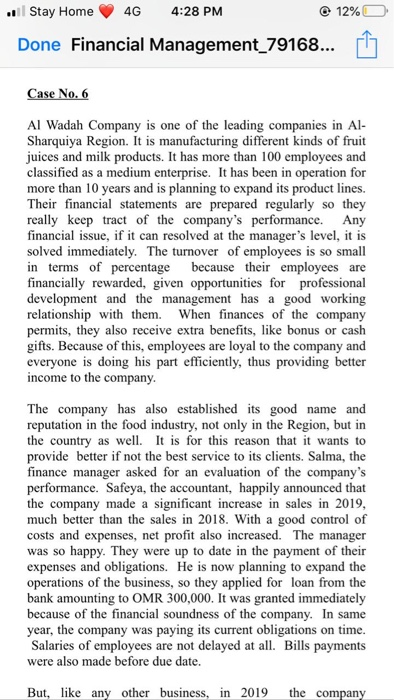

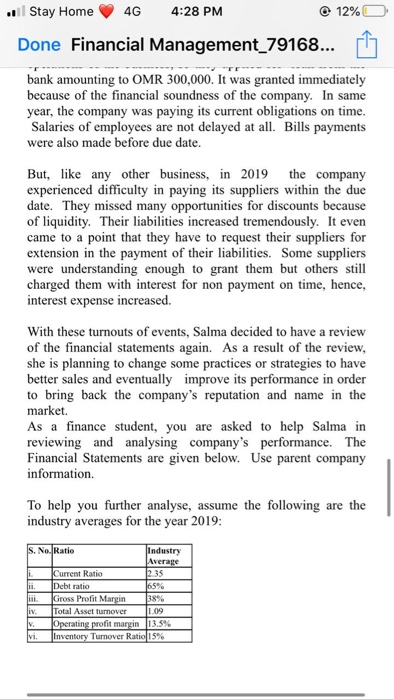

Question No. 6 a) Prepare the Common Size Income Statement of the company for Years 2018-2019. Use parent company information. (3 marks) b)Based on your calculation, analyze the firm's overall performance in 2019 by giving your comments on gross profit, operating profit and net profit. (2 marks) . Stay Home 4G 4:28 PM 12% Done Financial Management_79168... Case No. 6 Al Wadah Company is one of the leading companies in Al- Sharquiya Region. It is manufacturing different kinds of fruit juices and milk products. It has more than 100 employees and classified as a medium enterprise. It has been in operation for more than 10 years and is planning to expand its product lines. Their financial statements are prepared regularly so they really keep tract of the company's performance. Any financial issue, if it can resolved at the manager's level, it is solved immediately. The turnover of employees is so small in terms of percentage because their employees are financially rewarded, given opportunities for professional development and the management has a good working relationship with them. When finances of the company permits, they also receive extra benefits, like bonus or cash gifts. Because of this, employees are loyal to the company and everyone is doing his part efficiently, thus providing better income to the company. The company has also established its good name and reputation in the food industry, not only in the Region, but in the country as well. It is for this reason that it wants to provide better if not the best service to its clients. Salma, the finance manager asked for an evaluation of the company's performance. Safeya, the accountant, happily announced that the company made a significant increase in sales in 2019, much better than the sales in 2018. With a good control of costs and expenses, net profit also increased. The manager was so happy. They were up to date in the payment of their expenses and obligations. He is now planning to expand the operations of the business, so they applied for loan from the bank amounting to OMR 300,000. It was granted immediately because of the financial soundness of the company. In same year, the company was paying its current obligations on time. Salaries of employees are not delayed at all. Bills payments were also made before due date. But, like any other business, in 2019 the company . Stay Home 4G 4:28 PM 12% Done Financial Management_79168... bank amounting to OMR 300,000. It was granted immediately because of the financial soundness of the company. In same year, the company was paying its current obligations on time. Salaries of employees are not delayed at all. Bills payments were also made before due date. But, like any other business, in 2019 the company experienced difficulty in paying its suppliers within the due date. They missed many opportunities for discounts because of liquidity. Their liabilities increased tremendously. It even came to a point that they have to request their suppliers for extension in the payment of their liabilities. Some suppliers were understanding enough to grant them but others still charged them with interest for non payment on time, hence, interest expense increased. With these turnouts of events, Salma decided to have a review of the financial statements again. As a result of the review, she is planning to change some practices or strategies to have better sales and eventually improve its performance in order to bring back the company's reputation and name in the market. As a finance student, you are asked to help Salma in reviewing and analysing company's performance. The Financial Statements are given below. Use parent company information. To help you further analyse, assume the following are the industry averages for the year 2019: II S.No. Ratio Industry Average Current Ratio 235 in. Debt ratio 65% Gross Profit Margin 38% liv. Total Asset lumover 1.09 v. Operating profit