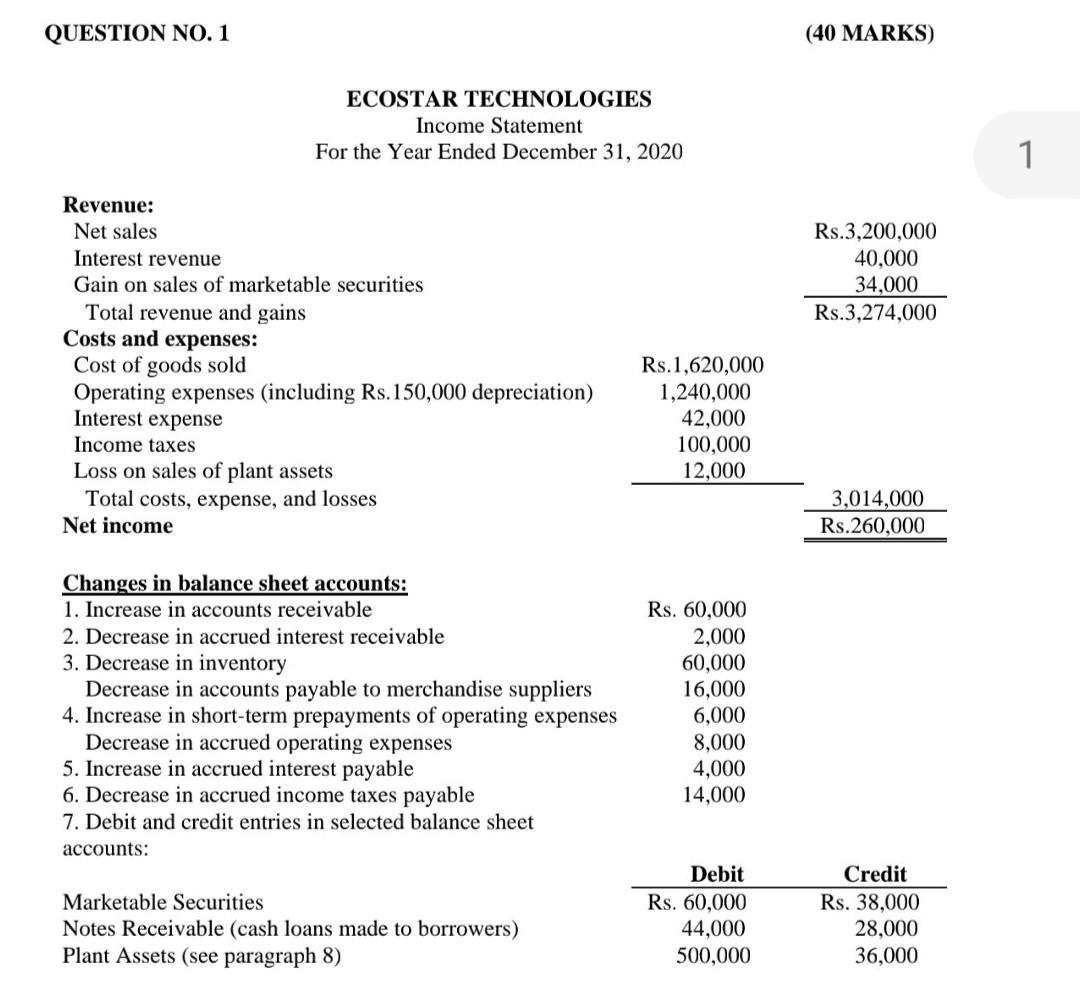

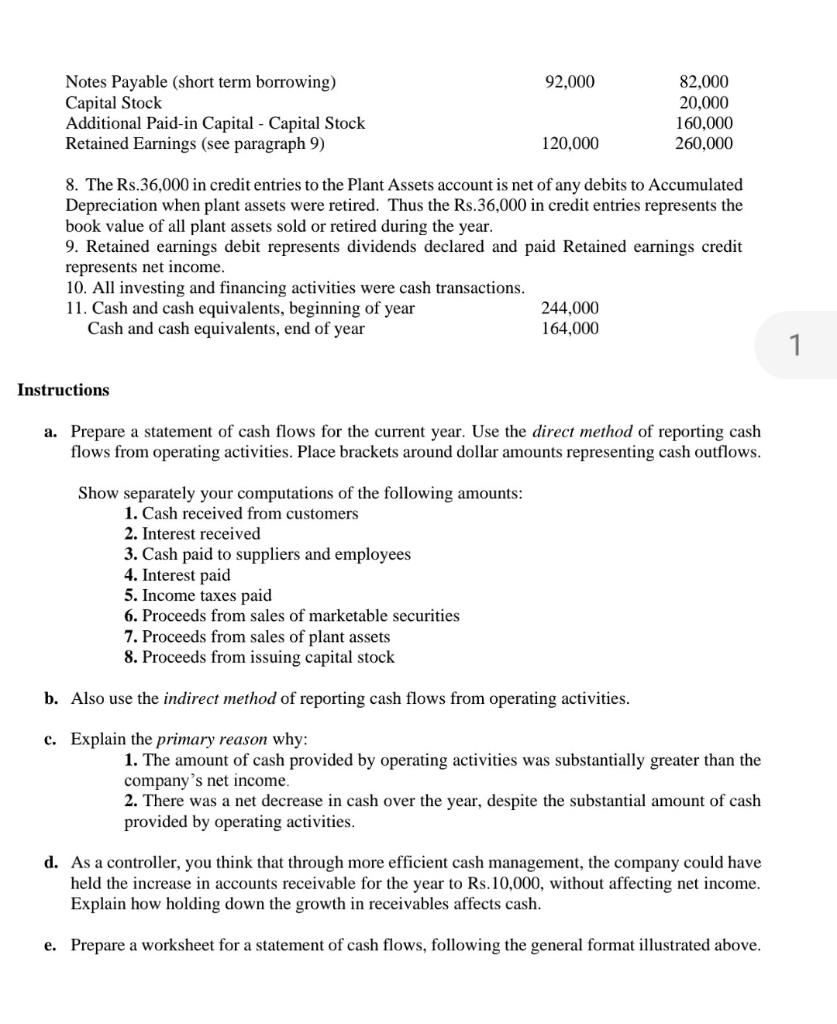

QUESTION NO. 1 (40 MARKS) ECOSTAR TECHNOLOGIES Income Statement For the Year Ended December 31, 2020 1 Rs.3,200,000 40,000 34,000 Rs.3,274,000 Revenue: Net sales Interest revenue Gain on sales of marketable securities Total revenue and gains Costs and expenses: Cost of goods sold Operating expenses (including Rs.150,000 depreciation) Interest expense Income taxes Loss on sales of plant assets Total costs, expense, and losses Net income Rs.1,620,000 1,240,000 42,000 100,000 12,000 3,014,000 Rs.260,000 Changes in balance sheet accounts: 1. Increase in accounts receivable 2. Decrease in accrued interest receivable 3. Decrease in inventory Decrease in accounts payable to merchandise suppliers 4. Increase in short-term prepayments of operating expenses Decrease in accrued operating expenses 5. Increase in accrued interest payable 6. Decrease in accrued income taxes payable 7. Debit and credit entries in selected balance sheet accounts: Rs. 60,000 2,000 60,000 16,000 6,000 8,000 4,000 14,000 Marketable Securities Notes Receivable (cash loans made to borrowers) Plant Assets (see paragraph 8) Debit Rs. 60,000 44,000 500,000 Credit Rs. 38,000 28,000 36,000 92,000 Notes Payable (short term borrowing) Capital Stock Additional Paid-in Capital - Capital Stock Retained Earnings (see paragraph 9) 82,000 20,000 160,000 260,000 120,000 8. The Rs.36,000 in credit entries to the Plant Assets account is net of any debits to Accumulated Depreciation when plant assets were retired. Thus the Rs.36,000 in credit entries represents the book value of all plant assets sold or retired during the year. 9. Retained earnings debit represents dividends declared and paid Retained earnings credit represents net income. 10. All investing and financing activities were cash transactions. 11. Cash and cash equivalents, beginning of year 244,000 Cash and cash equivalents, end of year 164,000 Instructions a. Prepare a statement of cash flows for the current year. Use the direct method of reporting cash flows from operating activities. Place brackets around dollar amounts representing cash outflows. Show separately your computations of the following amounts: 1. Cash received from customers 2. Interest received 3. Cash paid to suppliers and employees 4. Interest paid 5. Income taxes paid 6. Proceeds from sales of marketable securities 7. Proceeds from sales of plant assets 8. Proceeds from issuing capital stock b. Also use the indirect method of reporting cash flows from operating activities. c. Explain the primary reason why: 1. The amount of cash provided by operating activities was substantially greater than the company's net income. 2. There was a net decrease in cash over the year, despite the substantial amount of cash provided by operating activities. d. As a controller, you think that through more efficient cash management, the company could have held the increase in accounts receivable for the year to Rs. 10,000, without affecting net income. Explain how holding down the growth in receivables affects cash. e. Prepare a worksheet for a statement of cash flows, following the general format illustrated above