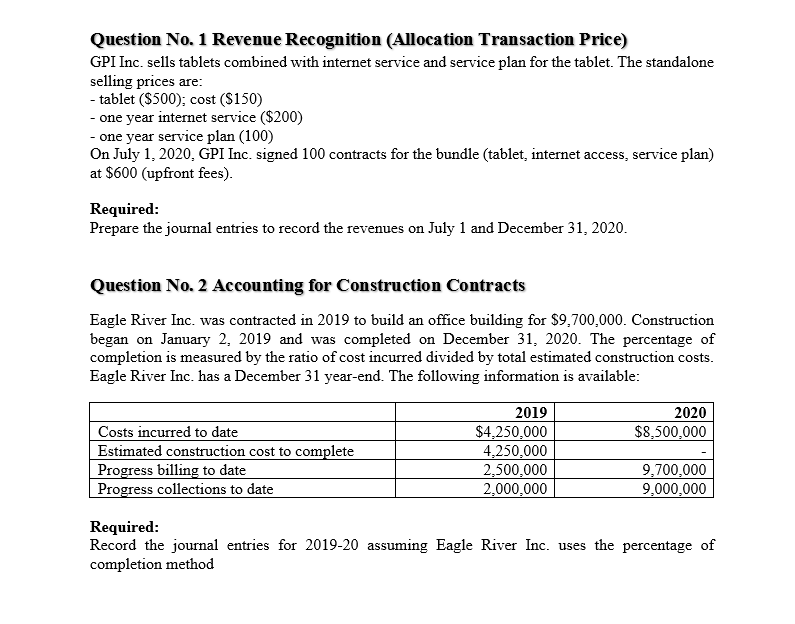

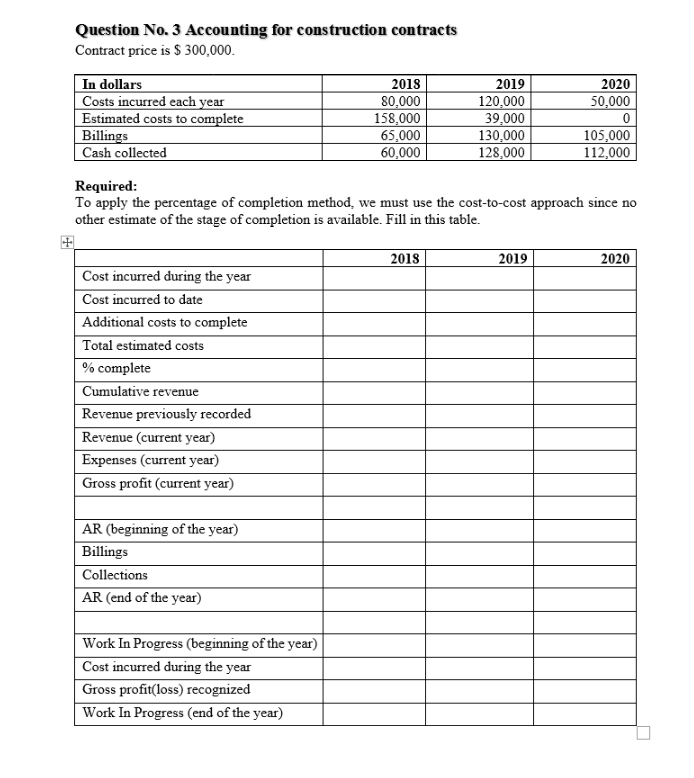

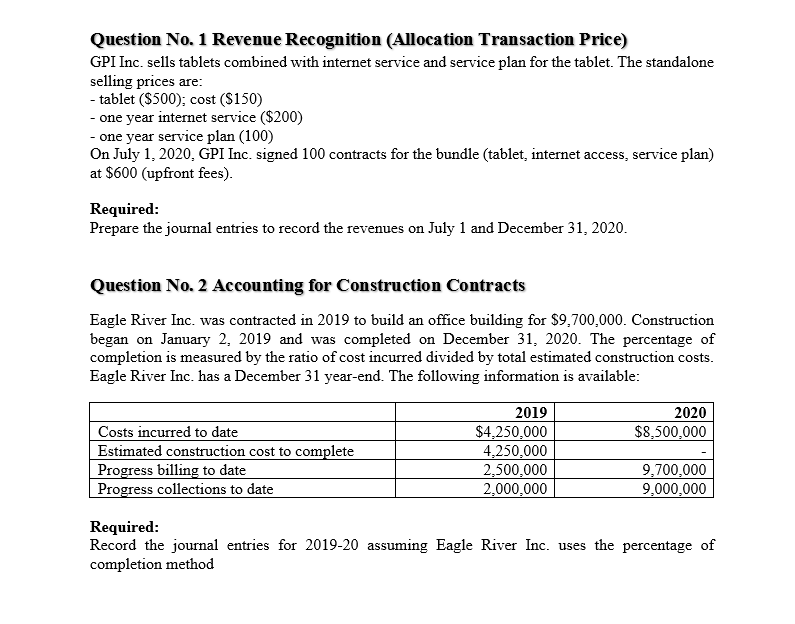

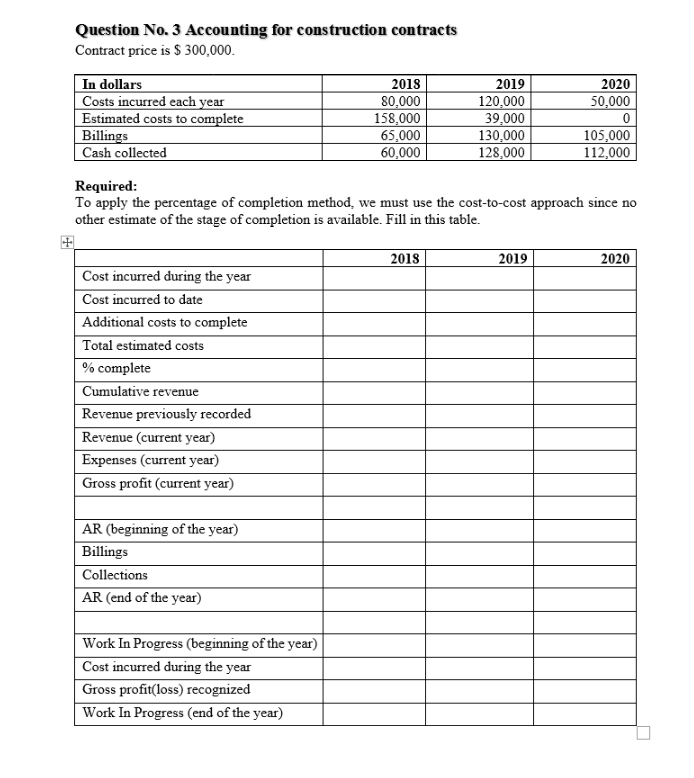

Question No. 1 Revenue Recognition (Allocation Transaction Price) GPI Inc. sells tablets combined with internet service and service plan for the tablet. The standalone selling prices are: - tablet ($500); cost ($150) - one year internet service ($200) - one year service plan (100) On July 1, 2020. GPI Inc. signed 100 contracts for the bundle (tablet, internet access, service plan) at $600 (upfront fees). Required: Prepare the journal entries to record the revenues on July 1 and December 31, 2020. Question No. 2 Accounting for Construction Contracts Eagle River Inc. was contracted in 2019 to build an office building for $9,700,000. Construction began on January 2, 2019 and was completed on December 31, 2020. The percentage of completion is measured by the ratio of cost incurred divided by total estimated construction costs. Eagle River Inc. has a December 31 year-end. The following information is available: 2020 $8,500,000 Costs incurred to date Estimated construction cost to complete Progress billing to date Progress collections to date 2019 $4,250,000 4,250,000 2,500,000 2,000,000 9,700,000 9,000,000 Required: Record the journal entries for 2019-20 assuming Eagle River Inc. uses the percentage of completion method Question No. 3 Accounting for construction contracts Contract price is $ 300,000 In dollars Costs incurred each year Estimated costs to complete Billings Cash collected 2018 80,000 158,000 65,000 60,000 2019 120,000 39,000 130,000 128,000 2020 50,000 0 105,000 112,000 Required: To apply the percentage of completion method, we must use the cost-to-cost approach since no other estimate of the stage of completion is available. Fill in this table. 2018 2019 2020 Cost incurred during the year Cost incurred to date Additional costs to complete Total estimated costs % complete Cumulative revenue Revenue previously recorded Revenue (current year) Expenses (current year) Gross profit (current year) AR (beginning of the year) Billings Collections AR (end of the year) Work In Progress (beginning of the year) Cost incurred during the year Gross profit(loss) recognized Work In Progress (end of the year)