margin 13.3% vi. Inventory Turnover Ratio 15% Question No. 6 a) Prepare the Common Size Income Statement of the company for Years 2018-2019. Use parent company information. (3 marks) b)Based on your calculation, analyze the firm's overall performance in 2019 by giving your comments on gross profit, operating profit and net profit. (2 marks) . Stay Home 4G 4:28 PM 12% Done Financial Management_79168... Case No. 6 Al Wadah Company is one of the leading companies in Al- Sharquiya Region. It is manufacturing different kinds of fruit juices and milk products. It has more than 100 employees and classified as a medium enterprise. It has been in operation for more than 10 years and is planning to expand its product lines. Their financial statements are prepared regularly so they really keep tract of the company's performance. Any financial issue, if it can resolved at the manager's level, it is solved immediately. The turnover of employees is so small in terms of percentage because their employees are financially rewarded, given opportunities for professional development and the management has a good working relationship with them. When finances of the company permits, they also receive extra benefits, like bonus or cash gifts. Because of this, employees are loyal to the company and everyone is doing his part efficiently, thus providing better income to the company. The company has also established its good name and reputation in the food industry, not only in the Region, but in the country as well. It is for this reason that it wants to provide better if not the best service to its clients. Salma, the finance manager asked for an evaluation of the company's performance. Safeya, the accountant, happily announced that the company made a significant increase in sales in 2019, much better than the sales in 2018. With a good control of costs and expenses, net profit also increased. The manager was so happy. They were up to date in the payment of their expenses and obligations. He is now planning to expand the operations of the business, so they applied for loan from the bank amounting to OMR 300,000. It was granted immediately because of the financial soundness of the company. In same year, the company was paying its current obligations on time. Salaries of employees are not delayed at all. Bills payments were also made before due date. But, like any other business, in 2019 the company . Stay Home 4G 4:28 PM 12% Done Financial Management_79168... bank amounting to OMR 300,000. It was granted immediately because of the financial soundness of the company. In same year, the company was paying its current obligations on time. Salaries of employees are not delayed at all. Bills payments were also made before due date. But, like any other business, in 2019 the company experienced difficulty in paying its suppliers within the due date. They missed many opportunities for discounts because of liquidity. Their liabilities increased tremendously. It even came to a point that they have to request their suppliers for extension in the payment of their liabilities. Some suppliers were understanding enough to grant them but others still charged them with interest for non payment on time, hence, interest expense increased. With these turnouts of events, Salma decided to have a review of the financial statements again. As a result of the review, she is planning to change some practices or strategies to have better sales and eventually improve its performance in order to bring back the company's reputation and name in the market. As a finance student, you are asked to help Salma in reviewing and analysing company's performance. The Financial Statements are given below. Use parent company information. To help you further analyse, assume the following are the industry averages for the year 2019: II S.No. Ratio Industry Average Current Ratio 235 in. Debt ratio 65% Gross Profit Margin 38% liv. Total Asset lumover 1.09 v. Operating profit margin 13.3% vi. Inventory Turnover Ratio 15%