Answered step by step

Verified Expert Solution

Question

1 Approved Answer

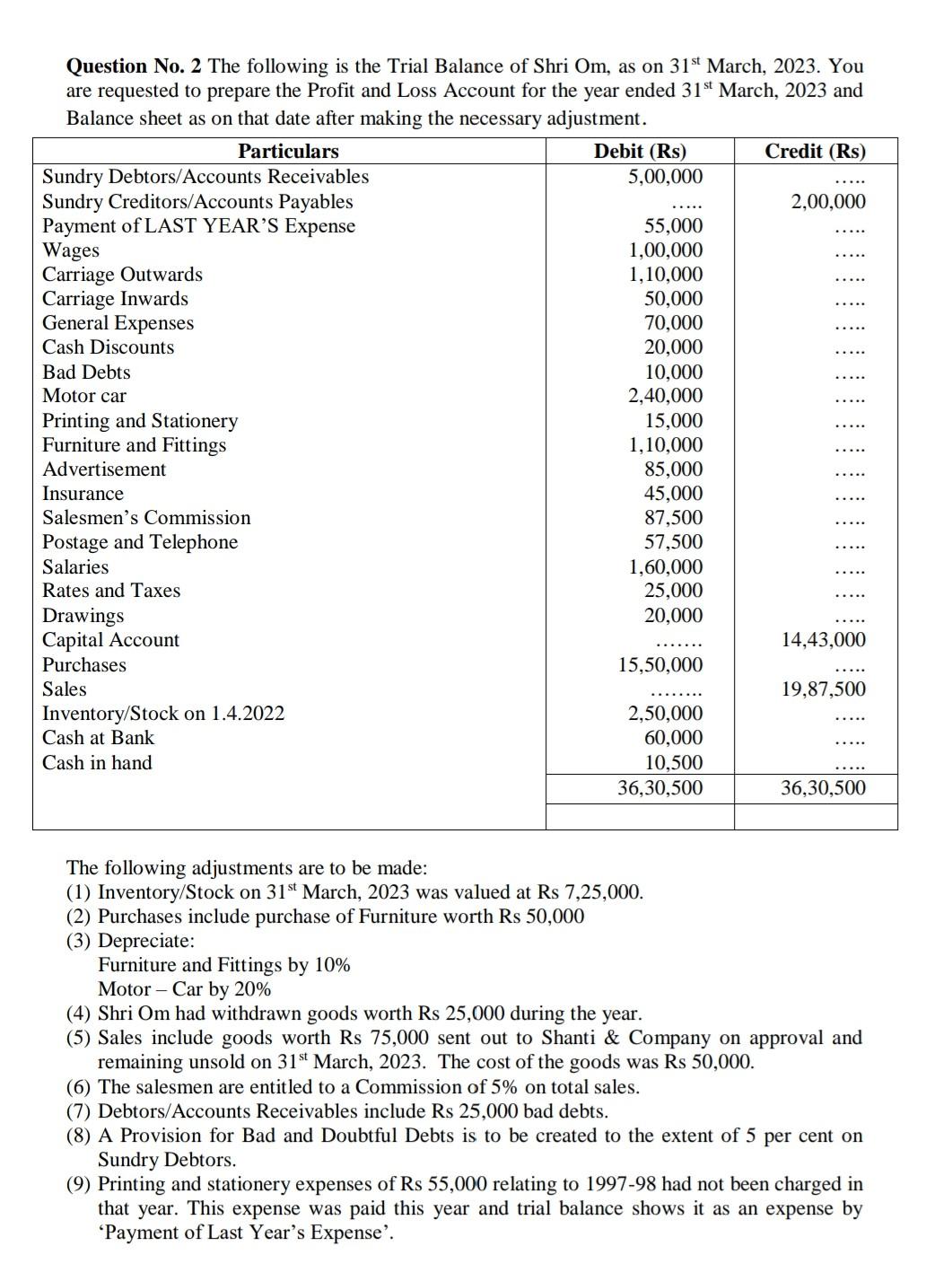

Question No. 2 The following is the Trial Balance of Shri Om, as on ( 31^{text {st }} ) March, 2023. You are requested to

Question No. 2 The following is the Trial Balance of Shri Om, as on \\( 31^{\\text {st }} \\) March, 2023. You are requested to prepare the Profit and Loss Account for the year ended \\( 31^{\\text {st }} \\) March, 2023 and The following adjustments are to be made: (1) Inventory/Stock on \\( 31^{\\text {st }} \\) March, 2023 was valued at Rs 7,25,000. (2) Purchases include purchase of Furniture worth Rs 50,000 (3) Depreciate: Furniture and Fittings by \10 Motor - Car by \20 (4) Shri Om had withdrawn goods worth Rs 25,000 during the year. (5) Sales include goods worth Rs 75,000 sent out to Shanti \\& Company on approval and remaining unsold on \\( 31^{\\text {st }} \\) March, 2023. The cost of the goods was Rs 50,000. (6) The salesmen are entitled to a Commission of \5 on total sales. (7) Debtors/Accounts Receivables include Rs 25,000 bad debts. (8) A Provision for Bad and Doubtful Debts is to be created to the extent of 5 per cent on Sundry Debtors. (9) Printing and stationery expenses of Rs 55,000 relating to 1997-98 had not been charged in that year. This expense was paid this year and trial balance shows it as an expense by 'Payment of Last Year's Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started