Answered step by step

Verified Expert Solution

Question

1 Approved Answer

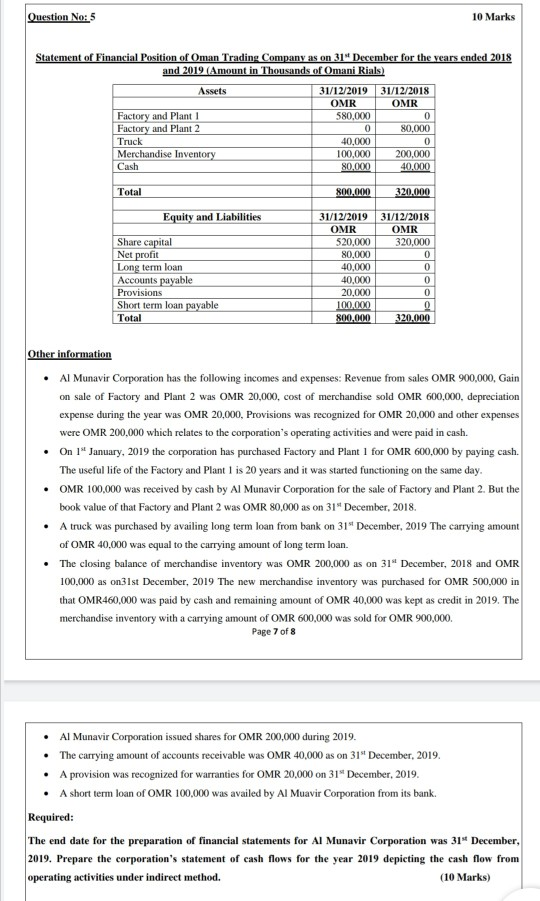

Question No: 5 10 Marks Statement of Financial Position of Oman Trading Company as on 31 December for the years ended 2018 and 2019 (Amount

Question No: 5 10 Marks Statement of Financial Position of Oman Trading Company as on 31" December for the years ended 2018 and 2019 (Amount in Thousands of Omani Rials) Assets Factory and Plant 1 Factory and Plant 2 Truck Merchandise Inventory Cash 31/12/2019 31/12/2018 OMR OMR 580,000 0 0 80,000 40,000 0 100,000 200,000 80.000 40.000 Total 800.000 Equity and Liabilities Share capital Net profit Long term loan Accounts payable Provisions Short term loan payable Total 31/12/2019 OMR 520,000 80,000 40,000 40,000 20.000 100.000 800.000 320.000 31/12/2018 OMR 320,000 0 0 0 0 0 320,000 Other information Al Munavir Corporation has the following incomes and expenses: Revenue from sales OMR 900,000. Gain on sale of Factory and Plant 2 was OMR 20,000, cost of merchandise sold OMR 600,000, depreciation expense during the year was OMR 20,000, Provisions was recognized for OMR 20,000 and other expenses were OMR 200,000 which relates to the corporation's operating activities and were paid in cash. On 19 January, 2019 the corporation has purchased Factory and Plant 1 for OMR 600,000 by paying cash. The useful life of the Factory and Plant 1 is 20 years and it was started functioning on the same day. OMR 100,000 was received by cash by Al Munavir Corporation for the sale of Factory and Plant 2. But the book value of that Factory and Plant 2 was OMR 80,000 as on 31" December, 2018 A truck was purchased by availing long term loan from bank on 31" December, 2019 The carrying amount of OMR 40,000 was equal to the carrying amount of long term loan. The closing balance of merchandise inventory was OMR 200,000 as on 31 December, 2018 and OMR 100,000 as on31st December, 2019 The new merchandise inventory was purchased for OMR 500,000 in that OMR460,000 was paid by cash and remaining amount of OMR 40,000 was kept as credit in 2019. The merchandise inventory with a carrying amount of OMR 600,000 was sold for OMR 900,000. Page 7 of 8 Al Munavir Corporation issued shares for OMR 200,000 during 2019. The carrying amount of accounts receivable was OMR 40,000 as on 31" December, 2019. A provision was recognized for warranties for OMR 20,000 on 31" December, 2019. A short term loan of OMR 100,000 was availed by Al Muavir Corporation from its bank. Required: The end date for the preparation of financial statements for Al Munavir Corporation was 31* December, 2019. Prepare the corporation's statement of cash flows for the year 2019 depicting the cash flow from operating activities under indirect method. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started