Answered step by step

Verified Expert Solution

Question

1 Approved Answer

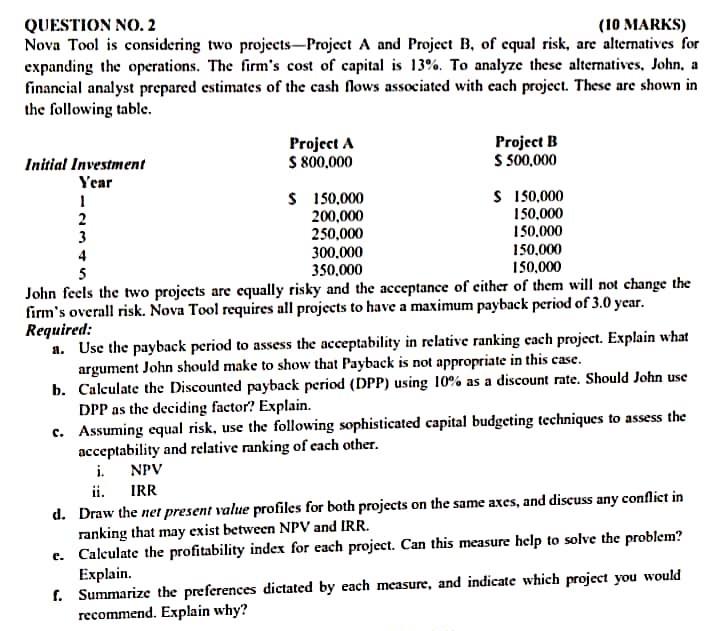

QUESTION NO. 2 (10 MARKS) Nova Tool is considering two projects Project A and Project B, of cqual risk, are alternatives for expanding the operations.

QUESTION NO. 2 (10 MARKS) Nova Tool is considering two projects Project A and Project B, of cqual risk, are alternatives for expanding the operations. The firm's cost of capital is 13%. To analyze these alternatives, John, a financial analyse prepared estimates of the cash Nows associated with each project. These are shown in the following table. Project A Project B Initial Investment S 800.000 S 500,000 Year 1 $ 150,000 $ 150,000 2 200,000 150,000 3 250,000 130,000 4 300.000 150,000 5 350.000 150,000 John feels the two projects are equally risky and the acceptance of either of them will not change the firm's overall risk. Nova Tool requires all projects to have a maximum payback period of 3.0 year. Required: a. Use the payback period to assess the acceptability in relative ranking each project. Explain what argument John should make to show that Payback is not appropriate in this case. b. Calculate the Discounted payback period (DPP) using 10% as a discount rate. Should John use DPP as the deciding factor? Explain. c. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each other. i. NPV ii. IRR d. Draw the net present value profiles for both projects on the same axes, and discuss any conflict in ranking that may exist between NPV and IRR. e. Calculate the profitability index for each project. Can this measure help to solve the problem? Explain. f. Summarize the preferences dictated by each measure, and indicate which project you would recommend. Explain why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started