Answered step by step

Verified Expert Solution

Question

1 Approved Answer

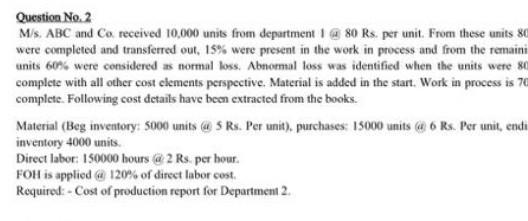

Question No. 2 Ms. ABC and Ca received 10,000 units from department 180 Rs. per unit. From these units 80 were completed and transferred out,

Question No. 2 Ms. ABC and Ca received 10,000 units from department 180 Rs. per unit. From these units 80 were completed and transferred out, 15% were present in the work in process and from the remaini units 60% were considered as normal loss. Abnormal loss was identified when the units were 80 complete with all other cost elements perspective. Material is added in the start. Work in process is 70 complete. Following cost details have been extracted from the books. Material (Beg inventory: 5000 units @ Rs. Per unit). purchases 15000 units 6 Rs. Per unit, ende inventory 4000 units. Direct labor: 150000 hours 2 Rs. per hour. FOH is applied @ 120% of direct labor cost, Required: - Cost of production report for Department 2. Question No. 2 Ms. ABC and Ca received 10,000 units from department 180 Rs. per unit. From these units 80 were completed and transferred out, 15% were present in the work in process and from the remaini units 60% were considered as normal loss. Abnormal loss was identified when the units were 80 complete with all other cost elements perspective. Material is added in the start. Work in process is 70 complete. Following cost details have been extracted from the books. Material (Beg inventory: 5000 units @ Rs. Per unit). purchases 15000 units 6 Rs. Per unit, ende inventory 4000 units. Direct labor: 150000 hours 2 Rs. per hour. FOH is applied @ 120% of direct labor cost, Required: - Cost of production report for Department 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started