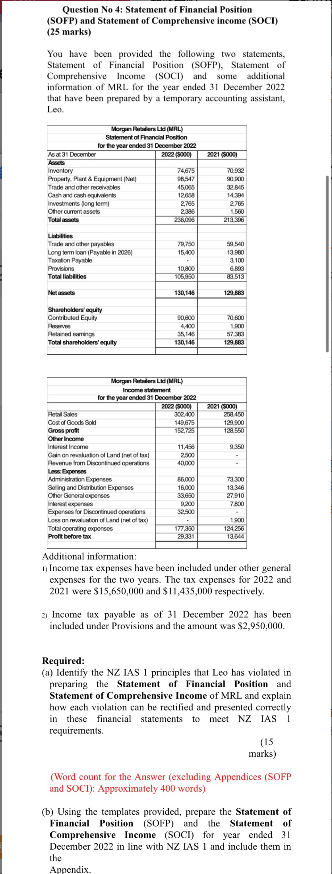

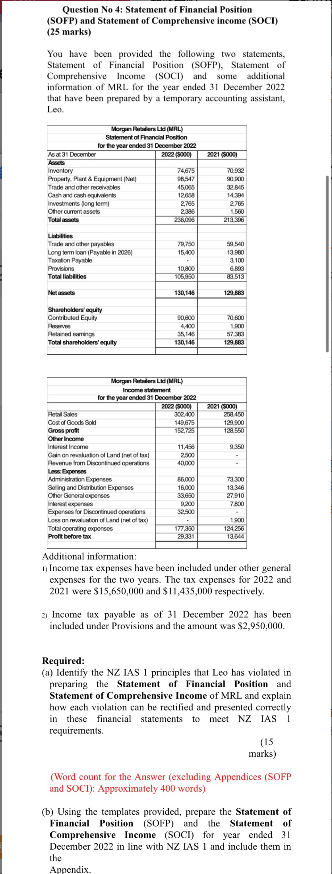

Question No 4: Statement of Financial Position (SOFP) and Statement of Comprehensive income (SOCI) (25 marks) You have been provided the following two statements, Statement of Financial Position (SOFP), Statement of Comprehensive Income (SOCI) and some additional information of MRL. for the year ended 31 Decemher 2022 that have been prepared by a temporary accounting assistant, Leo. Additional information: 1) Income tax expenses have heen included under other general expenses for the two years. The tax expenses for 2022 and 2021 were $15,650,000 and $11,435,000 respectively. 2) Income tax piyable as of 31 December 2022 has been included under Provisions and the amount was $2,950,000. Required: (a) Identify the NZ 1AS1 principles that Leo bis violated in preparing the Statement of Financial Position and Statement of Comprehensive Income of MRL and explain how each violation can be rectified and presented correctly in these financial statements to meet NZ IAS I requirements. (15 marks) (Word count for the Answer (excluding Appendices (SOFP and SOCI): Approximately 400 words) (b) Using the templates provided, prepare the Statement of Financial Position (SO|iP) and the Statement of Comprehensive Inconte (SOCI) for year ended 31 Devember 2022 in line with NZ LAS 1 and include them in the Appendix Question No 4: Statement of Financial Position (SOFP) and Statement of Comprehensive income (SOCI) (25 marks) You have been provided the following two statements, Statement of Financial Position (SOFP), Statement of Comprehensive Income (SOCI) and some additional information of MRL. for the year ended 31 Decemher 2022 that have been prepared by a temporary accounting assistant, Leo. Additional information: 1) Income tax expenses have heen included under other general expenses for the two years. The tax expenses for 2022 and 2021 were $15,650,000 and $11,435,000 respectively. 2) Income tax piyable as of 31 December 2022 has been included under Provisions and the amount was $2,950,000. Required: (a) Identify the NZ 1AS1 principles that Leo bis violated in preparing the Statement of Financial Position and Statement of Comprehensive Income of MRL and explain how each violation can be rectified and presented correctly in these financial statements to meet NZ IAS I requirements. (15 marks) (Word count for the Answer (excluding Appendices (SOFP and SOCI): Approximately 400 words) (b) Using the templates provided, prepare the Statement of Financial Position (SO|iP) and the Statement of Comprehensive Inconte (SOCI) for year ended 31 Devember 2022 in line with NZ LAS 1 and include them in the Appendix