Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question No 1: (Marks 8) Use the data set which is labeled on your name in Excel sheet. Names are given alphabetical from A to

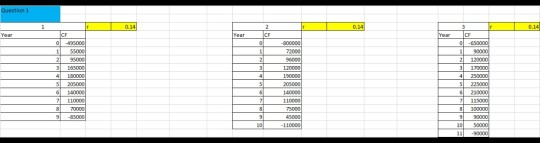

Question No 1: (Marks 8) Use the data set which is labeled on your name in Excel sheet. Names are given alphabetical from A to Z. Click on left or right to find the sheet with your name) Al Balushi Oil Mohamad Al Balushy the owner of Al Balushi Oil, is evaluating new oil production wells in Eastern part of Oman. Sara Al Farsi, the company's geologist, has just finished her analysis of the wells site. She has estimated that the well One would be productive for eight years, Two-nine years, Three - ten years. After which the oil will be fully produced. Sara has taken an estimate of the gold deposit to Zainab Al Amri, the company's financial officer. Sara asked Zainab to conduct an analysis of the new wells (One, Two and Three) and provide her recommendation on whether the company should open a new well and which project is better than others. Zainab has used the estimates provided by Sara to determine the revenues that could be expected from the wells. She has also projected the expenses of opening the wells and the annual operating expenses. If the company opens well, it will have certain large expenses for the purchase and installation of equipment, and at the end of the project the company will incur some expenses associated with the liquidation of the wells. The expected cash flows each year from the well for project Well One, Well Two and Well Three are shown in the tables. 1. Calculate the payback period, modified internal rate of return (3 methods), net present value, profitability index of proposed projects. Determine which project is better and explain why. 2. Based on your analysis, explain what advantages and disadvantages of each method of evaluating investment projects has. 3. If the company finds financial resources for the development of two wells, which two projects would you recommend. Provided that the required rate of return is reduced by 2%. * You should describe each step in detail and provide intermediate calculations. Add tables from Excel if necessary. * Do not delete anything from the Word file. * Write your answers after each question. * Be careful when rounding. Leave two decimal places. BE 30 000011 DOOGT 06 6 DOOD DOOGE MOSTE 73000 110000 8 2006 16 3000 2 02 10 LOGO sl S 41 2 al 2 20000 C G 12 212000 9500 12 000 72000 000 006 WOODS OGORO OF Yew near CE You 14 O HD TOTO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started