Answered step by step

Verified Expert Solution

Question

1 Approved Answer

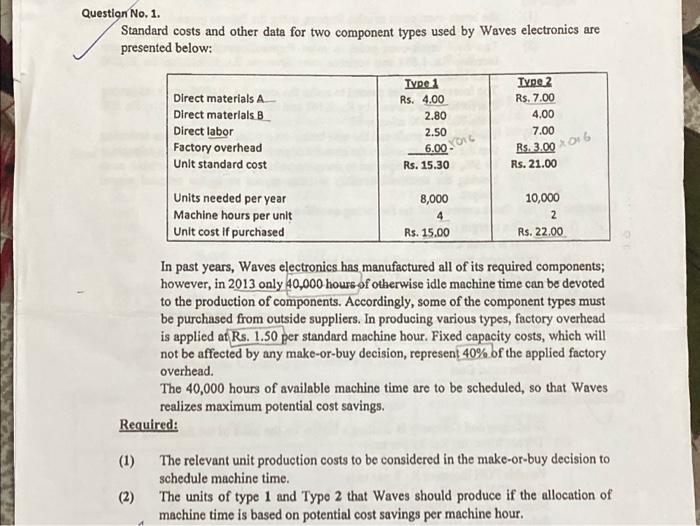

Question No. 1. Standard costs and other data for two component types used by Waves electronics are presented below: (1) Direct materials A Direct materials

Question No. 1. Standard costs and other data for two component types used by Waves electronics are presented below: (1) Direct materials A Direct materials B Direct labor Factory overhead Unit standard cost (2) Units needed per year Machine hours per unit Unit cost if purchased Required: Type 1 Rs. 4.00 2.80 2.50 6.00- Rs. 15.30 93016 8,000 4 Rs. 15.00 Type 2 Rs. 7.00 4.00 7.00 Rs. 3.00 x 16 Rs. 21.00 10,000 2 Rs. 22.00 In past years, Waves electronics has manufactured all of its required components; however, in 2013 only 40,000 hours of otherwise idle machine time can be devoted to the production of components. Accordingly, some of the component types must be purchased from outside suppliers. In producing various types, factory overhead is applied at Rs. 1.50 per standard machine hour. Fixed capacity costs, which will not be affected by any make-or-buy decision, represent 40% of the applied factory overhead. The 40,000 hours of available machine time are to be scheduled, so that Waves realizes maximum potential cost savings. The relevant unit production costs to be considered in the make-or-buy decision to schedule machine time. The units of type 1 and Type 2 that Waves should produce if the allocation of machine time is based on potential cost savings per machine hour.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started