Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question NO. 2 A. For several years, Kathryn Mead has operated a successful business organized as a sole proprietorship. In order to raise the capital

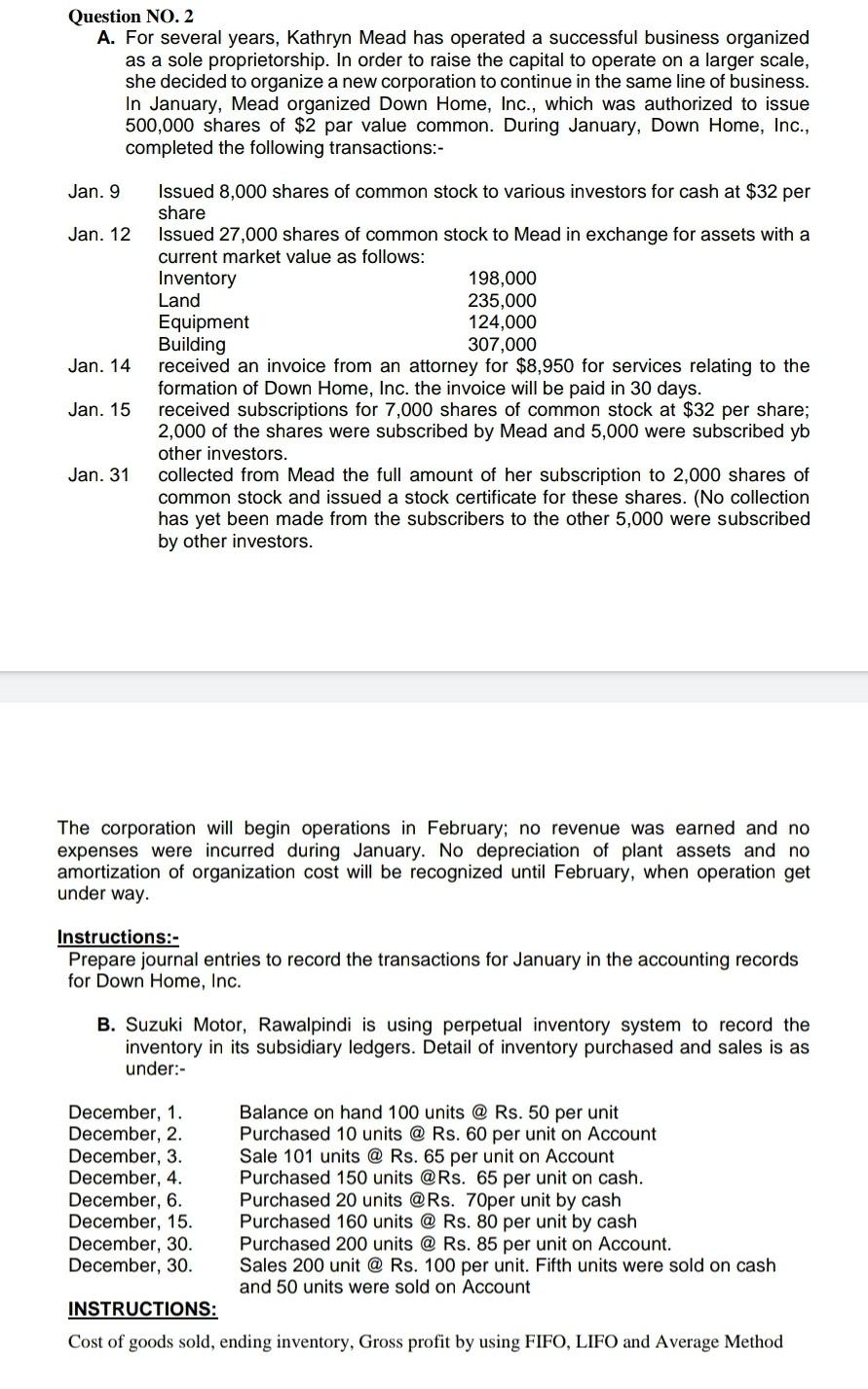

Question NO. 2 A. For several years, Kathryn Mead has operated a successful business organized as a sole proprietorship. In order to raise the capital to operate on a larger scale, she decided to organize a new corporation to continue in the same line of business. In January, Mead organized Down Home, Inc., which was authorized to issue 500,000 shares of $2 par value common. During January, Down Home, Inc., completed the following transactions:- Jan. 9 Jan. 12 Jan. 14 Issued 8,000 shares of common stock to various investors for cash at $32 per share Issued 27,000 shares of common stock to Mead in exchange for assets with a current market value as follows: Inventory 198,000 Land 235,000 Equipment 124,000 Building 307,000 received an invoice from an attorney for $8,950 for services relating to the formation of Down Home, Inc. the invoice will be paid in 30 days. received subscriptions for 7,000 shares of common stock at $32 per share; 2,000 of the shares were subscribed by Mead and 5,000 were subscribed yb other investors. collected from Mead the full amount of her subscription to 2,000 shares of common stock and issued a stock certificate for these shares. (No collection has yet been made from the subscribers to the other 5,000 were subscribed by other investors. Jan. 15 Jan. 31 The corporation will begin operations in February; no revenue was earned and no expenses were incurred during Jan No depreciation of plant assets and no amortization of organization cost will be recognized until February, when operation get under way. Instructions:- Prepare journal entries to record the transactions for January in the accounting records for Down Home, Inc. B. Suzuki Motor, Rawalpindi is using perpetual inventory system to record the inventory in its subsidiary ledgers. Detail of inventory purchased and sales is as under:- December, 1. Balance on hand 100 units @ Rs. 50 per unit December, 2. Purchased 10 units @ Rs. 60 per unit on Account December, 3. Sale 101 units @ Rs. 65 per unit on Account December, 4. Purchased 150 units @ Rs. 65 per unit on cash. December, 6. Purchased 20 units @ Rs. 70per unit by cash December, 15. Purchased 160 units @ Rs. 80 per unit by cash December, 30. Purchased 200 units @ Rs. 85 per unit on Account. December, 30. Sales 200 unit @ Rs. 100 per unit. Fifth units were sold on cash and 50 units were sold on Account INSTRUCTIONS: Cost of goods sold, ending inventory, Gross profit by using FIFO, LIFO and Average Method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started